Join Our Telegram channel to stay up to date on breaking news coverage

In a transition from May to June 2023, crypto prices dipped while stocks rose amidst a resolution to the debt limit crisis. Despite caution, optimism persists in the crypto market as builders lay the groundwork for the future.

Crypto Prices Experience Downturn Amidst May and June Transition

The transition from the gloomy May weather to the beginning of June was accompanied by a slight dip in crypto prices. The leading cryptocurrency, Bitcoin, faced a 0.5% decline over the past 24 hours, marking the second consecutive day that it dropped below the $27,000 mark.

The Bitcoin price was around $26,950. This decline continued the downward trend that began in May when Bitcoin’s price experienced a nearly 4% dip, breaking a four-month streak of gains.

Bitcoin had experienced a remarkable surge earlier this year, with its value skyrocketing by over 60% from January. In mid-April, it reached a peak of around $31,000. This surge was driven by the renewed interest in cryptocurrencies as a safe haven following a series of bank failures in the United States, which raised concerns about the stability of traditional financial systems, which many say is far from over.

Cryptocurrency assets like Bitcoin are known for their volatility. Any monthly movement below a 5% threshold is relatively subdued, given the significant volatility associated with these assets.

The broad Market Index was down by approximately 2% to 3%. While the month had been somewhat choppy, there’s still optimism in finding the next significant narrative that would push the prices higher.

Market expectations had recently factored in a resumption of more hawkish monetary policies. This shift in sentiment occurred after signs of inflation waning emerged in early May, suggesting that the US central bank could potentially pause its year-long campaign of interest rate increases.

While the repricing of interest rates higher was viewed as positive, it didn’t fail to pose a headwind for the market.

Debt Limit Resolution Spurs Stock Rise, while Other Cryptocurrencies Experience Mixed Performance

Apart from Bitcoin, the second-largest cryptocurrency, Ethereum, exhibited a relatively stable trading price, standing at approximately $1,870, showing a slight increase from the previous day.

On the other hand, other major digital assets experienced minor declines, with the exception of Litecoin, which recently rose by more than 7%. The Litecoin network’s halving scheduled in two months and increased activity in May appeared to have buoyed investor confidence in the cryptocurrency.

Litecoin (LTC) and RNDR, the token associated with the Render Network, were the top gainers in the for May. Over the past 30 days, LTC and RNDR had seen gains of roughly 20% and 7.5% respectively. This growth can be attributed to the increasing buzz and hype surrounding the repurposing of graphic processing units (GPUs) as large artificial intelligence (AI) clusters.

The Render Network’s decentralized AI cluster aligned with this narrative, leading to its outperformance and benefiting from the excitement around language models like Chat GPT and other large language models (LLMs).

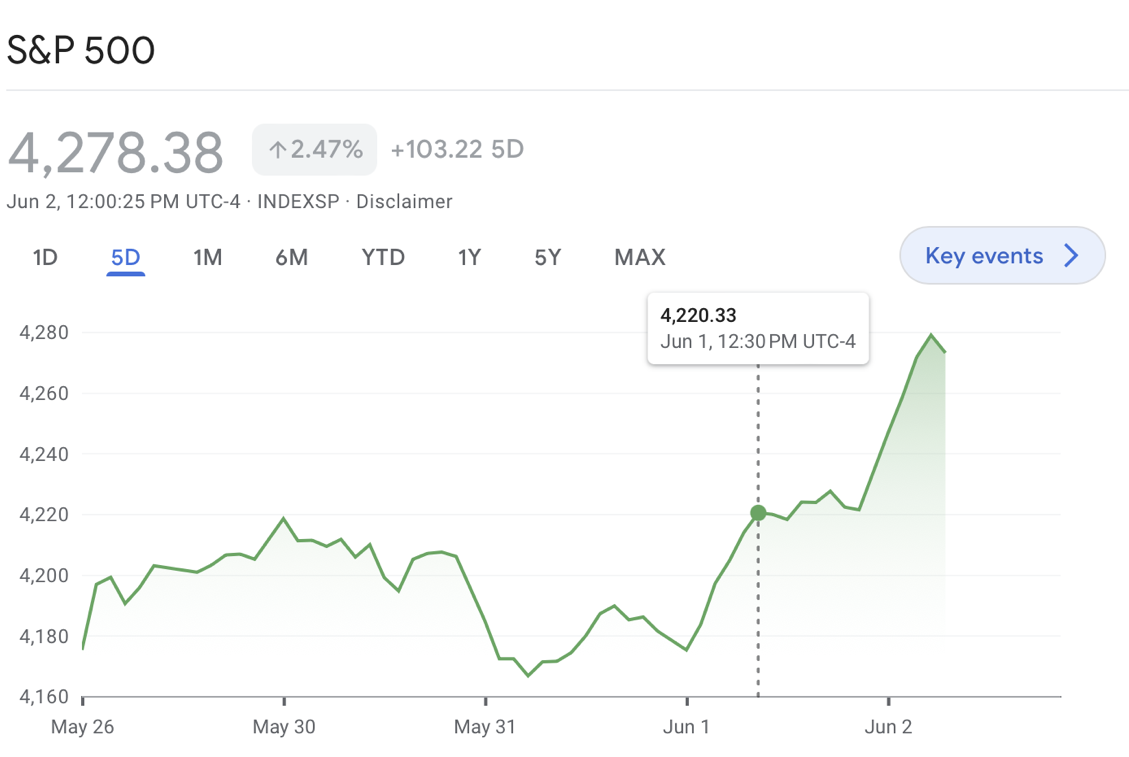

In contrast to the crypto market, the stock market witnessed a positive shift. This increase in stock prices occurred after the US House of Representatives passed a bill to raise the debt limit, ensuring that the government could meet its financial obligations and avoid a shutdown in the near term.

Both the tech-heavy Nasdaq Composite and the S&P 500, which has a substantial technology component, rose by approximately 1%. Meanwhile, gold experienced a modest 0.6% increase, reaching above $1,995, although it remained below its near-record high achieved nearly a month ago.

Leo Mizuhara, the CEO of Hashnote, an institutional crypto management platform, commented on the recent developments in crypto markets. Mizuhara acknowledged that the resolution to the debt ceiling crisis and the increasing adoption of digital assets in Asia, particularly in Hong Kong, had averted a potential crisis in the crypto market.

Despite this positive turn of events, Mizuhara expressed caution, stating that he did not anticipate a significant breakout for Bitcoin at the moment. He drew parallels to the market conditions observed in 2019 when investors were recovering from an extended bear market.

According to Mizuhara, the current phase could be characterized as a “builder’s market.” He emphasized that numerous intriguing protocols and companies were being launched, and venture funding was gradually returning to the industry. He likened the current phase to 2019, suggesting that it represented a build-up phase that lays the foundation for the next bull cycle.

Despite the challenges faced by the crypto industry in the United States, Mizuhara’s overall sentiment remained optimistic due to the positive developments occurring globally.

Crypto Market Outlook for June – Here’s What to Watch

June holds great significance for cryptocurrency investors as key events unfold, shaping the market’s trajectory. Notably, Hong Kong’s proposal to grant individual investors access to cryptocurrencies stands out among the upcoming developments. Moreover, crucial data releases, including the interest rate decision, are expected to inject life into the market.

The debt ceiling law secured approval from the U.S. House of Representatives on June 1, with Senate approval anticipated by June 5. Once signed by President Biden, this resolution will settle the debt ceiling matter until 2025, alleviating concerns of a U.S. default that plagued the cryptocurrency markets in May.

June also brings pivotal announcements from the Federal Reserve, with the interest rate decision scheduled for the 14th, along with promising advancements in Hong Kong.

The upcoming week will witness the publication of US Services PMI and ISM PMI data, which hold significance in assessing the economy’s health. Notable overachievement in these metrics may have adverse effects on cryptocurrencies.

June carries certain risks as well. The ongoing Genesis bankruptcy proceedings pose potential challenges, with potential implications for DCG and its subsidiaries in the worst-case scenario. SEC lawsuits targeting U.S.-based crypto companies also raise concerns.

Data from CoinShares reveals a six-week outflow from cryptocurrency funds among corporate and qualified investors, indicating diminished expectations for price appreciation for the remainder of the year. Nevertheless, crypto-focused funds continue to participate in seed investment rounds, demonstrating sustained support for startup projects.

Lastly, Bitcoin’s price forecast for June appears volatile. JPMorgan analysts foresee Bitcoin peaking at $45,000 within the next 12 months, while Michael Poppe predicts a short-term rise to $29,000. John Hussman warns of a potential crash, with Bitcoin potentially seeking a new bottom below $20,000.

With so many events influencing the price of cryptocurrencies, in particular, Bitcoin, June will likely be exciting.

Meanwhile, there are multiple presale assets available, like Wall Street Memes, that can potentially be more beneficial since they allow users to make gains away from the volatile waters of the crypto space.

Related Articles

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage