Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has dropped a fraction in the past 24 hours to trade for $51,871 as of 1:25 a.m. EST time on trading volume that surged 45% over the last 24 hours.

As things stands, the Bitcoin price is 23% away from its all-time high of $69,000, recorded on Nov. 10, 2021.

#Bitcoin Price Drawdown from ATH – currently stands at -23% pic.twitter.com/upAGrYmgHG

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) February 20, 2024

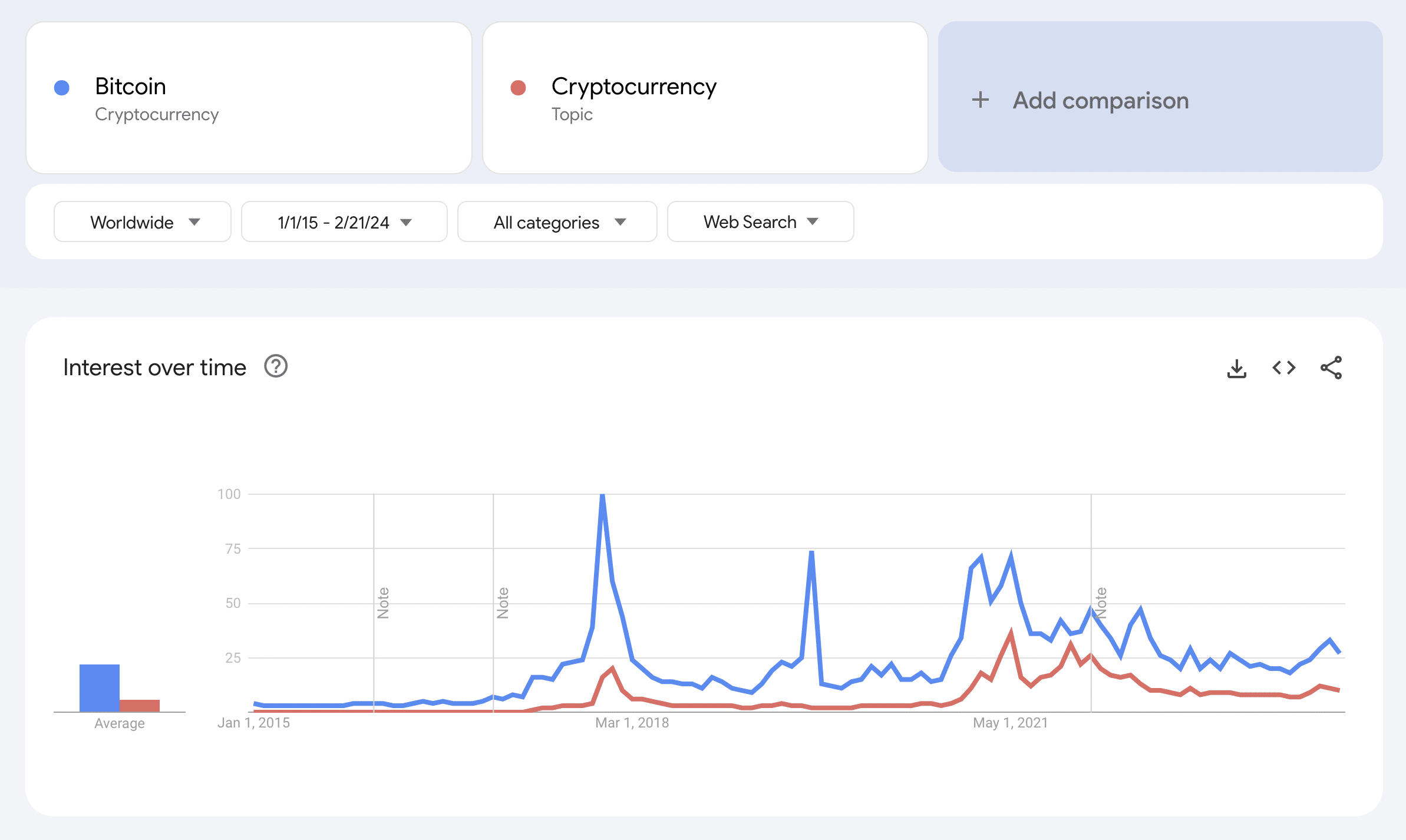

Nevertheless, retail investors appear absent despite BTC rising 242% over the last 15 months. This is unorthodox considering retail has predominantly been the main driver of previous bull runs so far. To put this in perspective, a Google Trends search shows there is low interest in this cycle.

Meanwhile, reports indicate that VanEck’s HODL, the firm’s spot BTC exchange-traded fund (ETF) product, recorded a striking rise in trading volume. The surge comes less than a week after VanEck indicated it would slash fees, but the massive spike was still surprising.

$HODL is going wild today with $258m in volume already, a 14x jump over its daily average, and it's not one big investor (which would make sense) but rather 32,000 individual trades, which is 60x its avg. Not sure how to explain.. maybe it was added to a platform over wknd ? pic.twitter.com/VTkjboS0ff

— Eric Balchunas (@EricBalchunas) February 20, 2024

Trading volume surged to $258 million, representing a 14X increase, ascribed to 32,000 individual trades. “This is 60X its average,” says Balchunas, adding that other ETFs that did well include WisdomTree’s BTCW and Blackrock’s IBIT.

BTCW recorded a trading volume of $154 million, which represents a 12X increase in the investment product’s average. It also constitutes a 25X increase on its assets ascribed to 23,000 individual trades. This is also unorthodox given that BTCW had posted only 221 trades on Friday.

More interesting-ness: $BTCW also popping off, $154m trades, 12x its avg and 25x its assets via 23,000 indiv trades. For context, it saw a mere 221 trades on Friday. At the same time $IBIT volume is elevated but not crazy like this. WTF? ETF Unsolved Mysteries will continue after… pic.twitter.com/IXQmCKuCWl

— Eric Balchunas (@EricBalchunas) February 20, 2024

Furthermore, BlackRock’s IBIT also saw a sizeable surge in trading volumes, which Balchunas described as among “unsolved mysteries.”

Bitcoin Price Prognosis Amid Skyrocketing Spot BTC ETF Trading Volumes

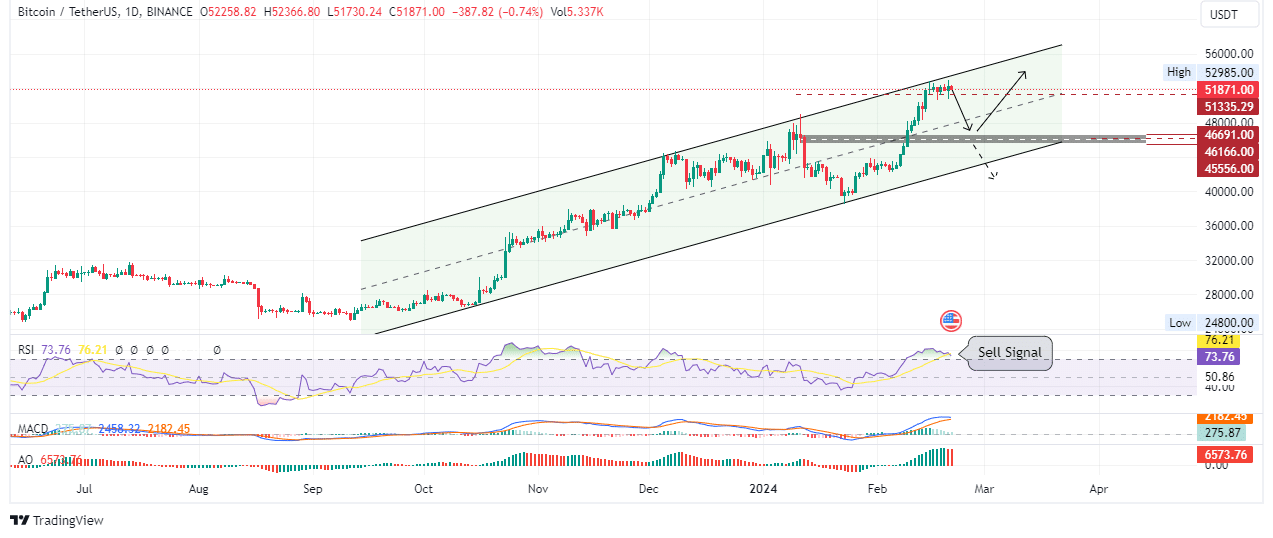

The Bitcoin price horizontal consolidation continues, with immediate support presenting at $51,335. A decisive candlestick close below this buyer congestion level could initiate a downtrend. This could see BTC break below the midline of the channel to test the supply zone turned bullish breaker between $45,556 and $46,691.

The bears could manage to haul the Bitcoin price below the midline (mean threshold) of the order block at $46,166. A close below this level on the daily timeframe would confirm the continuation of the downtrend.

If the supply zone holds as support, however, it could provide a good entry for sidelined and late investors before the Bitcoin price takes the next leg up. The most logical move in such a turn of events would be to clear the range high of $52,985, bringing the $56,000 milestone into focus.

In a dire case, the Bitcoin price could extend the fall below the lower boundary of the ascending channel to the $40,000 psychological level.

The Relative Strength Index (RSI) has already executed a sell signal crossing below the signal line (yellow band). Also, the histogram bars of the Awesome Oscillator (AO) are flashing red to show the bears gaining ground. This status is reinforced by fading histogram bars of the Moving Average Convergence Divergence (MACD) indicator. These features accentuate the bearish suposition.

TradingView: BTC/USDT 1-day chart

Converse Case

On the other hand, if buyer momentum increases at current rates, the Bitcoin price could shatter or break out from above the confines of the ascending parallel channel. This could set the pace for BTC to target the $55,000 milestone, or in a highly bullish case, extend the gains to the $60,000 psychological level.

The Bitcoin Price From An On-Chain Perspective

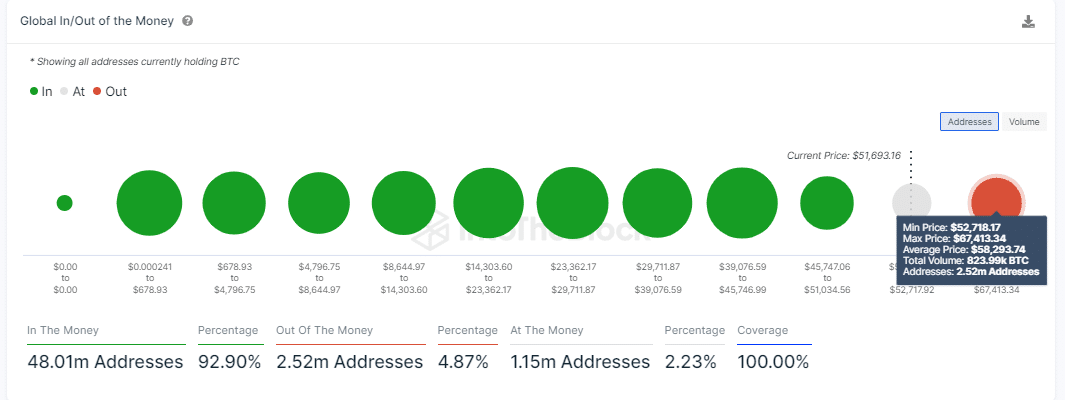

On-chain aggregator tool, IntoTheBlock, reveals key roadblocks and important support bases for the Bitcoin price. The Global In/Out of the Money (GIOM) metric shows that while BTC enjoys strong support downward, the region between $52,718 and $67,413 could deliver significant opposition to BTC upside potential. Here, approximately 2.52 million addresses holding around 823,990 BTC tokens would be looking to sell at breakeven prices of $58,293.74.

BTC GIOM

Also, 92.9% of BTC holders are currently sitting on unrealized profit (in the money). This is against 4.87% who are sitting on unrealized losses (out of the money). Meanwhile, only around 2.23% are breaking even (at the money).

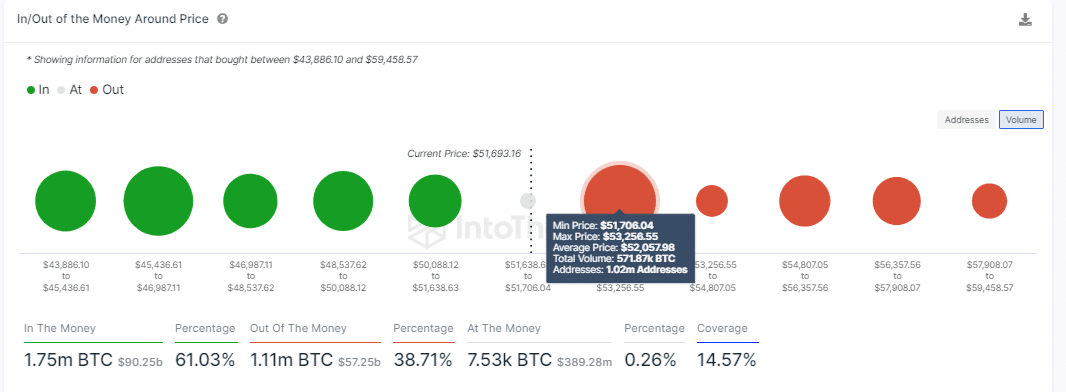

On the other hand, the In/Out of the Money Around Price (IOMAP) model puts initial resistance slightly lower between $51,706 and $53,256, where 1.02 million addresses hold approximately 571,870 BTC tokens bought at an average price of $52,057.98.

BTC IOMAP

Meanwhile, while the Bitcoin price continues to consolidate, investors are looking at the halving, an event expected to solidify the next directional bias for BTC. With it, proactive traders are buying BTCMTX, a project providing easy entry into the BTC market. The project is recording massive success in the presale with analysts including YouTuber Jacob Bury anticipating 10X growth potential.

Promising Alternative To Bitcoin

BTCMTX, ranked among analysts’ top choices for the five best cryptos to buy in 2024, is the powering token for the Bitcoin Minetrix project, which enables investors to mine BTC by staking their holdings.

Acknowledging the Simplicity of #BitcoinMinetrix 🔄#BTCMTX: Empowering users with secure funds and tradeable tokens they control.

Traditional Cloud Mining: Mired in intricate contracts and terms. 📝 pic.twitter.com/rS4J2h6du0

— Bitcoinminetrix (@bitcoinminetrix) February 20, 2024

Specifically, BTCMTX token holders stake their holdings for mining credits and then redeem or burn them for mining hash power. In so doing, it has decentralized and tokenized the entire process, enhancing convenience for community members.

Considering the contrast between mining #Bitcoin and buying $BTC? 💭

💡 Play a vital role in network expansion.

🔒 Gain greater control over the acquisition journey.

🔧 Deepen understanding of the technical complexities. pic.twitter.com/yJNEtUNY2K

— Bitcoinminetrix (@bitcoinminetrix) February 19, 2024

The project has revolutionized Bitcoin mining as we know it, and ensuring all third-party risks are eliminated. Other benefits include no hassles relating to heat, space, or cost, among others.

Embarking on a new era of cloud mining with #BTCMTX! 🚀

Users gather staking credits, managing their mining skills.#Ethereum network's smart contracts guarantee automatic, decentralized allocations, ensuring a secure and dependable mining experience. 🔗⛏️ pic.twitter.com/1SpVeCK2DN

— Bitcoinminetrix (@bitcoinminetrix) February 18, 2024

Bitcoin Minetrix is in the presale stage, where each token is selling for $0.0136. Investors can buy BTCMTX on the official website, with presale sales now reaching $11.259 million out of a target objective of $12.178 million.

Exciting news for the #Crypto mining industry! 🚀#PolarisTechnology unveils plans for a $100 million, 200MW data center in Muskogee, Oklahoma.

What opportunities do you think this development will bring to the local community?#BitcoinMinetrix has successfully raised more… pic.twitter.com/m6jQ29WJ1D

— Bitcoinminetrix (@bitcoinminetrix) February 20, 2024

Visit Bitcoin Minetrix to buy BTC MTX here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Bitcoin Held By Coinbase Plunges To $20 Billion, Lowest Since 2015

- Bitcoin Price Prediction: IntoTheBlock Says Five Catalysts, Led By The BTC Halving, May Drive Bitcoin To ATH In Six Months As This New ICO Heads For $12 Million

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage