Join Our Telegram channel to stay up to date on breaking news coverage

Latin American (Latam) crypto holders are turning to Bitget as an alternative platform following Binance and Coinbase’s legal disputes. Users in Latam who want a reliable and secure crypto trading platform are flocking to Bitget. Other significant exchanges are facing legal challenges too.

During the past week, Bitget users in Latin America jumped by 43%, and deposits shot up 134%.

Bitget’s Latin American User Base Surges Amid Binance and Coinbase Lawsuits

Bitget, a cryptocurrency exchange, has dramatically increased Latin American accounts. User registrations are up after US regulators sued Binance and Coinbase. Bitget said that new users in the region increased by 43% between June 6 and 9, led by Brazil and Argentina.

The crypto exchange Bitget has seen impressive growth in Brazil and Argentina. Brazil has seen a 54% increase in new clients and a remarkable 208% increase in deposits.

In Argentina, the customer base has grown by 33%, and the funds deposited have grown by 87%. In addition to Venezuela, Colombia, and Mexico, Bitget operates in many other countries. The region’s total deposits have been up 134% in recent days.

Bitget has more than 8 million clients worldwide, but the number of users in Latin America wasn’t disclosed. The recent figures are a result of significant events in the United States.

Binance and Coinbase Face Legal Action as Bitget Gains Momentum

On June 5, Binance, a crypto exchange, faced legal action from the US Securities and Exchange Commission (SEC). The company was charged with selling securities without registration, not being registered as an exchange or broker, and mixing funds up.

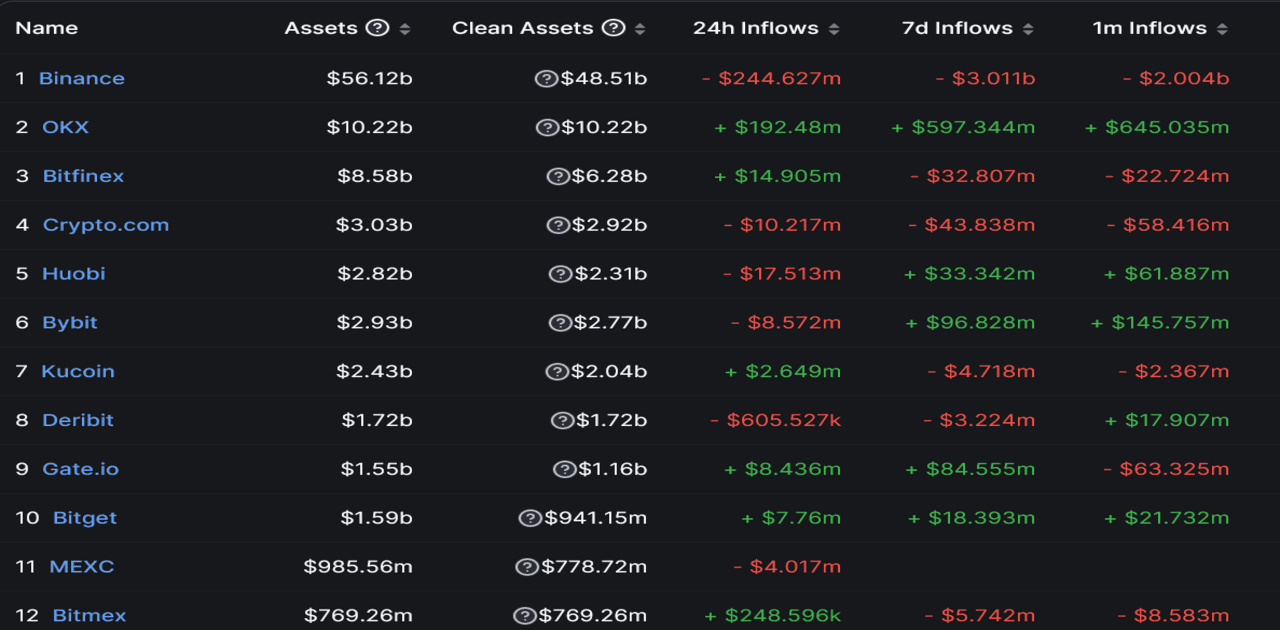

In the last seven days, Binance experienced net outflows of $3.128 billion, while Bitget saw deposits increase by $14.8 million, as per data from Defillama. Among crypto exchanges, OKX got the most deposits last week, with $603 million.

The crypto industry is still very new and has experienced tremendous growth in recent years. [..] favorable policies are being implemented in places like Hong Kong, Dubai, and Singapore, and new opportunities are emerging. So, we are convinced that things will settle down over time, with the industry consolidating itself among the strongest ones in the modern economy, says Gracy Chen, managing director of Bitget.

US regulators also sued Coinbase, another cryptocurrency exchange, on June 6. Since 2019, they’ve offered unregistered securities and operated as an unregistered broker. Gary Gensler, Chair of the SEC, criticized Coinbase for not protecting against fraud and manipulation and not addressing conflicts of interest.

Data collected from Coingecko Coinbase’s trade volume has increased by 113.06% to $1.5 billion in less than 24 hours.

Binance and Coinbase, two prominent crypto exchanges, are expanding in Brazil to tap into its growing market. In Brazil, the Brazilian Central Bank guaranteed Binance Payment a license to offer fiat-to-crypto and crypto-to-fiat services.

With Coinbase, Brazilians can buy and sell cryptocurrencies with local bank transfers. Brazilian cryptocurrency users need more accessible, more convenient exchanges that cater to them.

Join Our Telegram channel to stay up to date on breaking news coverage