Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price is up 1.21% to trade for $43,633 as of 12:35 a.m. EST time, with trading volume dropping 25%.

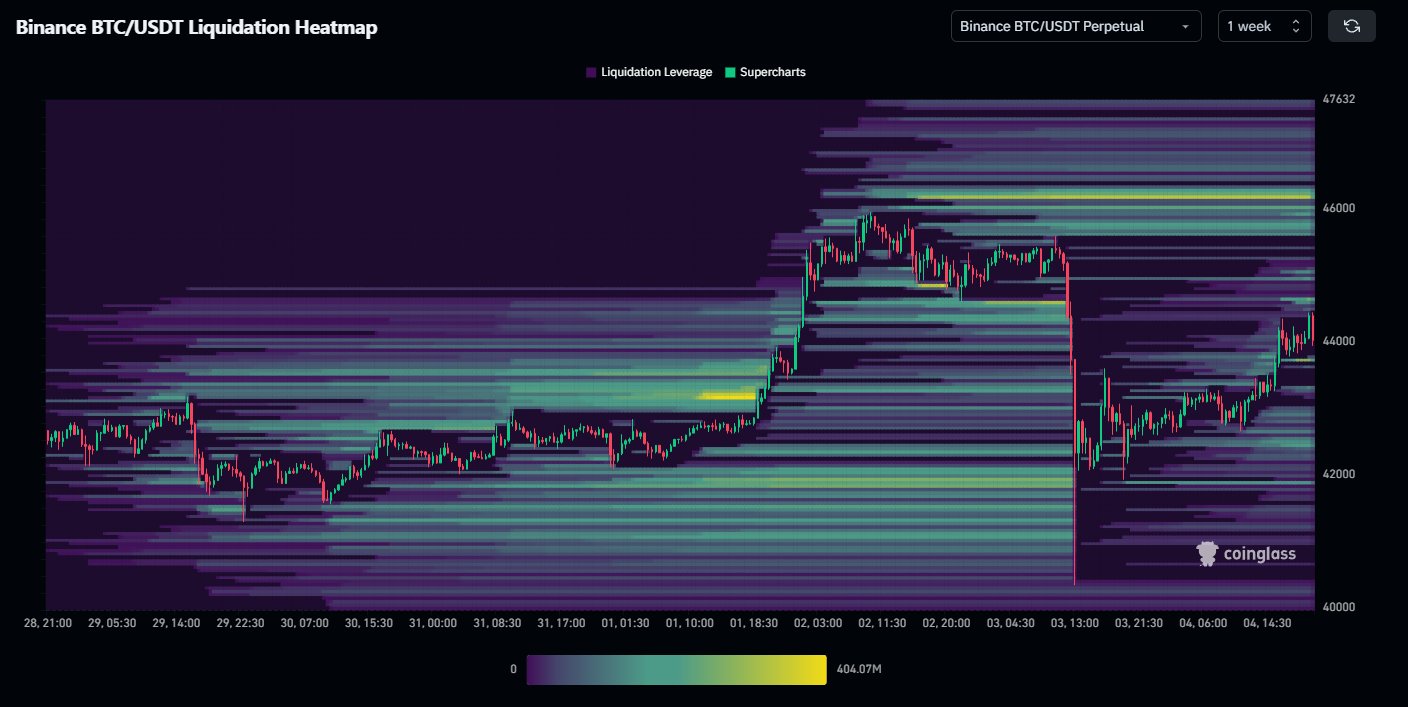

Trading volume is dropping as the market exercises caution following the January 3 crash that saw longs and shorts alike battered. This is best seen in the BTC liquidations heat map, which shows that the Bitcoin price is still in limbo.

The crypto market may have to wait for positions to build up again to determine the next directional bias.

It comes as the window for exchange-traded fund (ETF) approvals opens and as Bloomberg Intelligence analysts reiterate that there’s a 90% chance the Securities and Exchange Commission will green light Bitcoin ETFs by January 10.

Meanwhile, the January New York trading session was eventful, with numerous developments on the spot BTC ETF theme. For starters, Grayscale officially listed GBTC on their retail-facing website, with the firm’s CLO Craig Salm revealing that he was filling out some forms.

Just filling out some Forms

— Craig Salm (@CraigSalm) January 4, 2024

Also, a senior reporter at TechCrunch, Jacquelyn Melinek, said on X that spot Bitcoin ETFs will be approved by the SEC for multiple firms today, Jan. 5, citing “sources extremely close to the matter.”

heard from sources extremely close to the matter that the bitcoin spot ETF is going to be approved by the SEC for *multiple* firms' applications

— Jacquelyn Melinek (@jacqmelinek) January 4, 2024

Elsewhere, the head of research at CoinShares James Butterfill shared that the current Bitcoin price points to the market pricing $1 billion seed into US spot-based ETFs. The executive based his thesis on the firm’s fund flows model.

Nevertheless, the climax of the Thursday session came on the back of asset managers filing their 8-A forms.

Bitcoin Price Bounces Amid News Of Asset Managers Filing Their 8-A Forms In Progression Towards Possible Spot BTC ETF Approvals

Grayscale, Valkyrie, VanEck, and Cathie Wood’s Ark Invest joined Fidelity in filing their form 8-As, in a move that signaled progress towards potential spot bitcoin ETF approvals. The filings point to registration that allows issuers to trade on an exchange upon product approval.

Bloomberg analyst Eric Balchunas says that the SEC is giving its final comments to issuers on their applications, and the multiple applicants will submit their final 19b-4s and S-1s after comments. In his opinion, we are as close as ever to official approval of spot Bitcoin ETFs in the US.

Nevertheless, it remains unclear which ETF filers will receive approvals first with some like Bitwise, Hashdex, and VanEck already publishing ad commercials. The likes of Fidelity, BlackRock, and Grayscale are among those in the race, with several applicants already submitting their registrations of securities with the financial regulator, a sign that the first approvals are around the corner.

Bitcoin Price Prognosis As Window For Spot BTC ETF Approval Opens

Bitcoin price remains bullish, consolidating within the confines of an ascending parallel channel. It remains within the midline of this bullish technical formation after the January crash triggered by a Matrixport report that sent millions of dollars in positions down the drain.

Judging the outlook of the Relative Strength Index (RSI), Bitcoin price could drop before a move north. The RSI is moving south to show momentum is dropping. The Awesome Oscillator (AO) indicator also supports the bearish outlook showing that sellers are also at play. Nevertheless, as long as the price remains within the confines of the channel, the bulls can expect more gains.

It is also worth it to note that the Average Directional Index (ADX) indicator is dropping to show that the strength of the red candle (bearish pull) is fading. Notably, the ADX quantifies the strength of a trend, with Bitcoin price registering lower highs since the onset of the year, and this trend is now waning.

With the governing pattern being an ascending triangle, Bitcoin price could hit $48,000 if an approval comes, before a correction in the aftermath of a possible ‘buy the rumor sell the news’ situation.

Without the approval, however, investors can expect continued consolidation or early profit booking.

Converse Case

On the other hand, if the bears take charge Bitcoin price could drop, slipping past the $40,000 psychological level. In the dire case, the slump could see BTC market value hit $37,800. For the prevailing bullish thesis to be invalidated, however, the price must break and close below the $30,000 psychological level.

As indicated, however, for the next directional bias the market must wait for positions to build up again as traders are still in the risk-averse state. This explains the low trading volume.

Meanwhile, as investors look to ride the Bitcoin rally that spot BTC ETF approvals could trigger, enlightened investors are looking for ways to own BTC. This explains the growing attention and interest in BTCMTX, featuring among analysts’ top picks for the best ICOs to buy in 2023.

Promising Alternative To Bitcoin

BTCMTX presents itself as a promising alternative to Bitcoin as well as the gateway into the BTC ecosystem. This is through its cloud-mining system, decentralized and tokenized so there are neither third parties nor the hassles related to traditional mining.

The #BitcoinMinetrix Solution 💡

Presenting a reliable cloud mining platform for everyday #Crypto users that aims to fix the problem of high hardware costs and deceptive scams that have deterred people from $BTC mining.

This decentralized method safeguards users' interests. 🛡️ pic.twitter.com/GDFmveEvGQ

— Bitcoinminetrix (@bitcoinminetrix) January 4, 2024

The ticker for the Bitcoin Minetrix ecosystem stands among analysts’ top choices for the best investments in 2024 with potential for 1000X returns. It is a stake-to-mine project, where investors stake their BTCMTX tokens for credits and then redeem these credits for mining hash power.

🌐The Stake-to-Mine concept is a novel idea that promises to bring #Bitcoin mining back into the realm of possibility for ordinary #Crypto aficionados, for several reasons.

Users of #BTCMTX need only an #Ethereum compatible wallet such as #MetaMask, making things very simple.🔐 pic.twitter.com/XJmuATMaXW

— Bitcoinminetrix (@bitcoinminetrix) January 4, 2024

Investors looking to buy BTCMTX can do so on the Bitcoin Minetrix website, where each token is selling for $0.0126. This price tag is only on the shelf for the next 24 hours, after which the price will increase.

This make it your last chance to take advantage of the low rates as there is barely 24 hours left. Join the BTCMTX community to be part of the transformation of accessibility and safety in mining, achieved through innovative cloud mining and staking methods.

Delve into the vibrant world of #BitcoinMining, set to skyrocket into a $12 billion industry by 2027!

Through #BitcoinMinetrix, we're transforming accessibility and safety in mining, utilizing innovative cloud mining and staking methods for everyone. 🌐⚒️ pic.twitter.com/AFhLqpEfcD

— Bitcoinminetrix (@bitcoinminetrix) January 2, 2024

Visit Bitcoin Minetrix website to buy BTCMTX here.

Also Read:

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- How To Buy Bitcoin Minetrix – BTCMTX Presale 2024 Review

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage