Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s price shows the desire to grow, with several attempts to breach the resistances holding it from going further up. However, the buying pressure is not strong enough to push the coin past $31k. A lot of it is believed to be caused by market uncertainty.

Bitcoin’s recent bull run resulted from BlackRock and several other companies submitting their Bitcoin spot ETF filings.

The market was growing increasingly bearish after the US SEC filed lawsuits against Binance and Coinbase, but BlackRock, Fidelity, and other companies managed to turn things around.

After two weeks of growth, the market looked promising until the SEC rejected the proposals, saying that the lack of clarity is the reason.

BlackRock, the world’s largest asset manager, introduced changes within days and refiled the application. The company’s swift reaction returned optimism to the buyers, but many assume that the SEC Chair, Gary Gensler, will simply find another reason to reject the proposal.

Jay Clayton, on the other hand, believes that Bitcoin spot ETF could still get a pass. The former SEC Chairman commented recently that the ETF approval would be hard to resist if market efficacy is demonstrated.

While the SEC under Clayton’s leadership also rejected ETF proposals in the past, he said that the situation is now different from the one in his time.

Let’s go back to 2015-2016. This is an offshore, retail, nothing close to what I would say are the core of our financial markets. At that time, if you look at trading of Bitcoin, the emergence of Bitcoin, it looked like stocks, but it was nothing like it. Now we’ve seen development all the way to the point where companies whose reputation in the market matters are saying, ‘You know what, we think that trading, that the custody, those protections around this market are sufficient that we’re willing to put our name on it and offer that product.’ That’s actually an incredible development, not one I expected. I was very skeptical of trading in the Bitcoin market when I was the SEC Chair. I thought there were studies that 90% of it was washing trading, ripe for manipulation and the like…

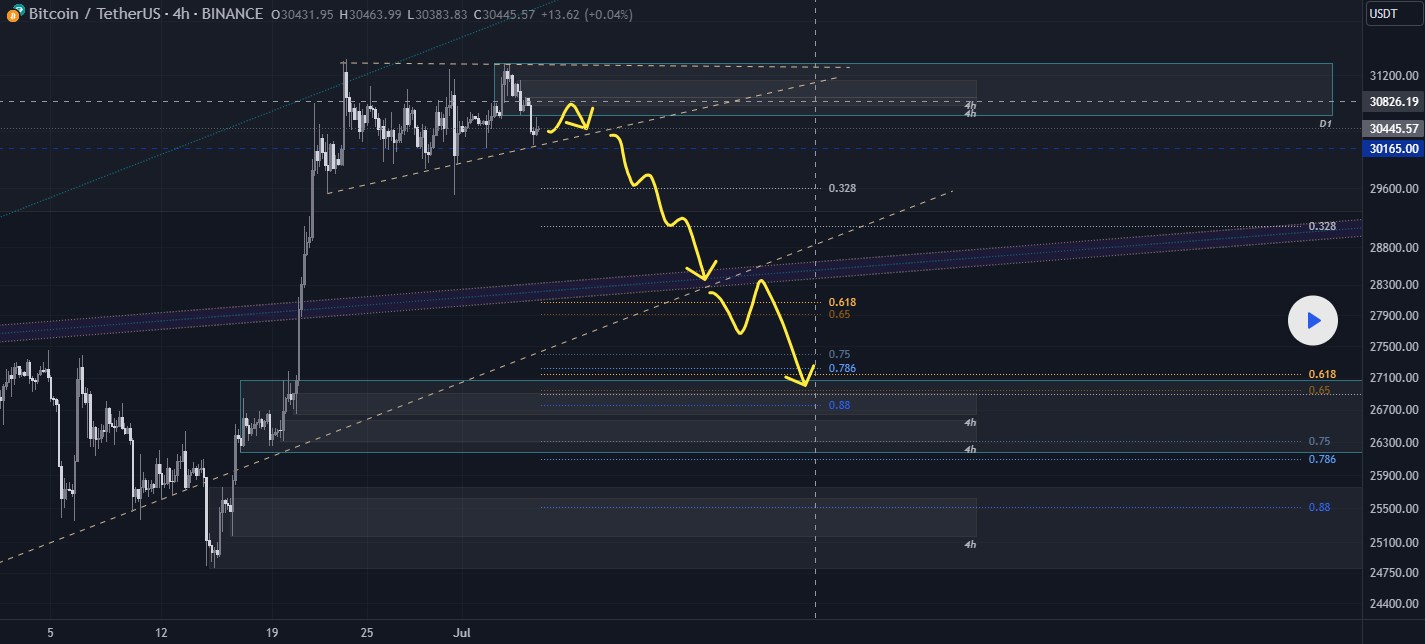

Bitcoin makes another Burj Khalifa as the price spikes, then gets rejected

After spiking up to $31,366 on July 6th, Bitcoin price was trading sideways for four days, between early Friday and late Monday, only to repeat similar behavior late on July 10th. The coin saw another surge, although this one only took it near the $31k range before its price was again rejected to $30,220.

As many have pointed out, Bitcoin is stuck above $30k, which is still positive. However, its inability to progress further only increases the chances of the support eventually breaking.

Michael van de Poppe, CEO and founder of Eight, said that the recent move had the hallmarks of a leverage crunch. He said that “Bitcoin had a leverage crunch in the past 24 hours, taking out all the highs & going back to the start in one go. The only difference between now and Thursday? No new lows have been made. $30,200 supporting. Don’t get chopped out!”

The markets just continues chopping.#Bitcoin had a leverage crunch in the past 24 hours, taking out all the highs & going back to the start in one go.

The only difference between now and Thursday? No new lows have been made.

$30,200 supporting.

Don't get chopped out! pic.twitter.com/nDG26u7BKZ

— Michaël van de Poppe (@CryptoMichNL) July 11, 2023

At the time of writing, Bitcoin is down 2% compared to yesterday’s high, sitting at $30,451. While it managed to break the resistance at $30.4k, holding it back for the past several days, stronger resistances still keep it in place.

Despite this, investors are optimistic in the long term, knowing that next year’s halving will bring a new bull run.

Bitcoin halving will not benefit the miners, says Berenberg Capital Market

Bitcoin halvings are always highly anticipated events, as bull runs usually follow them. This is why miners tend to stop selling their BTC when a halving starts approaching, which reduces the market supply, and contributes to the upcoming bull run.

However, according to a recent bull case presented by Berenberg Capital Market, the next year’s halving will not be great for the miners.

The research note explained that nearly half of Bitcoin miners operate with suboptimal efficiency. They will expect significant challenges after the halving, as their rewards will be reduced.

There is a window between the halving and a Bitcoin bull run that makes the coin more valuable, and it often lasts for months. It will be very hard for miners to continue their operations and pay high electricity bills while waiting for Bitcoin to start moving.

Where is Bitcoin going from here?

Bitcoin’s price has been making moves influenced by recent developers, but technical signals can still point the way for investors and traders.

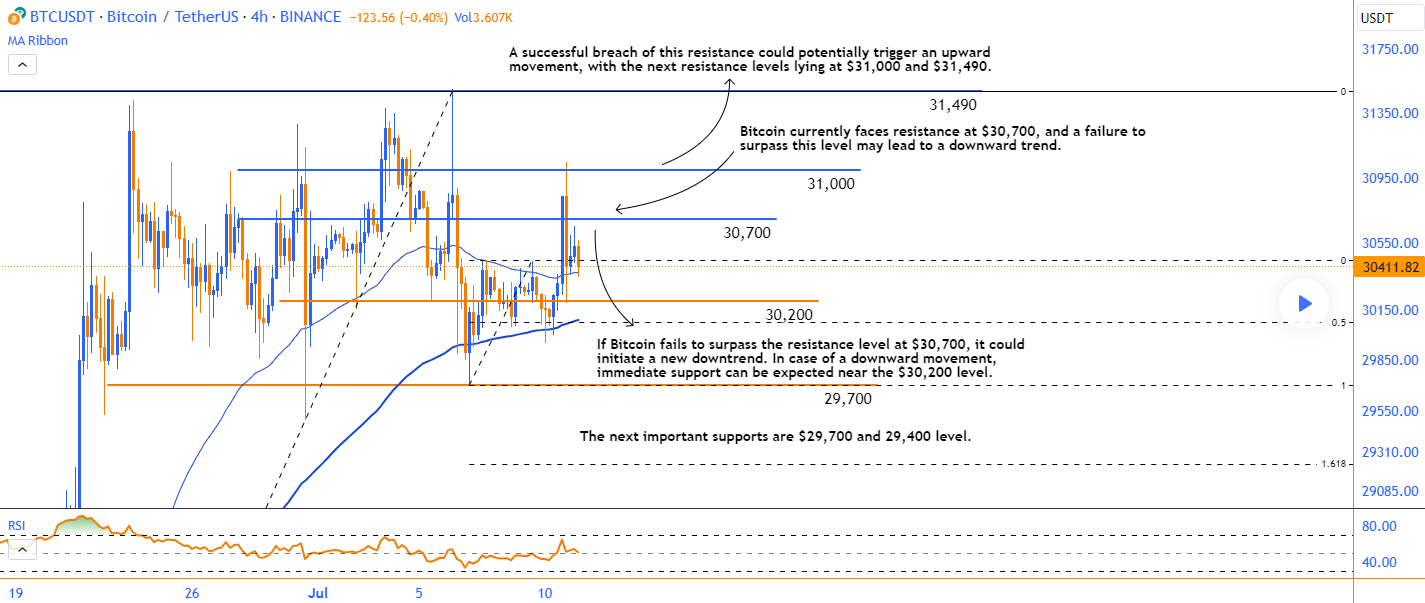

According to analysts, the coin is currently being traded at a price of $30,400 over a 4-hour period. The RSI sits at 50.95, indicating that the market sentiment is currently neutral. Meanwhile, the EMA 50 is $30,373, while the EMA 100 is $30,088. Finally, the MACD value sits at 25.

Analysts believe that Bitcoin must surpass the resistance at $30,700 to resist the downward trend.

If it fails, it still has immediate support at $30,200, but the price in free fall could easily break it, in which case the support at $30k would be tested. If this level breaks as well, Bitcoin will decline toward $29,700, or potentially even lower to $29,400.

If the buying pressure manages to push the coin up strongly enough for it to break the resistance at $30,700, BTC will have a chance to retest the resistance at $31k. If this level breaks as well, the next one sits at $31.4k. Breaking this barrier as well could open the door to new opportunities, such as BTC hitting $32k.

Wall Street Memes presale hits $14 million raised

Despite the neutral sentiment toward Bitcoin at the moment, investors still seem more than excited about Wall Street Memes (WSM). The new meme coin has managed to sell enough of its tokens to raise $14 million, and the presale is still going.

The next stage is expected within hours when the price of the WSM token will go from the current $0.0313 to $0.0316.

The token was inspired by the subreddit called WallStreetBets, which consists of amateur investors.

After seeing institutions shorting the stocks of multiple respected companies in early 2021 in order to make money, amateur investors started buying the targeted shares en masse, pumping their prices.

Outraged by the institutions’ disregard for the future of these companies, Redditors came to the rescue while costing institutional investors a lot of money.

Wall Street Memes is a way to commemorate their struggle. Those who wish to participate in the presale can buy WSM tokens in exchange for ETH, BNB, and USDT, or simply buy them with their credit/debit cards.

Related

- Former SEC Chair Says BlackRock Bitcoin ETF “Incredible Development,” Outlines Approval Criteria

- Bitcoin’s Recovery Stuns Investors, But This Lesser-Known Crypto Could Outshine It

- 3.5 Million Inscriptions for Bitcoin Ordinals NFTs. Is This The Big Comeback?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage