Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin Price Prediction – May 19

The Bitcoin price failed to surpass the $46,000 and $46,500 resistance levels. As a result, BTC begins a fresh decline below the $40,000 support.

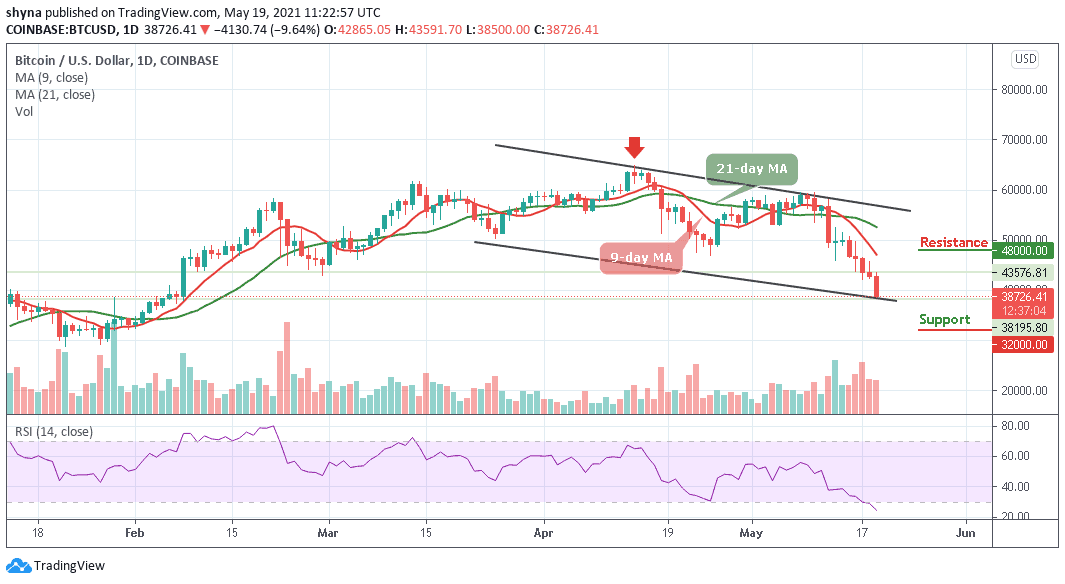

BTC/USD Long-term Trend: Bearish (Daily Chart)

Key levels:

Resistance Levels: $48,000, $50,000, $52,000

Support Levels: $32,000, $30,000, $28,000

BTC/USD has dumped to its lowest level since early February 2021 as more selling pressure has mounted up. Yesterday’s Asian trading session has seen the Bitcoin price tumbled below $40,000 for the first time since February 6. Therefore, the coin dropped to a low of just below $39,000 a couple of hours ago. Moreover, the first digital asset is currently hovering at $38,726 after touching the low of $38,500 support.

Bitcoin Price Prediction: BTC Price Could see a Further Drop

The Bitcoin (BTC) and other major cryptos as seen on the coin market cap have caught a bearish fever in the last few hours. With Bitcoin price moving towards the south, the first 10 cryptocurrencies listed on the coin market cap fall drastically in price. The crypto market is experiencing a serious downtrend as the 9-day moving average remains below the 21-day moving average. On the other hand, if the Bitcoin price crosses above the 9-day moving average, it could locate the potential resistance at $48,000, $50,000, and $52,000 levels.

Bitcoin price was rejected at the important level above $43,591; much like it was at $45,851. However, with $40,000 as the new psychological barrier to the bull-run, any movement below it now is a bear territory, and bulls will need to stay on their toes. However, if a deeper correction follows here, it could be considered extremely unhealthy for BTC/USD as the critical supports are located at $32,000, $30,000, and $28,000. The technical indicator Relative Strength Index (14) is now within the oversold region to confirm the bearish trend.

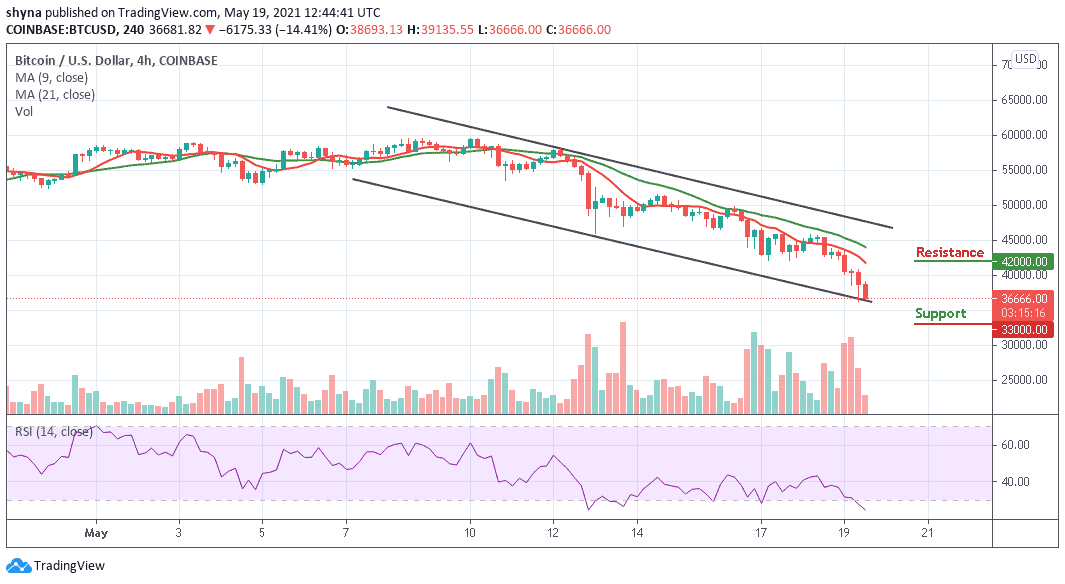

BTC/USD Medium – Term Trend: Bearish (4H Chart)

Looking at the 4-hour chart, BTC/USD is seen on a downward move and the coin may continue to depreciate if the $36,500 support is broken. However, the 9-day moving average remains below the 21-day moving average and the Bitcoin price may continue to fall and could reach the critical supports at $33,000, $31,000, and $29,000 respectively.

Meanwhile, if the bulls can hold the current price tight, BTC/USD may likely cross above the moving averages to hit the potential resistance at $42,000, $40,000, and $38,000 levels. The Relative Strength Index (14) is now moving into the oversold zone, indicating more bearish signals into the market.

Join Our Telegram channel to stay up to date on breaking news coverage