Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is up almost 1% in the past 24 hours but down 5% in the last week to trade for $66,409 as of 05:22 a.m. EST time.

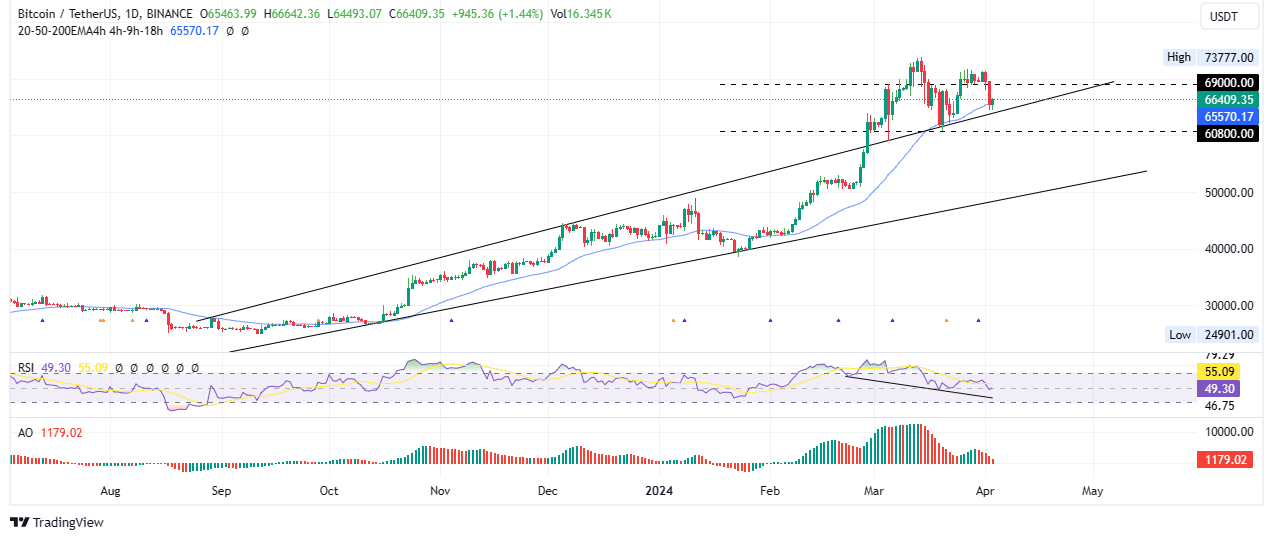

The 200-day Exponential Moving Average (EMA) is continuing to hold after providing formidable support for the Bitcoin price over the last six months, analyst Ali Martinez told his 56K followers in a post on X. If it breaks, the downside momentum for the Bitcoin price could extend, much like happened around mid-January.

The 200EMA on the #Bitcoin four-hour chart has been formidable support. Since early February, it has prevented #BTC from dropping further.

For this reason, I'm paying close attention to this level because if it holds, it guarantees a rebound, but if it breaks as it did in… pic.twitter.com/cnfruT9wUJ

— Ali (@ali_charts) April 2, 2024

Bitcoin Price Dumps As BTC RSI Slips Beneath 50 Mean Level

The upward momentum for the Bitcoin price remains slim to none, as seen with the position of the Relative Strength Index (RSI). Notably, this momentum indicator is below the ‘50’ mean level.

The last time this was seen was around the last week of January before spot HTC exchange-traded funds (ETFs) inflows started going berserk. Then, the Bitcoin price was around the $41,800 level.

NEW: 🔸Bitcoin RSI is back under 50 and has reset to levels last seen when #Bitcoin was $41,800, just before the ETF inflows really took off!

Get ready for the next leg up! 🚀 pic.twitter.com/MwtqJspDET

— Bitcoin Archive (@BTC_Archive) April 2, 2024

Meanwhile, all eyes remain peeled on the Bitcoin halving, out just over two weeks. With this optimism, BTC ETF inflows have started to read positive again after a prolonged slowdown, which catalyzed the dump in the Bitcoin price.

🚨LATEST: Weekly ETF Flows Are Positive Again!

After last week’s outflows this is very promising to see.

Don’t be fooled by the little shakeout, the bigger picture remains the same.

6-figure #Bitcoin is coming soon!!! pic.twitter.com/CoQKTMf7jb

— Kyle Chassé (@kyle_chasse) April 2, 2024

With the positive ETF flows inspiring hope in the market, reports have also indicated that the Bitcoin ETFs are likely to be integrated into the UBS platform. The firm boasts up to $3.5 trillion in assets under management (AUM).

UPDATE: sources saying that #Bitcoin ETF’s will be added to @UBS platform next week and widely available.

– removal from PWM silo.

– removal of ‘unsolicited’ order restriction.

– @UBS manages $3.5T in global wealth.— Andrew (@AP_Abacus) April 2, 2024

The integration of Bitcoin ETFs would mark a landmark shift in traditional finance as it points to more adoption for BTC and crypto in general from wealthy individuals.

Since the landmark approval of multiple spot BTC ETFs in January, the cryptocurrency adoption curve has steepened, with big players capitulating to the allure of crypto.

One analyst, @CryptoMichNL on X, says that the consolidation of the Bitcoin price and BTC peaking as part of the pre-halving rally are “Two essential ingredients and I think we won’t be seeing a new ATH pre-halving.”

#Bitcoin consolidating and #Bitcoin peaking pre-halving.

Two essential ingredients and I think we won't be seeing a new ATH pre-halving.

If Bitcoin dips further in the Summer, I'll be happy to be buying it at $56-60K.

It's still altcoins time. pic.twitter.com/CongTohvNA

— Michaël van de Poppe (@CryptoMichNL) April 3, 2024

Bitcoin Price Prediction Amid Growing Institutional Adoption For BTC

For now, there remain conflicting sentiments among analysts and traders of how the next few days before the halving would be for BTC price. History and experience, however, tell us that sentiment is often the best indicator. The best signal for sentiment in a volatile market is a pullback.

With the 200-EMA holding as support for the Bitcoin price, the latest pullback could be setting the stage for a pre-halving rally. There is a caveat! The Bitcoin price must first flip the $69,000 roadblock into support on the daily timeframe and hold steady above it. This would be the first sign that a new all-time high is looming.

Such a move would encourage additional buy orders, especially among the risk-averse traders who are waiting for a safer entry.

Not buying yet…

— Ran Neuner (@cryptomanran) April 2, 2024

The ensuing buying pressure could fuel further upside for the Bitcoin price, likely enough for it to reclaim the $73,777 peak. In a highly bullish case, the Bitcoin price could extend the climb to record a new peak above the $74,000 range.

TradingView: BTC/USDT 1-day chart

On the other hand, the RSI has recorded lower lows while the Bitcoin price is recording higher lows. Analysts interpret this as a hidden bearish divergence. If it executes, the Bitcoin price could confirm the loss of the support due to the 200-day EMA at $65,570 by breaking below the upper boundary of the governing chart pattern.

Such a move could see the Bitcoin price provide another buying opportunity around the $60,800 level.

Meanwhile, experts are also looking at BTCMTX, a Bitcoin derivative analysts say has the potential for 10X gains on launch.

Analysts also rank it among their top choices for penny cryptos with the potential for explosive growth.

Promising Alternative To Bitcoin

Ahead of the expected BTC halving, BTCMTX presents itself as the most promising alternative to Bitcoin. It is the powering token for the Bitcoin Minetrix ecosystem, a cloud-mining project making Bitcoin ownership achievable even for the ordinary folk.

#BitcoinMinetrix introduces a tokenized cloud mining platform, enabling regular individuals to participate in decentralized $BTC mining. 🌟

Effectively eradicating the risk of third-party cloud mining scams and granting full control over operations. 🔐 pic.twitter.com/5oWTwsR75v

— Bitcoinminetrix (@bitcoinminetrix) April 2, 2024

The project operates as a tokenized cloud-mining platform where community members can mine BTC in a decentralized fashion.

#BTCMTX presents a reliable cloud mining solution designed for all #Crypto fans.

Previous worries about hardware and scams have discouraged numerous individuals.

This decentralized approach guarantees a clear and secure mining adventure. 🌟🔐 pic.twitter.com/A0IVhRLOnw

— Bitcoinminetrix (@bitcoinminetrix) April 1, 2024

Bitcoin Minetrix is in the presale stage, allowing interested investors to buy BTCMTX for $0.0144 per token.

Just 3 days remaining until Stage 35 of #BitcoinMinetrix wraps up! ⏳

Do you think government regulations have a significant impact on #Bitcoin mining? 🏛️ pic.twitter.com/aiLtMxZy7h

— Bitcoinminetrix (@bitcoinminetrix) April 2, 2024

So far, presale sales have reached upwards of $12.8 million out of a target objective of $13.7 million.

#Iceland faces a unique dilemma: balancing #Bitcoin mining with food sustainability. 🌍

Prime Minister @katrinjak highlights the nation's crossroads.

How can Iceland leverage renewable energy for mining while ensuring food self-sufficiency?#BitcoinMinetrix has achieved… pic.twitter.com/U3MuM1Esr2

— Bitcoinminetrix (@bitcoinminetrix) March 26, 2024

Token holders can stake their holdings for mining credits and then redeem these credits for mining hash power.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Official Oboypapi Shares a New Way to Earn Bitcoin with the Bitcoin Minetrix Stake-to-Mine Approach

- Filipino YouTuber ALROCK Reviews the New Stake-to-Mine Crypto – Bitcoin Minetrix

Join Our Telegram channel to stay up to date on breaking news coverage