Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price dropped 5% to trade for $65,098 as of 02:11 EST time on trading volume that surged 25%.

But even as the BTC price shows weakness, Standard Chartered says it might reach $150,000 by the end of 2024 and $250,000 in 2025, before settling at around $200,000.

🔸JUST IN: Standard Chartered raises #Bitcoin target to $150K this year and $250K for 2025. pic.twitter.com/lqzcljBm5A

— Bitcoin Archive (@BTC_Archive) March 18, 2024

It added that the Ethereum price will climb to $8,000 by the end of 2024 if the US approves a spot ETH exchange-traded fund (ETF).

The experts weigh in on GBTC!

Bitcoin Price to Hit $200,000 by 2025: Standard Chartered – Can Green Bitcoin Outperform BTC?https://t.co/w2mT4kp0fo

— GreenBitcoin (@GreenBTCtoken) February 19, 2024

The bank ascribed this ambitious forecast for Bitcoin to how spot BTC ETFs are performing relative to the price of gold after gold ETFs were introduced in the US. “We think the gold analogy – in terms of both ETF impact and the optimal portfolio mix – remains a good starting point for estimating the ‘correct’ BTC price level medium-term,” the bank said.

Standard Chartered also said it’s likely that a spot ETH ETF is approved by may 23, adding that this could attract inflows of as much as $45 billion in the first year, propelling the Ethereum price to nearly $8,000 by the end of 2024.

Bitcoin Price Outlook Following Standard Chartered’s Ambitious Forecast

Meanwhile, the Bitcoin price is on a load-shedding exercise, provoking a wider market crash. Data on CoinMarketCap indicates that the cryptocurrency market has lost around $230 billion in market capitalization in just six days. Specifically, it has moved from $2.89 trillion to $2.66 trillion.

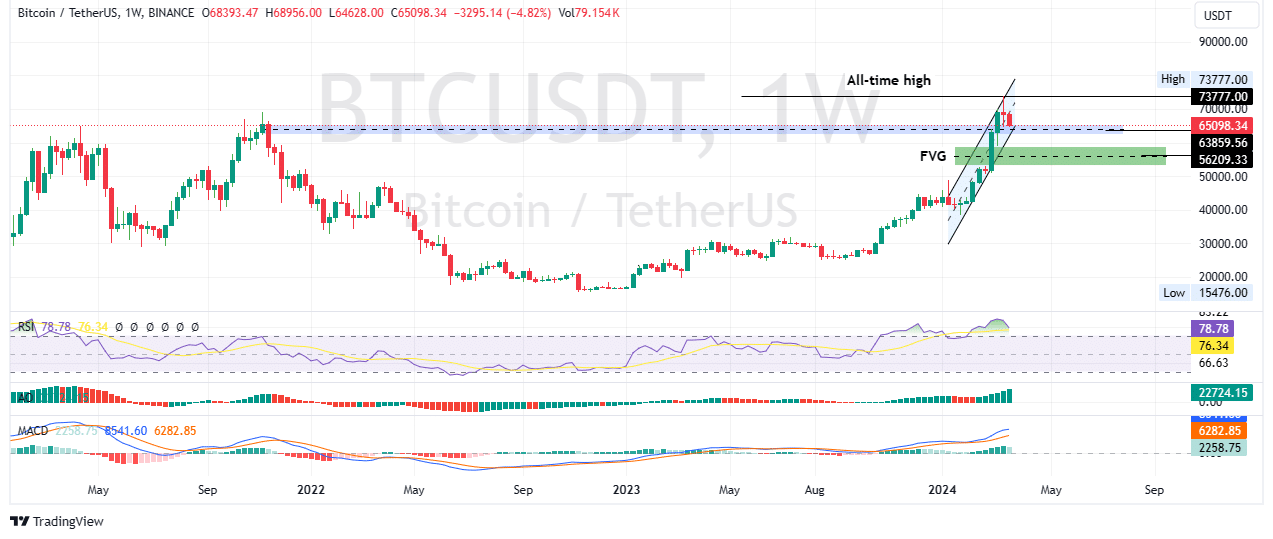

As the momentum in the Bitcoin price continues to fade, investors have started taking profits. With this, BTC price has slipped below the crucial support offered by the midline of the ascending parallel channel. It is now testing the upper boundary of the weekly supply zone at $65,519. If the Bitcoin price breaks and closes below the mean threshold of this order block at $63,859, it would confirm the continuation of the downtrend.

Such a directional bias could see the Bitcoin price roll over to the weekly imbalance, the Fair Value Gap (FVG), which stretches from $52,985 to $59,005.

The Relative Strength Index (RSI) supports the case to the downside, nose-diving to show falling momentum. The histogram bars of the Moving Average Convergence Divergence (MACD) are also fading showing the bullish cycle is waning as momentum eases.

TradingView: BTC/USDT 1-week chart

On the other hand, if the bulls recover the market, the Bitcoin price could push north, flipping the midline of the channel back into support. A decisive weekly candlestick close above this level would pave the way for a continuation of the trend. This could see the Bitcoin price extend to reclaim its $73,777 peak, or in a highly bullish case, shatter this blockade to hit the $80,000 milestone.

Elsewhere, while the Bitcoin price shows weakness, forward-looking investors are buying GBTC, a Bitcoin derivative currently in the early stages of its ICO.

Promising Alternative To Bitcoin

After raising over $6.2 million from investors drawn by Bitcoin season and the anticipated bull market, GBTC is on a tear. It is the powering token for the Green Bitcoin ecosystem, a predict-to-earn project built atop Ethereum’s infrastructure using the ERC-20 token standard. It is also a gamified staking platform with participants earning rewards by predicting Bitcoin price action.

As #Bitcoin approaches all-time highs, everyone on your feed is making predictions.

But Green Bitcoin is the only place where you can STAKE and EARN on those predictions! pic.twitter.com/yGgux4u9b9

— GreenBitcoin (@GreenBTCtoken) February 16, 2024

There are rewards for GBTC holders and up to 100% token bonuses for the daily and weekly BTC price prediction challenges.

The project also presents its sustainable staking model called ‘Gamified Green Staking,’ where users get to earn passive income through staking rewards that currently stand at 92% annually.

The distribution of $GBTC token rewards will occur at a rate of 1.6 $GBTC tokens per Ethereum (ETH) block. These rewards will be disbursed over 5 months, after which, Gamified Green Bitcoin Staking will be launched.

Did you know you can earn HUGE, simply by staking your Green Bitcoin?

If you haven't yet, go to our website and check out the Staking feature! pic.twitter.com/6wiv99ER0O

— GreenBitcoin (@GreenBTCtoken) February 25, 2024

Investors looking to buy GBTC can do so on the official website, where it is selling for $1.0682. This price tag will only last for about another four days before a price hike so get yours today.

To celebrate $6M we’re launching our GBTC GIVEAWAYS!

To enter, simply: Like + RT + Tag a friend!

The first prize is a $200 GBTC Airdrop. THERE WILL BE MANY MORE! Winner will be announced in replies in 24hrs. pic.twitter.com/k0sxIFOMnQ

— GreenBitcoin (@GreenBTCtoken) March 18, 2024

Also Read:

- Top Cryptos with Potential for 10x Returns in 2024 – Green Bitcoin, Scotty the AI, and Frog Wif Hat

- US Senators Urge SEC Chair Gary Gensler To Halt Crypto ETF Approvals Over “Enormous Risks”

- Why You Should Check Out Green Bitcoin (GBTC) – The Next 50x Token Taking The Market By Storm

- Green Bitcoin (GBTC) Is A Token You Don’t Want To Miss Out – Learn About Its Gamified Green Staking

- Best Crypto ICOs of 2024: Top Picks for Big Returns

Join Our Telegram channel to stay up to date on breaking news coverage