Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has exploded 10% in the last 24 hours to trade for $62,465 as of 5:40 a.m. EST time on a 98% surge in trading volume.

Amid heightened interest in the BTC token, a report by on-chain market intelligence firm Glassnode indicated that the levels of BTC supply over the counter (OTC) had plummeted to depletion levels.

#Bitcoin probability of reaching $61K is high given the supply constraint on the OTC desk.

OTC desk supply is at its lowest level in 6 years which will push to buy $BTC at the public exchange.

Institutions are here for real folks! pic.twitter.com/eV4hsZOKSW

— Mikybull 🐂Crypto (@MikybullCrypto) February 28, 2024

Such a turnout could force institutions to buy Bitcoin from public exchanges, with the ensuing demand pressure likely to send the Bitcoin price further north. The depletion of BTC tokens over the counter is attributed to institutional demand, inspired by interest in spot BTC exchange-traded funds (ETF) investment products.

#Bitcoin manages to reach a $670 million net inflow.

Mostly, this is coming through Blackrock's ETF and interest.

The price is $62,600, with insanely strong movements before the halving.

What to look for?

If a correction happens, I aim at $46K or $53K for longs. pic.twitter.com/4l8W1ukBy7

— Michaël van de Poppe (@CryptoMichNL) February 29, 2024

This is so much so that Bloomberg Intelligence ETF specialist Eric Balchunas recently indicated that the allure of BTC ETFs has surpassed that of Gold, adding that there is a decent chance that the assets under management (AUM) for Bitcoin ETFs could surpass those of Gold ETFs in less than two years.

Gold's Pain is Bitcoin ETFs' Gain in Store of Value Smackdown.. new from me on how gold being in the gutter is like the cherry on top for bitcoin fans who just got to witness the biggest ETF launch ever. Decent chance bitcoin ETFs pass gold ETFs in aum in less than 2yrs w… pic.twitter.com/rXJra1dyhF

— Eric Balchunas (@EricBalchunas) February 26, 2024

The bullish sentiment seen in the Bitcoin price has analysts impressed by the trajectory, with one saying, “Bitcoin [price] has not seen a correction of more than 5%” for over a month. @DaanCrypto also recognizes that Bitcoin is on track for its second-best February in its history.

#Bitcoin Is on track for it's second best February in its history.

The best year that's tracked was 2013 with a +62% gain. But back then, price was trading at ~$30 so arguably MUCH less impressive. pic.twitter.com/m6Rga3rwL6

— Daan Crypto Trades (@DaanCrypto) February 29, 2024

Rich Dad Poor Dad author Robert Kiyosaki says Bitcoin is doing its job to dethrone the dollar and restore integrity to money. With the BTC ETFs making headlines in the US market, CNBC host of Mad Money Jim Cramer says an ETH ETF could come soon.

Given the success of the bitcoin etf it's pretty obvious that an ethereum etf will soon bloom

— Jim Cramer (@jimcramer) February 28, 2024

Morgan Stanley Wants A Piece Of The Spot Bitcoin ETF Cake

Meanwhile, Morgan Stanley, one the most important financial consultancies globally with up to $1.3 trillion in assets under management (AUM), predicts that cryptocurrencies will disrupt the global financial system in 2024.

With this in mind, CoinDesk reported that the firm is conducting due diligence on whether to add a spot Bitcoin ETF product to its brokerage platform. The company is a leader in alternative investments and private markets, with more than $150 billion in assets under management.

JUST IN: Morgan Stanley is now considering offering spot #Bitcoin ETFs to customers of its large brokerage platform. pic.twitter.com/TUQwKGkaWw

— Bitcoin Magazine (@BitcoinMagazine) February 28, 2024

Based on the report, the firm has started adding Bitcoin ETF language to its filings with the US Securities and Exchange Commission (SEC) for its in-house investment arm. Citing an excerpt from Wednesday’s filing for the Morgan Stanley Europe Opportunity Fund, “The Fund may obtain investment exposure to Bitcoin indirectly through investing in Bitcoin ETFs.”

Several Morgan Stanley funds have collectively been one of the largest holders of Grayscale’s GBTC.

Bitcoin Price Outlook As BTC ETF Narrative Drives Markets

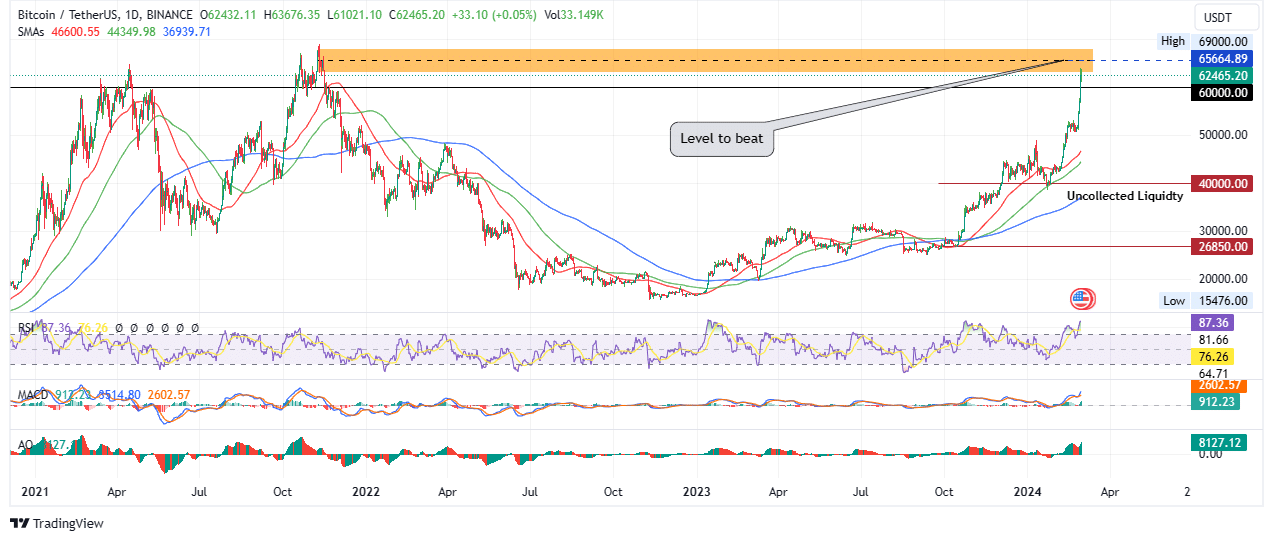

The Bitcoin price is trading within the supply zone that extends between $62,905 and $68,212. To confirm the continuation of the uptrend, the price must flip the $65,664 resistance to a support level. Such a move would pave the way for a flip of the supply barrier into a bullish breaker, effectively providing the jumping-off point for the king of cryptocurrency to reclaim its all-time high above $69,000. As it stands, BTC is only 9% away from its peak price.

At 87, the Relative Strength Index (RSI) shows BTC is already massively overbought. However, considering this momentum indicator is still inclined north, buying pressure continues to increase. This coupled with the strong presence of the bulls in the BTC market, seen with the Awesome Oscillator (AO) and the Moving Average Convergence Divergence histogram bars in positive territory, accentuates the bullish supposition.

TradingView: BTC/USDT 1-day chart

On the other hand, if the supply zone holds as a resistance level, the Bitcoin price could suffer rejection. This could send the BTC price back to the $50,000 milestone.

However, as Bitcoin pumps, a new project called Green Bitcoin is attracting increasing investor attention.

Promising Alternative To Bitcoin

GBTC is the ticker for the Green Bitcoin ecosystem, serving as an environmentally conscious alternative to Bitcoin. It integrates Bitcoin’s legacy with the eco-friendly features that are characteristic of the Ethereum network.

Green Bitcoin is now NUMBER 1 on the list of BEST CRYPTO PRESALES!https://t.co/Ng4Su8wA0W

— GreenBitcoin (@GreenBTCtoken) February 27, 2024

The project introduces a prediction game that allows users to earn $GBTC rewards via the revolutionary Gamified Green Staking mechanism. This is called ‘Gamified Green Staking’ and allows users to earn passive income through staking rewards.

Some analysts rank Green Bitcoin among the best penny crypto investments, while crypto analyst and YouTuber Jacob Bury rates it one of the best crypto altcoins to buy before the 2024 Bitcoin halving.

So far, funds raised have soared past $1.249 million as it races towards its $1.475 million target.

Investors looking to buy GBTC can do so on the official website. The token is currently selling for $0.5362, a price tag that will hold for less than five days before an increase.

Also Read:

- Could This New Meme Coin 10X Your Investment in the Upcoming Bull Run?

- CryptoTV Reviews the BTC-Inspired Predict-To-Earn Crypto with High Upside Potential

- How To Buy Green Bitcoin On Presale – Alessandro De Crypto Video Review

- Cilinix Crypto Presale Update of Two Bitcoin-Related Altcoin – Bitcoin Minetrix and Green Bitcoin

Join Our Telegram channel to stay up to date on breaking news coverage