Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – September 20

Today, the Bitcoin price is seen plunging from over $11,000 to touch the low of $10,759.

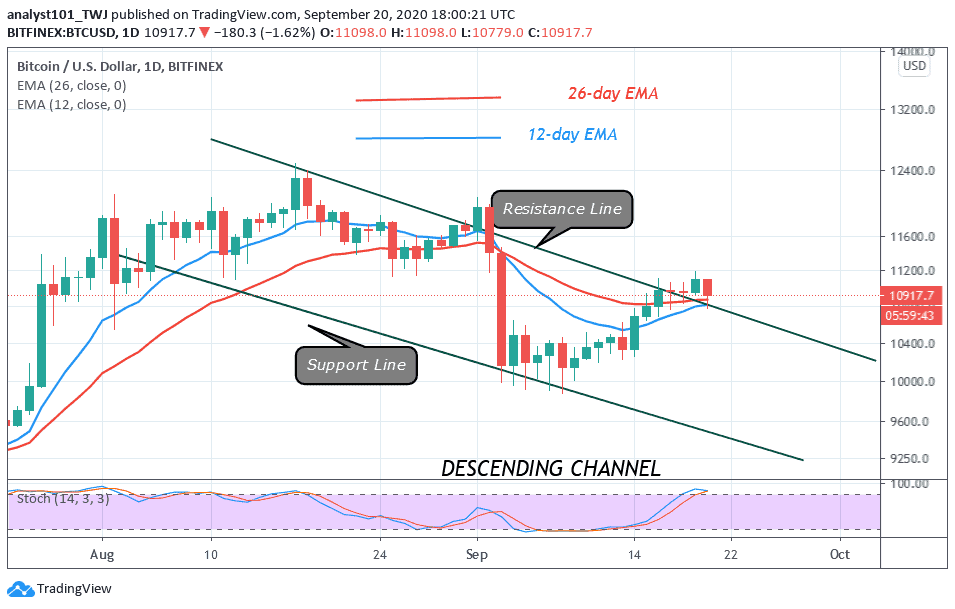

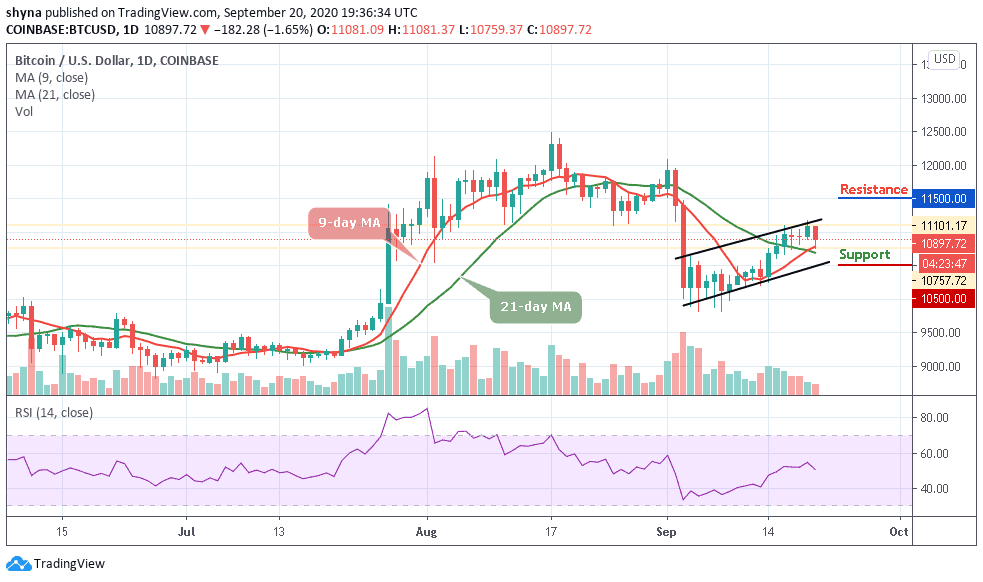

BTC/USD Long-term Trend: Bearish (Daily Chart)

Key levels:

Resistance Levels: $11,500, $11,700, $11,900

Support Levels: $10,500, $10,300, $10,200

BTC/USD drops below $11,000 during the early Asian hours of trading but the coin failed to recover above the critical level so far. At the time of writing, the price of Bitcoin is moving around $10,897 as the coin is down with 1.65% within 24 hours. The number one cryptocurrency hit a brick wall on the approach to $10,700 and dropped under the pivotal area in a matter of hours.

What to Expect from Bitcoin (BTC)

An upside break above the 9-day and 21-day moving averages around is a must to start a substantial recovery. Once this happens, the next hurdles may be seen near the resistance levels of $11,500, $11,700, and $11,900. On the downside, initial support is near the 21-day MA at the $10,600 level and if there is a successful break below this level, the bears are likely to gain strength by bringing the price to a low of $10,500, $10,300, and $10,100 respectively.

Currently, Bitcoin price follows a dominant bearish bias and a glance at the technical indicator RSI (14) displays a negative picture for BTC in the near-term. In addition, maintaining a gradual downward trend in the negative region, the signal line of RSI (14) decreases as it faces a downward trend for an increase in selling entries.

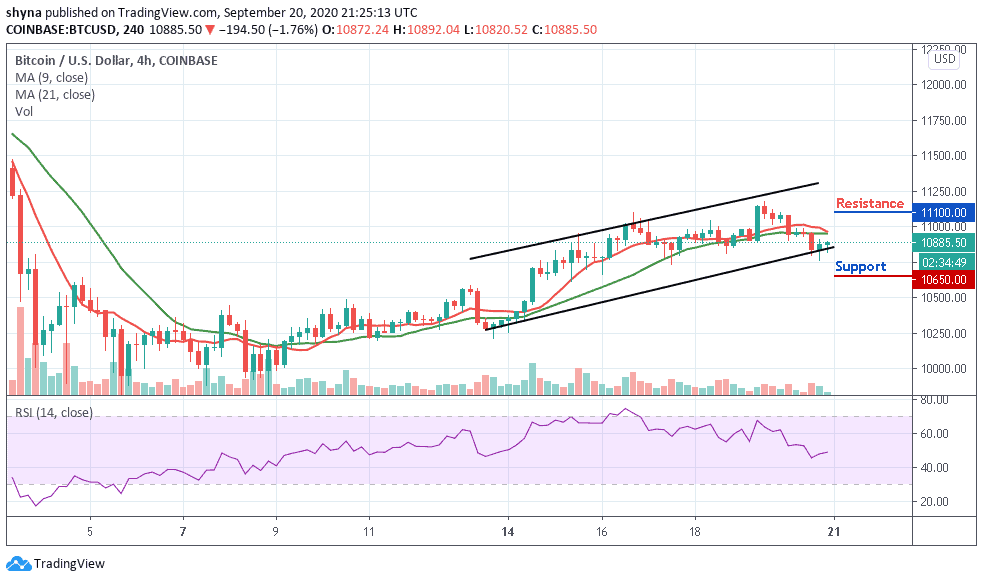

BTC/USD Medium – Term Trend: Bullish (4H Chart)

Looking at the 4-hour chart, Bitcoin’s price is currently trading around $10,883 and below the 9-day and 21-day moving averages after falling from $11,081 where the coin started trading today. Whereas, the 4-hour chart shows that the bullish supply is coming up slightly in the market while the sellers are trying to drag the price down.

Moreover, if the buyers can strengthen and re-group, they can further push the price back to an $11,000 resistance level. Therefore, breaking the mentioned resistance could also allow the bulls to test the $11,100 and above. Meanwhile, the market is indecisive as the RSI (14) indicator moves below the 50-level, but any further movement below the lower boundary of the channel may reach the support level of $10,650 and below.

Join Our Telegram channel to stay up to date on breaking news coverage