Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – May 17

BTC/USD rests above $9,700 after a retreat from the downside. Further downside momentum appears to be imminent but $9,500 may likely come out as support.

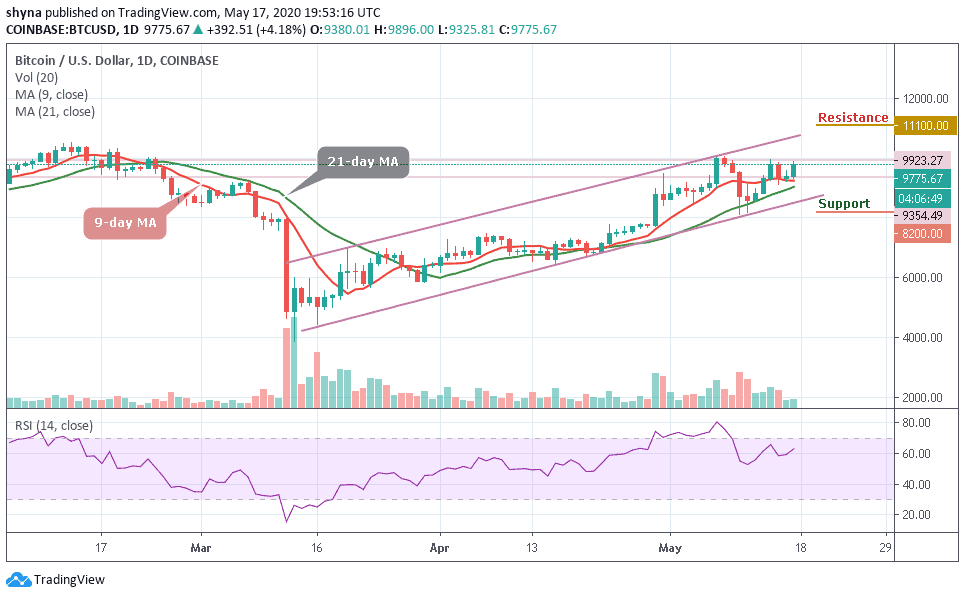

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $11,100, $11,300, $11,500

Support Levels: $8,200, $8,000, $7,800

BTC/USD has gone crazily bullish for over a few days now. For now, BTC/USD is dancing at $9,775.67 after gaining 4.18% of its value today. More so, where Bitcoin will go next after the impressive rally this week is likely to depend on the ability of the bulls to hold the price above the key support at $9,700.

Nevertheless, a further retracement seems imminent and it is likely to break below $9,500. Meanwhile, looking at the chart, $8,200, $8,000, and $7,800 serve as the major support levels, making room for BTC to fall even further. The technical indicator RSI (14) for the coin is still above the 60-level, suggesting more bullish movements as the 9-day MA signal line is above the 21-day MA.

As the daily chart reveals, if the bulls could put more effort and push the price above the upper boundary of the channel, BTC/USD may see resistance level at $10,000, any further movement could send it to the potential resistance levels of $11,100, $11,300 and $11,500 respectively as the technical levels remain positive.

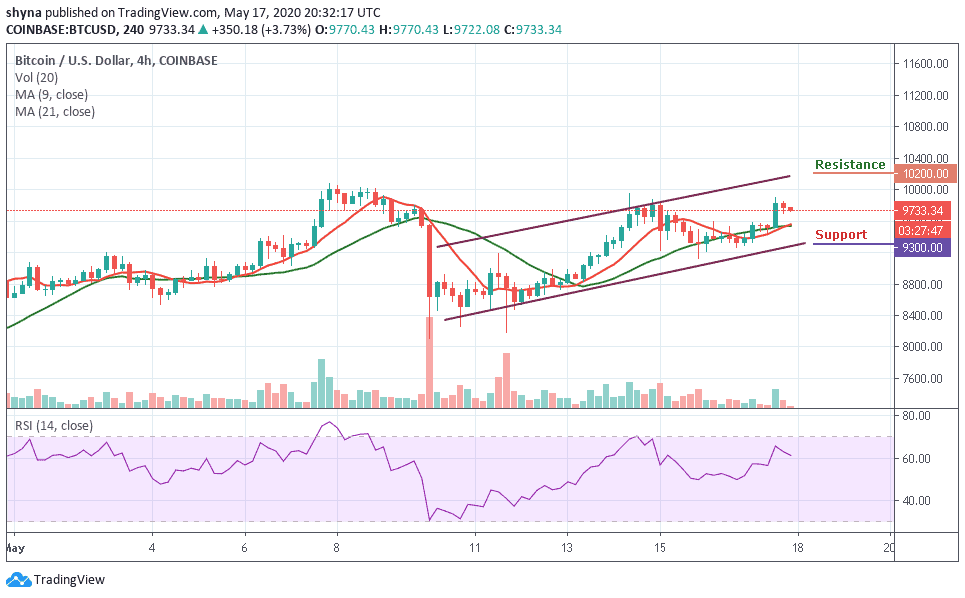

BTC/USD Medium-Term Trend: Bullish (4H Chart)

Looking at the 4-hour chart, the bears are about to step back into the market by bringing the price from $9,900 to $9,733, but the bulls are yet to hold the support at $9,700 which is still above the moving averages. Meanwhile, the $10,200 and above may come into play if BTC/USD breaks above the channel.

However, if the price breaks below the moving averages of the channel and begins to drop, the support levels of $9,300 and below may be in focus. Meanwhile, as the RSI (14) moves below 65-level, more bearish signals may play out before a rebound could come in.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage