Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price is up 5% in the last 24 hours to trade for $42,776 as of 12:40 a.m. EST time.

The king of cryptocurrency is showing strength again with tailwinds sprouting from the Federal Open Market Committee (FOMC) meeting. Federal Reserve chair Jerome Powell shifted decisively to a more dovish outlook for next year, indicating an historic monetary tightening is ending and saying rate increases were ”not the base case anymore.”

Bitcoin Price Reacts To FOMC Minutes As Monetary Tightening Era Ends

During the last press conference in early November, Fed chair Powell said that FOMC members were not even thinking about cutting interest rates. But yesterday he indicated that the FOMC members have been thinking about cuts for some time.

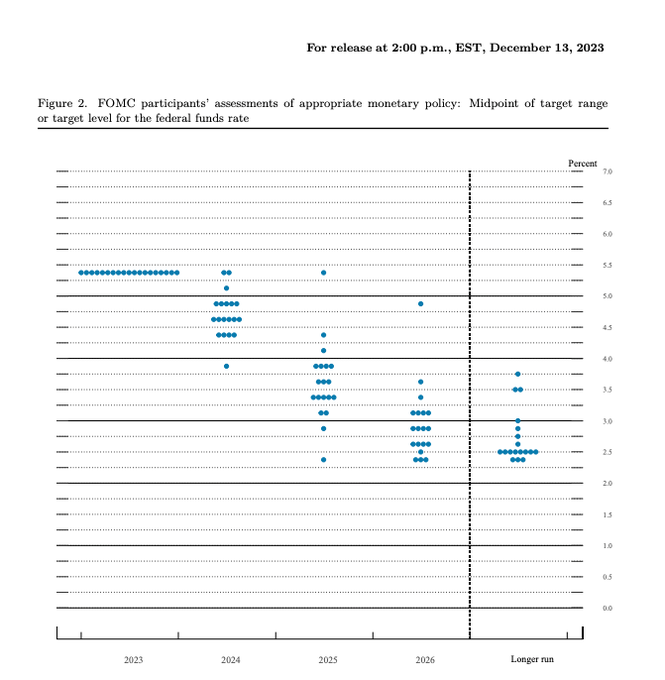

Keeping the interest rates unchanged at 5.25 – 5.50% for the third consecutive time, the November minutes were a sideshow. Focus is on the dot plots, which moved from 2 cuts to 3 cuts next year.

Based on the above plot, one FOMC member sees 6 rate cuts in 2024, while four see 4 cuts. Meanwhile, six see 3 cuts, five see 2 cuts; one sees 1 cut, and two see 0 cuts. To some, this may yet be the most confused “year ahead” FOMC seen in years.

When interest rates drop, investors tend to seek out where they can get better rates. The risk asset that will benefit most is crypto. This is basically a massive liquidity injection.

Last night, FED announced that there will be no change in the interest rates, and kept it steady.

Now, how did that affect #Bitcoin?

Well, firstly, people were already expecting that there will be no change in interest rates in this FOMC meeting, so the impact of this news was… pic.twitter.com/BIphninyPF

— Karan Singh Arora (@thisisksa) December 14, 2023

With this, some analysts and traders have revised their targets, with Michael Van de Poppe saying he is looking at $47,000 to $50,000 for his pre-spot ETF run.

FOMC is done, dovish stance and most likely rate cuts + the high on the interest rates is in.

For #Bitcoin, risk-off before FOMC took place. Bounce back upwards and I think, the trend is going to continue going up. My overall target for this pre-spot ETF run is $47-50K. pic.twitter.com/SU4Xs3djlw

— Michaël van de Poppe (@CryptoMichNL) December 13, 2023

Bitcoin Price Outlook As Volatility Skyrockets In The BTC Market

Bitcoin price is trading with a bullish bias despite the recent pullback, nurturing a recovery rally. The Relative Strength Index (RSI) is moving north, signaling rising momentum, which is a bullish signal. Similarly, the Awesome Oscillator (AO) remains in the positive territory, supporting the case for the bulls.

Increased buying pressure could see Bitcoin price extend to clear the range high of $44,700. In a highly bullish case, the gains could extrapolate for BTC to whiplash the $48,000 psychological level. Such a move would constitute a 10% climb above current levels.

On the flip side, if profit-taking kicks in, Bitcoin price could drop, possibly flipping the $40,000 psychological level from a support floor to a resistance. In the dire case, the slump could see BTC descend to tag the $30,000 level, at which point the current bullish outlook would be threatened.

Meanwhile, amid the growing frenzy in the Bitcoin market, now is the ideal time to buy BTCETF as the countdown to the expected approval of spot BTC exchange-traded funds (ETFs) closes in. The project is well ahead in its presale with experts anticipating 10X growth potential at launch.

Promising Alternative To Bitcoin

BTCETF is the powering token for the Bitcoin ETF Token ecosystem, the only project that rewards token holders as ETFs are approved.

https://twitter.com/BTCETF_Token/status/1734860770268111245

Each BTCETF token is selling for just $0.0068 as presales sales now boast an outstanding $3.931 million in USDT collections.

Visit Bitcoin ETF Token website to buy BTCETF in the presale here.

Also Read:

- How To Buy Bitcoin ETF Token On Presale – Alessandro De Crypto Video Review

- Could Bitcoin ETF Approval Spark a 10x Surge in Bitcoin ETF Token at Launch?

- Bitcoin ETF Token: Final Chance To Grab At Lowest Price Before Bull Run Ignites As Investors Pump $3.7m Into $BTCETF

- BTC Price Set To Soar Past $50K As Crypto Traders Flock To Bitcoin ETF Token Following Bumper $2.5 Million Fundraising

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage