Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price dropped almost 5% to trade for $65,644 as of 06:50 a.m. EST time as trading volume skyrocketed 65%.

The reverberations of this flash crash have extended across the market, pushing down altcoins as well as the overall crypto market capitalization plunged 5%.

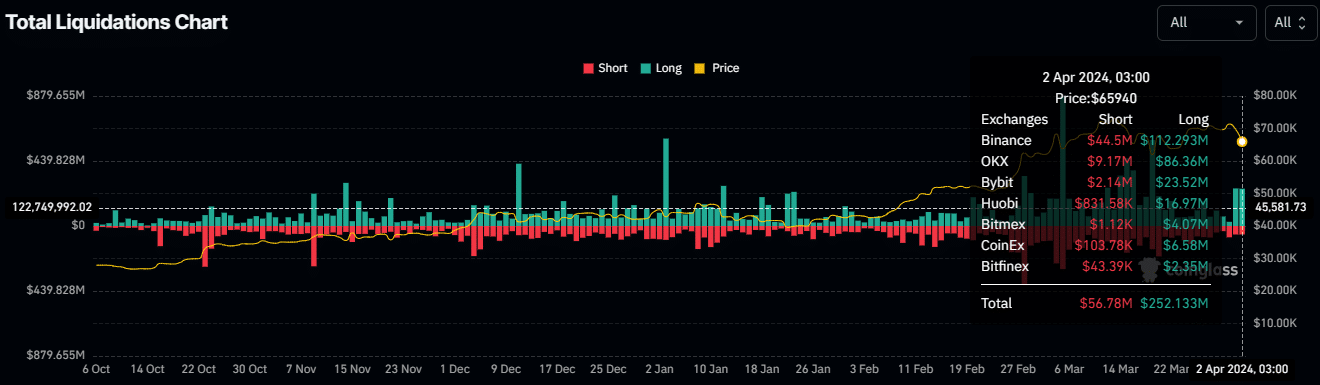

The dump saw nearly $310 million in total liquidations across the market, comprised approximately of $252 million in long positions and $56 million in shorts, according to Coinglass.

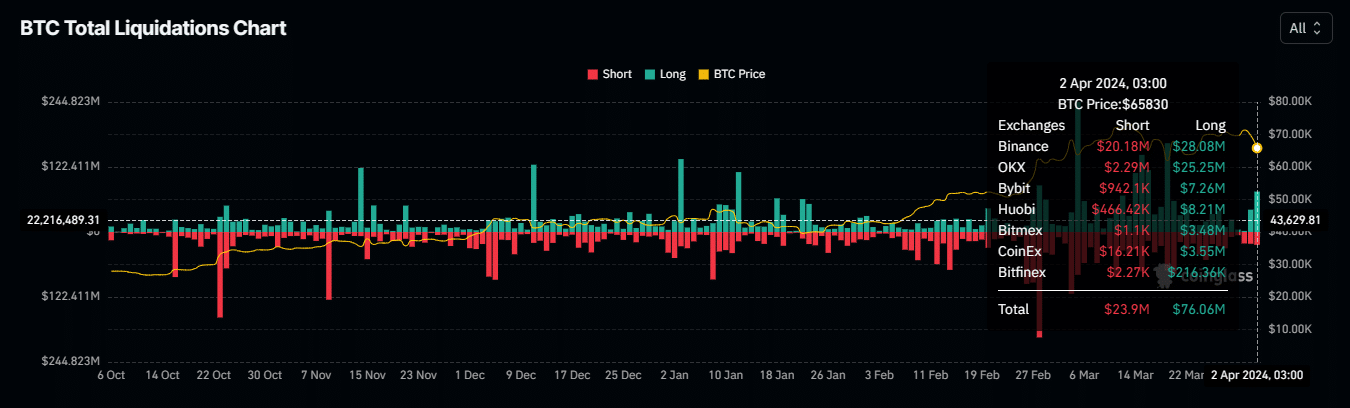

The BTC market saw almost $100 million in positions blown out of the water, composed of $76 million longs and around $23 million shorts.

Analysts’ Opinions About Bitcoin Price Crash

Although the flash crash caught many longs off guard, some analysts and traders saw this coming. One analysts, @CryptoTony on X, sees the dump as an opportunity to buy the dip. Dumps are for loading up,” he said.

Dumps are for loading up on

But remember key rule, buy support only. If close below then it is no longer support

— Crypto Tony (@CryptoTony__) April 2, 2024

Another analyst, @CryptoJelleNL, says the dump is merely shaking off froth.

#Bitcoin continues to chop around, right above the key weekly support.

I'll assume any price action in this region is designed to shake people out — before further price appreciation.

Sitting on my hands until conditions improve. pic.twitter.com/zp7NteeTM1

— Jelle (@CryptoJelleNL) April 2, 2024

Meanwhile, all eyes remain on the upcoming Bitcoin halving in just over two weeks. The landmark event is widely expected to kickstart the next bull cycle.

$BTC halving is coming in 18 days, meaning 100x surge!

$1k portfolio will be $10k-$500k after the halving

All you need is to buy the right lowcaps

Here's list of alts set to print MASSIVE profits over next 30d 🧵👇 pic.twitter.com/owi077eFVI

— Reflection🪩 (@0xReflection) April 1, 2024

With this in mind, some investors are positioning for more upside. According to Head of Research at Uphold Inc., @MHiesboeck on X, “…institutions and whales have bought more than 12,000 BTC mostly on Coinbase and Kraken and removed them to the private wallets.”

The researcher also notes that small investors (retail) continue to cash in on every spike, while the wealthy (large holders) buy every wick.”

During this Monday dump, institutions and whales have bought more than 12,000 $BTC mostly on Coinbase and Kraken and removed them to the private wallets. Small investors keep selling every spike, the big boys buying every wick. That should tell you something.

— Dr Martin Hiesboeck (@MHiesboeck) April 1, 2024

Elsewhere, blockchain tracker @whale_alert has flagged multiple transactions by large holders, as they prepare for the pre-halving rally.

- The first whale moved 1,000 BTC tokens worth $68.54 million from Bitfinex exchange to a new unknown wallet.

- A dormant address holding 500 BTC worth around $34.72 million was activated after 11.7 years.

- The third whale moved 1,500 BTC worth $103.08 million from an unknown wallet to another unknown wallet.

- At approximately 07:00 GMT, a fourth whale moved 75,887,800 USDT worth around $75.8 million from an unknown wallet to Coinbase Institutional. Notably, stablecoin movement to exchanges is a clear intention to buy.

Glassnode has also observed new capital into the asset class as old whales sell BTC to new whales at higher prices.

As the #Bitcoin Spot Price consolidates below the new ATH of $73k, the Long-Term Holder cohort has entered their distribution phase, selling to new investors at higher prices.

This represents an injection of new capital into the asset class, driving the realized cap up to new… pic.twitter.com/gGECO2oyyt

— glassnode (@glassnode) April 2, 2024

The Bitcoin price closed the first quarter up 64%, making it the third-best quarter over the past three years, much of that due to the arrival of spot BTC ETFs (exchange-traded funds).

Morning ☀️#Bitcoin closed Q1 up 64%, its third best quarter over the past three years. pic.twitter.com/8Scex32Jut

— Kaiko (@KaikoData) April 2, 2024

Bitcoin Price Outlook As Markets Prepare For Pre-Halving Rally

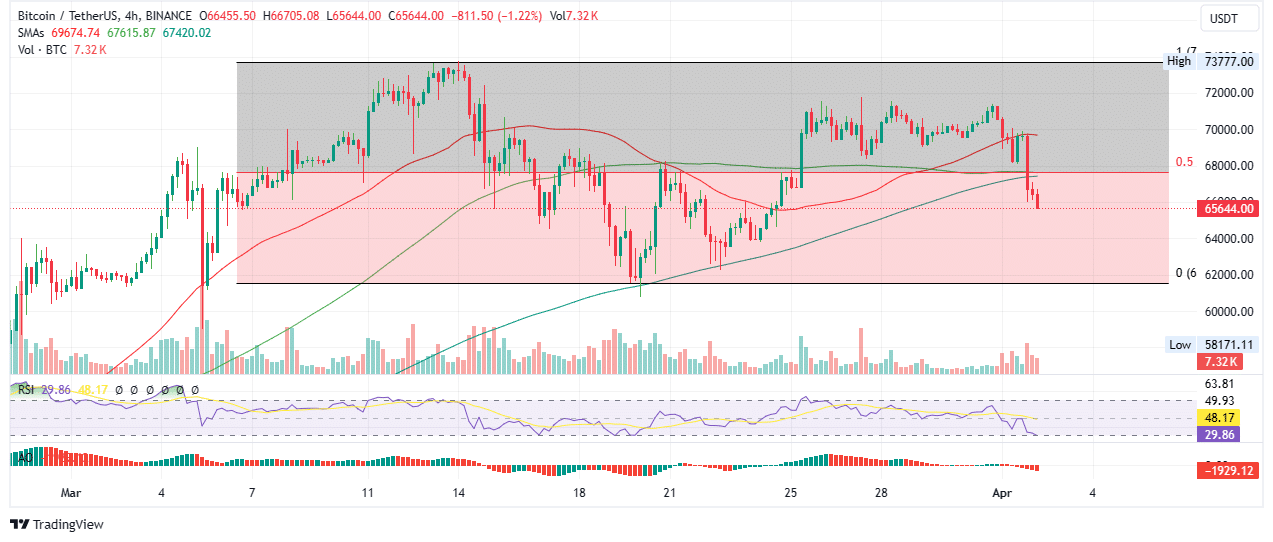

The Bitcoin price could drop to the midline of the lower section of the market range at around $64,700 as part of a mean reversal as the downtrend continues. Overhead pressure is growing, seen with the position of the 50-, 100-, and 200-day Simple Moving Averages (SMA) offering resistance at $69,674, $67,615, and $67,420.

Besides the SMAs, other bearish indicators include the nose-diving Relative Strength Index, suggesting falling momentum and the position of the Awesome Oscillator (AO) in negative territory. Beyond the above, the volume indicator is also showing red bars, suggesting a growing bearish sentiment.

In the dire case where $64,700 fails to hold as support, the Bitcoin price could extend the fall all the way to the bottom of the market range at $62,000 before BTC is safe to buy.

TradingView: BTC/USDT 4-hour chart

On the other hand, if sidelined and late bulls jump in, Bitcoin price could stage a recovery. This could see Bitcoin price climb to overcome resistance presented by the SMAs. A decisive candlestick close above the 50% Fibonacci placeholder of $67,621 would encourage more buy orders.

Confirmation of the end of the pullback will happen upon a candlestick close above the 50-day SMA at $69,674. This would constitute a climb of around 7% above current levels.

In a highly ambitious case, the Bitcoin price could reclaim the $73,777 peak, before marking another all-time high above the $74,000 threshold.

Meanwhile, in anticipation of a huge Bitcoin rally fired by the halving, forward-looking investors are flocking to the BTCMTX presale, which has raised upwards of $12.8 million.

BTCMTX features among analysts’ top five picks for cryptos that could be promising game-changers with 1000x potential.

Promising Alternative To Bitcoin

The BTCMTX presale gives investors easy and convenient entry into the Bitcoin Minetrix ecosystem. It is a cloud-mining project where BTCMTX token holders get to stake their holdings for credits.

These credits are redeemable for mining hash power. With the entire process tokenized and decentralized, it gives investors one better deal than the traditional Bitcoin mining approach.

#BTCMTX presents a reliable cloud mining solution designed for all #Crypto fans.

Previous worries about hardware and scams have discouraged numerous individuals.

This decentralized approach guarantees a clear and secure mining adventure. 🌟🔐 pic.twitter.com/A0IVhRLOnw

— Bitcoinminetrix (@bitcoinminetrix) April 1, 2024

Bitcoin Minetrix spares investors the challenge of high hardware costs and deceptive frauds that have stopped many people from mining BTC. It also ensures you do not need to suffer the heat, and every other hassle that comes with traditional BTC mining.

Knowing the benefits of #BitcoinMinetrix:

Easy access for convenience. 🌐

Streamlined cost structure for enhanced efficiency. 💲

Peace of mind with no worries about the resale value. 🔄 pic.twitter.com/hx3zJLXTfN

— Bitcoinminetrix (@bitcoinminetrix) January 18, 2024

Investors looking to buy BTCMTX, the powering token for the Bitcoin Minetrix ecosystem, can do so on the official website for only $0.0144 per token.

#Iceland faces a unique dilemma: balancing #Bitcoin mining with food sustainability. 🌍

Prime Minister @katrinjak highlights the nation's crossroads.

How can Iceland leverage renewable energy for mining while ensuring food self-sufficiency?#BitcoinMinetrix has achieved… pic.twitter.com/U3MuM1Esr2

— Bitcoinminetrix (@bitcoinminetrix) March 26, 2024

But the price will increase in less than three days, so interested investors should act soon to avoid missing out on the best price.

Just 3 days remaining until Stage 35 of #BitcoinMinetrix wraps up! ⏳

Do you think government regulations have a significant impact on #Bitcoin mining? 🏛️ pic.twitter.com/aiLtMxZy7h

— Bitcoinminetrix (@bitcoinminetrix) April 2, 2024

Visit Bitcoin Minetrix to buy BTCMTX here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Top 3 Crypto Presales to Watch for Potential 10x-15x Gains – Bitcoin Minetrix, Dogecoin20, and Green Bitcoin

- Cilinix Crypto Presale Update of Two Bitcoin-Related Altcoin – Bitcoin Minetrix and Green Bitcoin

- Lindy Shirries Reviews Bitcoin Minetrix Presale – A New Era of Efficient and Eco-Friendly Mining

Join Our Telegram channel to stay up to date on breaking news coverage