Join Our Telegram channel to stay up to date on breaking news coverage

Fund management giant BlackRock has deposited $100M in USD Coin (USDC) on the Ethereum blockchain for the launch of a tokenized digital asset fund.

A filing with the US Securities and Exchange Commission (SEC) shows the institution set up the BlackRock USD Institutional Digital Liquidity Fund in 2023, but has yet to launch it.

Securitize, a digital asset tokenization firm, will offer the fund and conduct the token sale, the filing said. The minimum investment is set at $100,000

🚨 #BlackRock, in collaboration with Securitize, plans to offer a tokenized pooled investment fund, setting a $100,000 minimum investment.

The fund, named the USD Institutional Digital Liquidity Fund, was announced through a Form D filing with the SEC.

— Satoshi Club (@esatoshiclub) March 19, 2024

An ERC-20 token known as BUIDL was launched on March 5 to tokenize the fund. Data from Etherscan shows BUIDL has one holder and a maximum supply of 100 tokens.

Blackrock Ventures Further Into Crypto After Bitcoin ETF Success

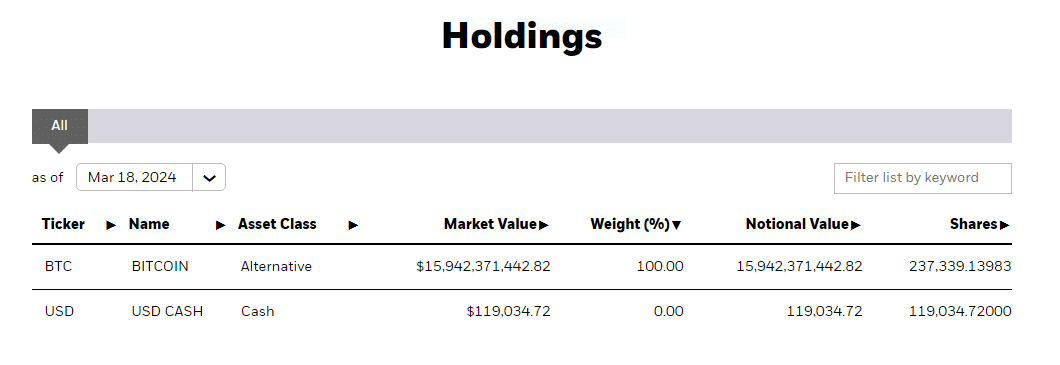

The development shows the world’s largest asset manager moving deeper into the crypto realm after it launched its BlackRock iShares Bitcoin Trust (IBIT) ETF in Janaury. IBIT has been the best-performing Bitcoin ETF since launching and currently holds 237,339 BTC, making it the single-largest holder of Bitcoin.

The firm is also among the eight applicants that have applied to launch a spot Ethereum ETF.

In January, BlackRock’s CEO, Larry Fink, said Bitcoin and Ether ETFs were “stepping stones towards tokenization. According to Fink, tokenization can solve issues of money laundering and corruption.

Also Read

- Ethereum To Hit $14K By 2025 If ETH ETFs Are Approved In May, Standard Chartered Says

- Fidelity Updates Its Spot Ethereum ETF Application To Include Staking

- Bitcoin Price Prediction: As MicroStrategy Buys More Bitcoins, Traders Snap Up This BTC ICO With An 89% APY

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage