Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – March 12

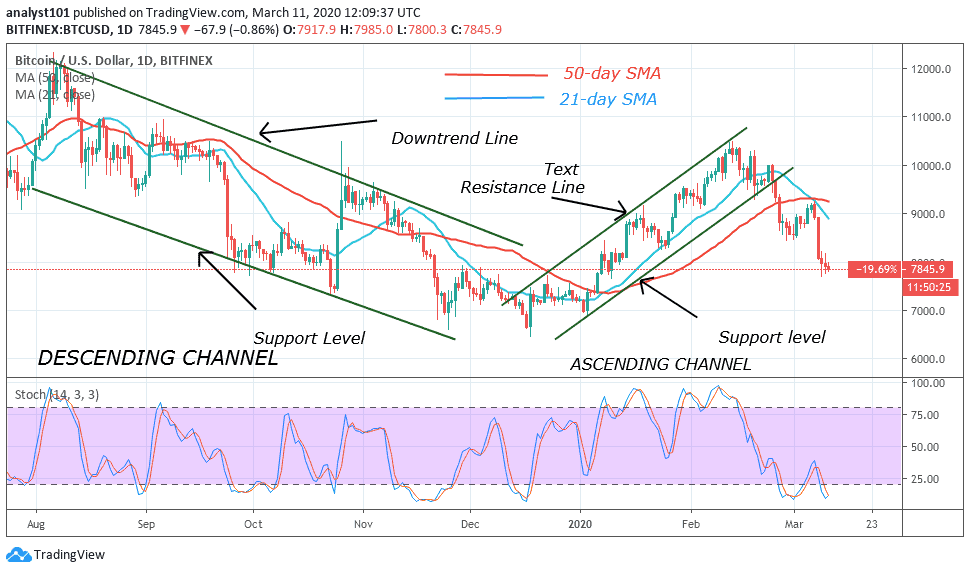

After the last breakdown on March 7, BTC/USD pair fell to a low of $7,700 on March 9. The price moved above $7,800 and resumed consolidation.

Key Levels:

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

Presently, the bulls have been defending the support zone of $7,700 and $7,800 for the past four days. In the meantime, the price is approaching the $7,700 low. It is anticipated that a bounce above the current support will push BTC to the next resistance above $8,400. Certainly, the bears must contest the price at that level. If the bulls succeed the market will move up to a high of $9,000. Conversely, if the bulls face an aggressive selling and turn back from the $8,400 resistance, BTC will drop down to $7,000 low.

Nonetheless, the market is still consolidating and a breakout or breakdown is unavoidable. Meanwhile, Bitcoin is still below 20 % range of the daily stochastic. This implies that Bitcoin has been in a bearish momentum and it is in the oversold region. It is expected that the bulls will emerge in the oversold region to push Bitcoin upward.

BTC/USD Medium-term Trend: Ranging (4-Hour Chart)

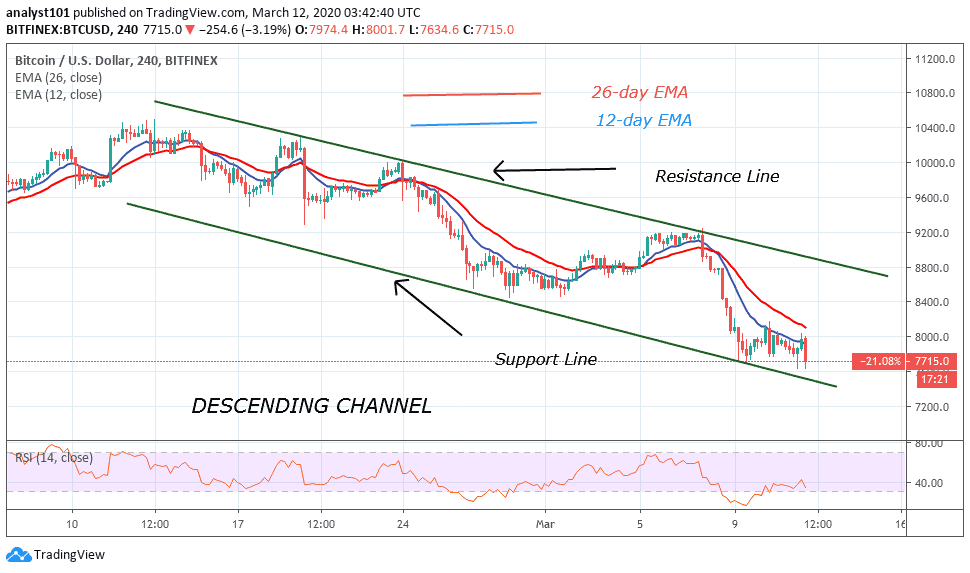

On the 4-hour chart, Bitcoin is in a period of consolidation between the zone of $7,700 and $7,800. Neither the bulls nor bears have the upper hand.

We are expecting a bounce at the low that will push BTC upward. Bitcoin may as well have a breakdown that will sink it to $7,000 low. The Relative Strength Index level 36 indicates that Bitcoin is approaching the oversold region of the market. It is also below the centerline 50 which invariably indicates that it may further fall.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage