Join Our Telegram channel to stay up to date on breaking news coverage

The launch of the Bitcoin Request for Comment (BRC)-69 token standard on July 3 has given a new lease of life to Bitcoin Ordinals.

Luminex launched the BRC-69 standard in order to alleviate the costs involved with inscribing ordinals onto the Bitcoin chain.

According to the bitcoin ordinals launchpad platform, the new standard has the ability to reduce the cost of inscription by 90%, resulting in a significant reduction of pressure on the chain.

“With BRC69, we can reduce the costs of inscriptions for Ordinals collections by over 90%. This reduction is achieved through a 4-step process: (1) inscribe traits, (2) deploy collection, (3) compile collection, and (4) mint assets,” the company tweeted.

🟨 (1/7) GM! Today, we're excited to introduce BRC69, a revolutionary standard for creating Recursive #Ordinals collections with ease. This standard will be instrumental in launching Recursive collections on Bitcoin.

More details here: https://t.co/zaID07tnD5

— Luminex (@luminexio) July 3, 2023

Game-Changer for Bitcoin Ordinals

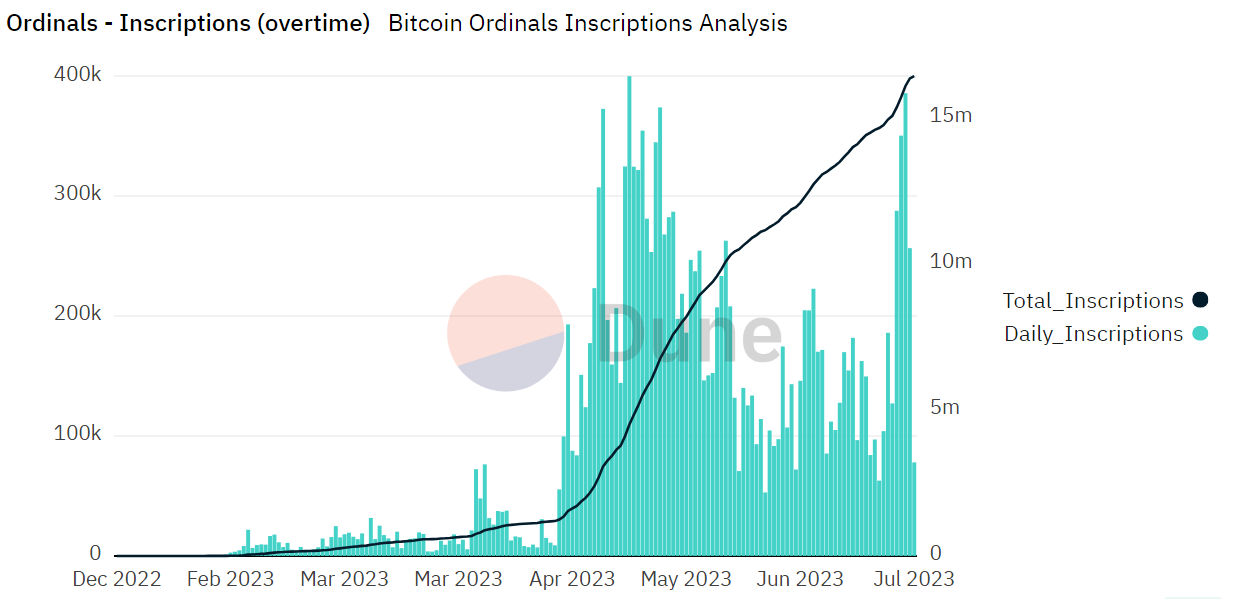

Since the debut of BRC-69, the number of ordinal inscriptions has seen a dramatic increase. According to data by Dune Analytics, the daily average of inscriptions has increased by over 250%.

Additionally, the daily records reached their highest total since May by closing at 385,920 inscriptions on June 9.

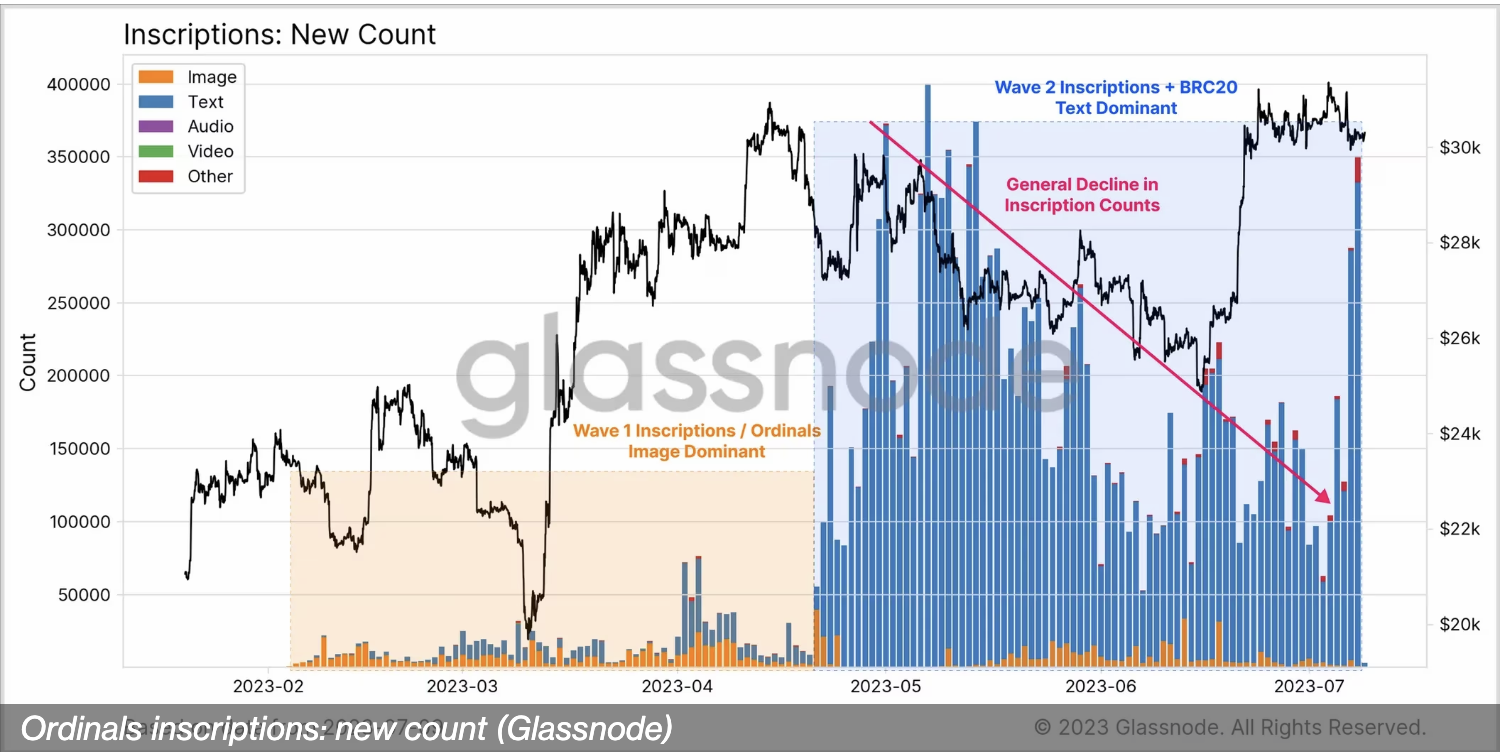

Overall, the new standard has also led to the rise of other forms of ordinals other than image, audio, or applications. In fact, since it was launched, ordinals categorized as “other” make up more than 50% of daily inscriptions.

Text inscriptions have also increased over image inscriptions. This is potentially due to the technique employed on BRC-69 to reduce transaction costs by inscribing text to render images.

Acording to Liminex:

“The brilliance of BRC69 lies in its simplicity. Minters only need to inscribe a single line of text instead of a full image. This text allows the final image to be automatically rendered on all ordinals-frontends, using solely on-chain resources, thanks to recursive inscriptions.”

Aside from the surge in ordinal activity, the standard has also proven its worth in reducing transaction fees. Despite the massive increase in daily inscriptions, the amount of transaction fees has managed to remain quite low.

When Bitcoin ordinals were launched in early January, the increased adoption coupled with high transaction costs resulted in a bottleneck on the chain. In May, the issue worsened such that the Binance exchange temporarily closed BTC withdrawals due to 400,000 pending transactions clogging the Mempool.

While the BRC-69 standard has caused more inscriptions, it has also reduced the pressure on the chain for unconfirmed transactions. A report by Glassnode confirmed that the number of transitions on the Binance Mempool has significantly decreased.

Bitcoin Ordinals Threaten Ethereum’s NFT Dominance

The sudden rise of Bitcoin ordinals adoption, thanks to BRC-69, has begun to threaten Ethereum’s position in the NFT market.

According to data from CryptoSlam, Bitcoin NFT sales are seeing a significant increase compared to Ethereum over the same period of time. However, Ethereum still has higher sales than Bitcoin.

Regardless, Bitcoin has made its mark in the NFT marketplace with some of its collections dethroning the likes of Azuki, BAYC, and MAYC in terms of volume.

#Bitcoin and #Ethereum rivalry is heating up in the #NFT sector as Bitcoin’s “ordinals” look set to overtake Ethereum in terms of sales growth and active buyer participation.#Ordinals has seen significant growth in both sales and active buyers, achieving an impressive 129.50%… pic.twitter.com/7QrjXlVuSX

— YusufHaji (@YusufHaji87) July 10, 2023

This switch implies that traders were more interested in Bitcoin NFTs than Ethereum. When it comes to NFTs, Ethereum used to reign as the king of volume. This was mainly due to the mass adoption the blockchain saw in 2021.

However, since the year started, collectors using the blockchain find it difficult to have a consistent long-term increase in the price value of their NFTs. Coincidentally, this is also the time when Bitcoin ordinals launched.

As Bitcoin developers continue to advance ordinals and make them more cost-efficient, the rule of Bitcoin in NFT will be inevitable.

Related Articles:

- Saylor’s Microstrategy Enjoys Share Price Bump As Bitcoin Halving Draws Closer

- Bitcoin Ordinals Launchpad Luminex’s New Collection Standard Cuts Inscription Costs By 90%

- Ethereum Launches Ethscriptions To Rival Bitcoin Ordinals

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage