Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – March 26

The Bitcoin price dropped slightly today but it is finding some form of support at the $6,505 level.

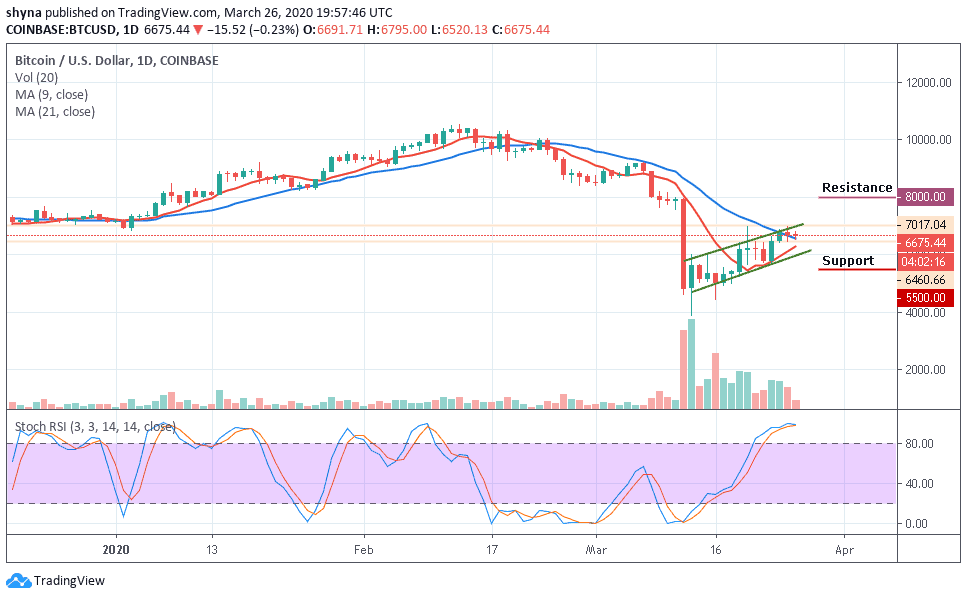

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $8,000, $8,200, $8,400

Support Levels: $5,500, $5,300, $5,100

Today, BTC/USD jumped ahead and faced a key resistance of $6,808 but was later rejected and now trading sideways. However, if BTC/USD continued to consolidate in this way, traders could soon see it breaking through the above-mentioned level of key resistance and it would then be obvious to target $7,000. More so, we could see a larger decline for the next two days if the downtrend continues to form in a pattern formation.

Currently, the market price for BTC/USD and the daily candle is trading above the 9-day and 21-day moving averages at $6,808 but if the bulls could push the price above the channel, the next resistance levels may be found at $8,000, $8,200 and $8,400. Typically when the uptrends are beginning to stand firm, traders will use the 9-day moving average as the nearest support level.

However, should in case the bulls fail to move the price up, we may see a price cut to $6,000 vital support. A further low drive could send the price to $5,500, $5,300 and $5,100 supports. For now, looking at the daily chart, the bulls are still defending critical support. But as things stand, the BTC/USD price may likely reverse again because the stochastic RSI is still moving within the overbought condition.

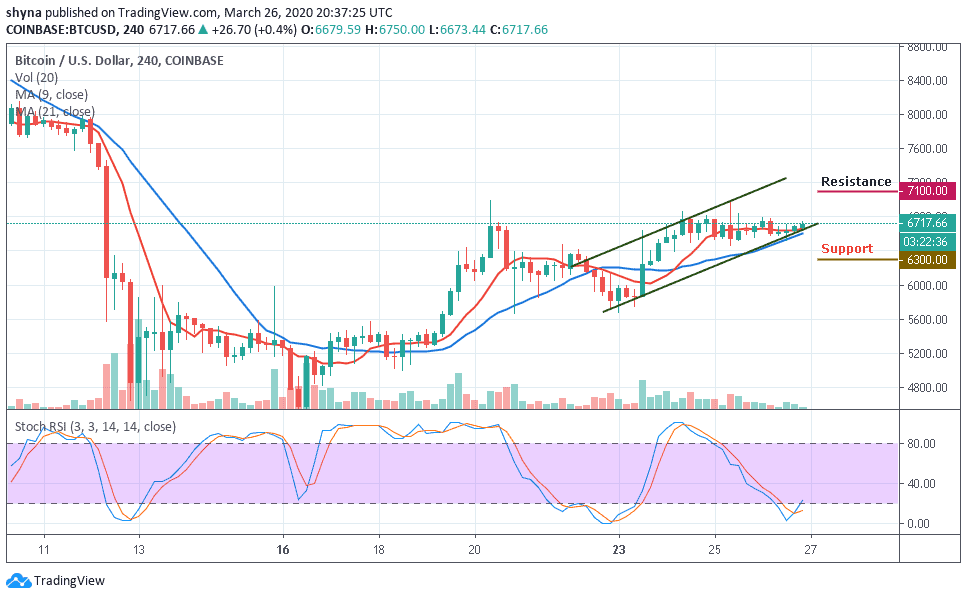

BTC/USD Medium-Term Trend: Ranging (4H Chart)

On the 4-Hour chart, BTC/USD trade in sideways. Nevertheless, the coin has not yet slipped below $6,500 and still in the loop of breaking above the moving averages. For now, BTC price hovers around $6,717 and may take time to persistently trade above $7,000 but the upward movement could near the $7,100 and $7,300 resistance level if the bulls regroup.

However, on the downside, immediate support is around the $6,600 level while the main support is at the $6,500 level. The price may likely fall below $6,400 if the bears step back into the market, a further bearish movement could test the critical support at $6,300 and $6,200 respectively. Meanwhile, the stochastic RSI is about moving out of the oversold zone, which may likely bring more bullish signals into the market soon.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage