Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – April 07

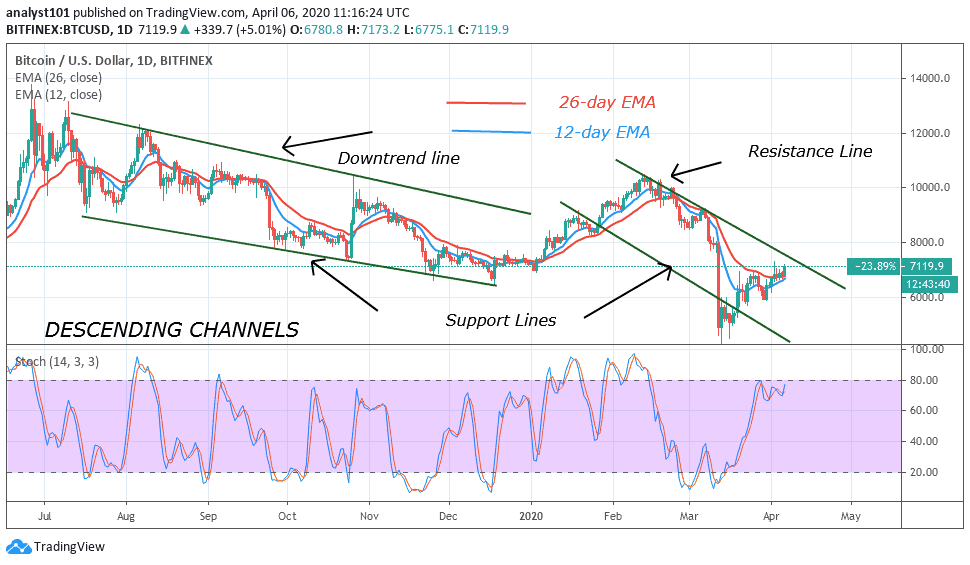

Yesterday, Bitcoin has finally broken above the $7,000 overhead resistance. The market shot up from the low of $6,775 to $7,403. The current move will extend to a high of $8,000 and $9,000 if the current price level is sustained.

Key Levels:

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

After the breakage of the overhead resistance, Bitcoin runs into the $7,400 resistance zone. The market is respecting the previous historical price level. Bitcoin was in consolidation above $7,400 price level between November and early January before the resumption of an uptrend. In that uptrend, the market reached the $10,000 overhead resistance in February.Today, the upward move has resumed and we expect the uptrend to surpass that level in February. Similarly, the bulls have broken the resistance line of the descending channel. This explains the fact that there is a change as price breaks and closes above the resistance line. Bitcoin is likely to continue its upward move. In addition, Bitcoin is approaching the overbought region above the 80% range of the daily stochastic. BTC is in a strong bullish momentum.

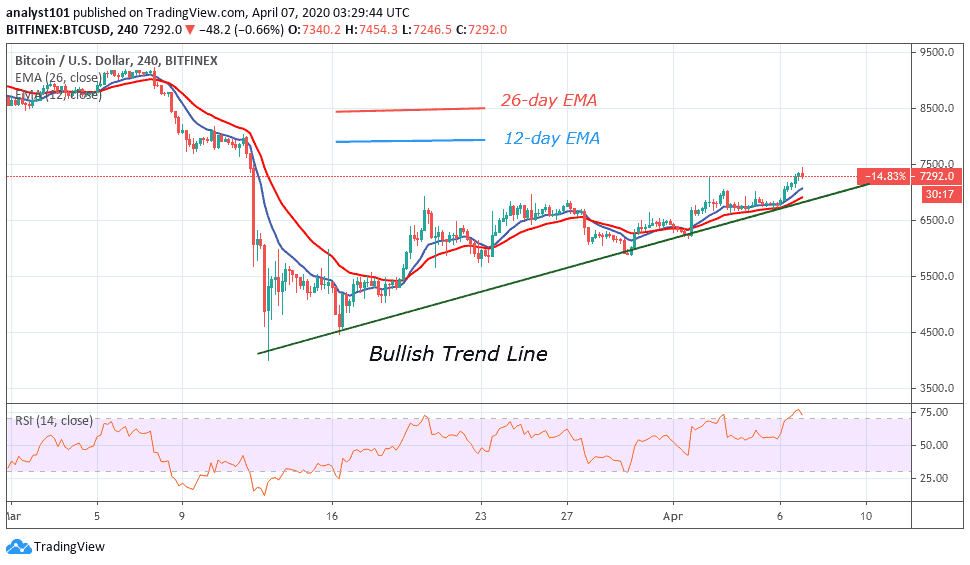

BTC/USD Medium-term Trend: Ranging (4-Hour Chart)

On the 4 hour chart, a bullish trend line is drawn showing support levels of price. BTC has rebounded above the support of the trend line and reached a high of $7,400. There is a likelihood of continuous upward move but BTC will face resistance at $7,800 price level. Meanwhile, Bitcoin has risen to level 78 of the Relative Strength Index period 14. This implies that Bitcoin has reached the overbought region of the market. There is a likelihood of the presence of sellers to emerge to push the coin downward.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage