Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price plunged nearly 4% to trade for $40,033 as of 1:05 a.m. EST time, but trading volume surged 125%.

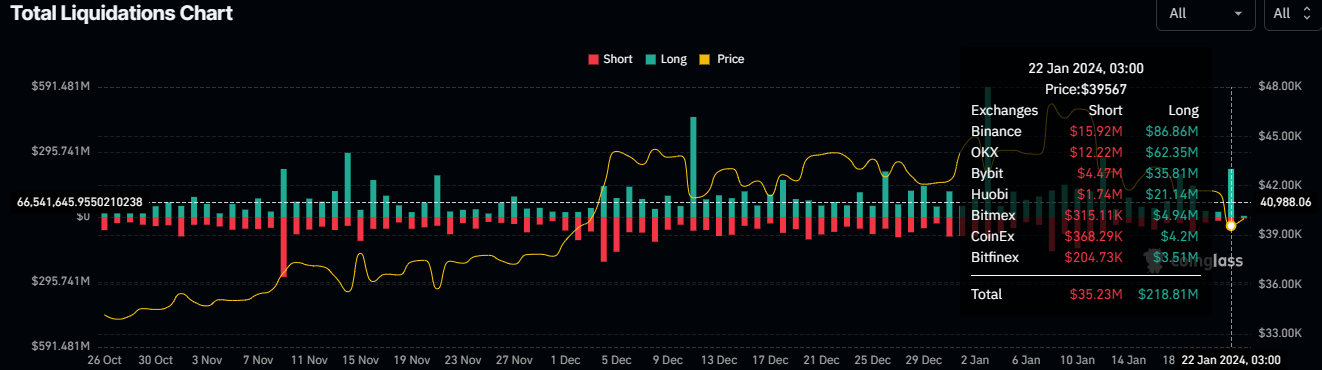

The move saw over $218 million in long positions liquidated against $35.23 million in short positions.

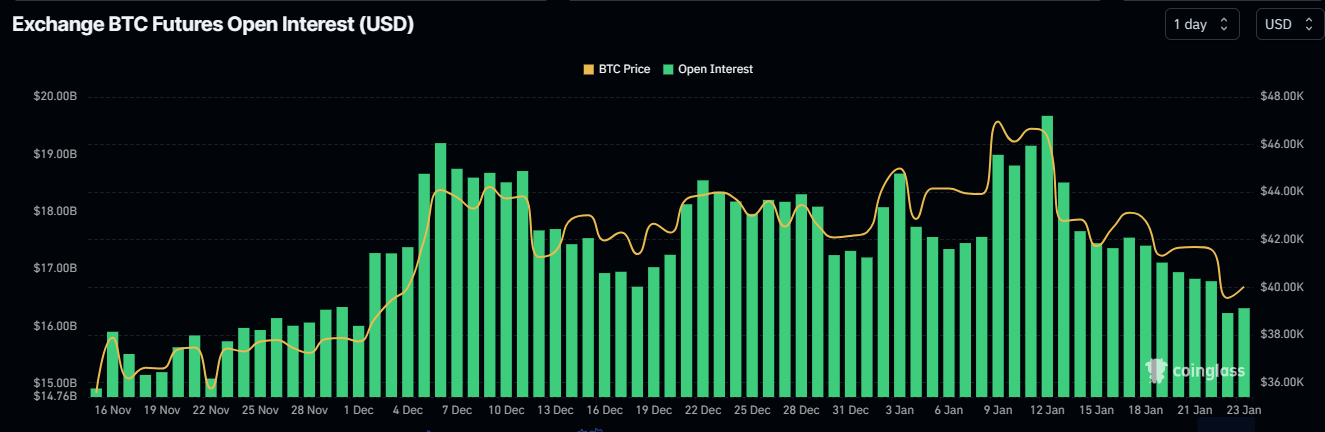

The move saw up to $480 million in open interest wiped out of the market, moving from$16.79 billion to $16.31 billion between January 22 and 23.

The drop comes amid rising volatility in the market, with altcoins also suffering in the aftermath of the crash in the Bitcoin price.

The surging volatility could extend until the market is certain that the Bitcoin price has bottomed out. Some analysts say the surging volatility is because of the “big players” in the BTC market ushered in by the landmark approval of spot Bitcoin exchange-traded funds (ETF) applications on January 10.

BTC drops 3% and everyone is in a full blown panic lmao

Ya'll wanted the ETF right?

Didn't you realize you were letting the worlds greatest market manipulators, into your private house of BTC?

What did you expect would happen ?

I predict WAYY more volatility, now that the big… https://t.co/Cdhr8ixXA1

— 💎FranksRevenge🐸.Eth ✝️🐸🟪 (@FrankClientele) January 22, 2024

Elsewhere, there is a faction of traders who say the dip was a healthy correction, sending the Bitcoin price to collect the buy-side liquidity below the $40,726 level.

Downside liquidity taken.

Pullback now -20%, on par with the previous corrections in this cycle.

Strong close today and I'm confident the bottom is in. #Bitcoin pic.twitter.com/tQTTdLR8WV

— Jelle (@CryptoJelleNL) January 22, 2024

The healthy correction thesis could be right, seeing as the Bitcoin price is nurturing what could be a recovery rally. It is recording a green candlestick after multiple red Japanese candles.

Bitcoin Price Could Face A Short Squeeze

Elsewhere, since the BTC exchange-traded funds (ETFs) started trading on January 11, investors have moved billions of dollars worth of Bitcoin out of the Grayscale spot ETF (GBTC).

A Coindesk report, which cited people close to the matter, revealed that much of these outflows were attributed to FTX liquidators selling 22 million shares worth. These were worth nearly $1 billion and took FTX’s GBTC ownership down to zero.

SCOOP: @FTX_Official sold about $1 billion of @Grayscale's $GBTC since #bitcoinETF approval – explaining a large chunk of its outflow.@IanAllison123 reportshttps://t.co/9t04mPvFhT

— CoinDesk (@CoinDesk) January 22, 2024

With the sales representing up to a third of the total GBTC outflows, the report alleges that FTX completed the sale of its substantial holdings and may therefore not have any more GBTC to sell. According to Crypto Banter founder Ran Neuner, this means easing selling pressure that may catalyze a bounce in the Bitcoin price.

Wait, if $1bn of the selling in GBTC was FTX LIQUIDATORS as reported, that is 1/3 of the total outflows. That changes the entire picture!!!! That selling is now done.

We could actually get a bounce now and that could trigger a short squeeze.

— Ran Neuner (@cryptomanran) January 22, 2024

With this, the Crypto Banter executive says a short squeeze may be in the works. For the layperson, a short squeeze is an unusual condition, which initiates a fast rise in the asset’s price. It is the result of a surge in short selling.

This means many investors bet on the price of the asset falling. It starts when the price unexpectedly jumps higher, gaining momentum as a huge number of the short sellers resolve to cut their losses and close their positions.

Bitcoin Price Outlook As Analysts Anticipate A Short Squeeze

The Bitcoin price is attempting a recovery rally, which could work out given the Relative Strength Index (RSI), has tipped north to show rising momentum. If investors buy the dip, the ensuing buying pressure could push the Bitcoin price north to reclaim the critical support at $40,726.

Further north, the gains could extend for the Bitcoin price to foray back into the channel, above the $43,750 support. This could provide the jumping-off point for BTC to target the $48,000 psychological level.

In a highly bullish case, the Bitcoin price could extend the climb, going as high as the $50,000 psychological level, last tested in December 2021. This would represent a 25% climb above current levels.

TradingView: BTC/USDT 1-day chart

Converse Case

On the other hand, it is impossible to ignore the weak price strength, which is seen by the position of the RSI below 50. The Moving Average Convergence Divergence (MACD) indicator that continues to move below the signal line (orange band) worsens this. The MACD is also in negative territory, adding credence to the bearish thesis.

Increases selling pressure could see the Bitcoin price extend the fall potentially testing the $37,800 support. A brake and close below this level would push BTC to a cliff, potentially sending the king of crypto to the depths of the $30,000 psychological level. A break and close below this level would invalidate the big-picture bullish outlook.

Meanwhile, crypto enthusiasts and BTC hobbyists remain focused on the halving event that will see mining rewards slashed in half. The event, expected to kickstart the next bull market, has investors lining up for BTC ownership, only that the pioneer crypto is not affordable for the ordinary folk. However, Bitcoin Minetrix provides the solution.

Promising Alternative To Bitcoin

For entry into the Bitcoin Minetrix ecosystem, investors must buy BTCMTX, the project’s powering token. Token holders stake their holdings for credits and then redeem these credits for mining hash power.

In so doing, the project spares you from the hassles that come with traditional mining, lowering the bar by eliminating risks of fraud, challenges of heat, noise, space, and costs.

#BitcoinMinetrix vs. Traditional Cloud Mining

Comparison of Entry Costs: 💰#BTCMTX = Affordable entry with a fixed commitment duration.#ConventionalCloudMining = Requires significant initial deposits. pic.twitter.com/5DhQ7ebHCL

— Bitcoinminetrix (@bitcoinminetrix) January 22, 2024

Bitcoin Minetrix is in the 21st stage of the presale, where each token sells for $0.013. The price tag will stand for slightly less than three days even as presale sales surge towards the target objective of $9.906 million. Thus far, presale sales have reached $9.1 million.

Major Announcement! 🌐#BitcoinMinetrix attains a remarkable milestone, raising over $9,000,000! pic.twitter.com/9rUOkm7Hb7

— Bitcoinminetrix (@bitcoinminetrix) January 22, 2024

Buy into the Bitcoin Minetrix ecosystem for a chance to get in on the BTC halving rally ahead of time. With such an easy pathway to Bitcoin mining and therefore BTC ownership, the landscape has never been this even, with a playing field where the wealthy and the ordinary folk both have fair chances of getting in on the action.

#BitcoinMinetrix revitalizes the landscape of cloud mining by merging stakeholding and cloud mining.

Pioneering tokenized cloud mining focusing on transparency, autonomy, and security, #BTCMTX is dedicated to providing a reliable pathway for $BTC mining enthusiasts. 🌐⚒️ pic.twitter.com/Mrxv0Hnrst

— Bitcoinminetrix (@bitcoinminetrix) January 22, 2024

Visit Bitcoin Minetrix to buy BTCMTX here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- ProShares Bitcoin ETF Trading Volume Plummets 75% As Investors Turn To Spot BTC ETFs

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage