Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has seen nothing but recovery or periods of stability ever since last Friday, June 16th. In a few short days, the price action reacted to a strong buying pressure, breaching several strong resistance levels. BTC only crossed a short distance in terms of price, but its recent growth still represents a big change in the previously bearish market.

The last surge took place in the previous 24 hours, taking BTC from under $27k to a resistance at $29k per coin. The asset has spent nearly 12 hours trying to breach the resistance, with only slight rejections to around $28,900.

As soon as it found stability, it attempted to breach the $29k barrier again, but so far, it had limited results.

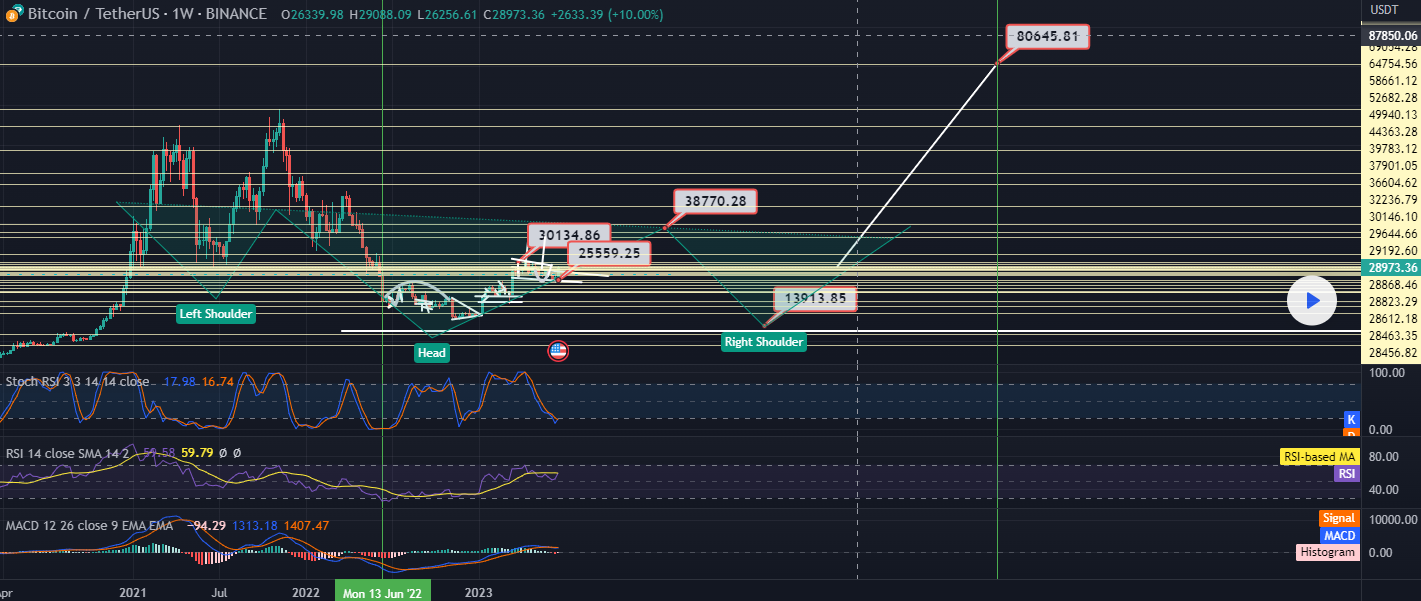

Analysts suggested a possibility of further growth, although they admit that this is uncertain. However, they are far more optimistic regarding 2025, expecting the real bull run to come months after the next halving, which should take place in 2024.

Others think that the coin made a wolf pattern and that the target of the pattern was already hit. If that ends up being the case, then a strong correction is likely to come in the near future. One analyst believes that the price could crash as far down as $21k, or even below that, in days to come.

Bitcoin blows up on Binance with a price of $138k

While Bitcoin started attracting attention from all corners of the world, the coin’s price on Binance soared to a massive height of $138k. Specifically, the surge happened on Binance.US, the US-based subsidiary of the world’s largest exchange by volume.

The surge happened in a sudden price wick on the BTC/USDT pair, although only for a few seconds. The surge took place at 6.50 AM UTC, before the coin’s value reverted to parity with other BTC spot markets. Interestingly, other BTC pairs traded as normal.

Experts explained that this likely wasn’t caused by a trader who wanted to buy BTC at 450% of its price. Instead, it was likely caused by low liquidity for this specific pair on Binance.US.

Invesco refiles for Bitcoin ETF

Another development that likely had even more to do with the coin’s current price behavior came from Invesco, which just refiled for spot Bitcoin ETF. The company tried to file for a BTC ETF two years ago, in 2021, when it collaborated with Galaxy Digital.

JUST IN: $1.49 trillion Invesco officially reactivates its spot #Bitcoin ETF filing pic.twitter.com/jxdwb2c9Pg

— Bitcoin Magazine (@BitcoinMagazine) June 21, 2023

However, like all other filings, the SEC rejected it. Now, encouraged by BlackRock’s new filing, Invesco seemingly decided that it is the right time to try again, thus showing its interest in a Bitcoin-based product and the crypto industry alike. The prominent investment management company is overseeing $1.49 trillion in assets. After filing for its Bitcoin Spot ETF in 2021, the company also applied for Bitcoin Futures ETF.

However, it pulled off in the last moment, citing regulatory concerns. Interestingly, this decision came after the SEC approved ProShares’ BTC Futures ETF.

ETF impulse pushes the price to $29k

From a technical point of view, Bitcoin is still not ready to see the price of $29k or grow further than that. In fact, analysts still expect corrections to start at any time and maybe take Bitcoin to even lower levels than what was seen in the last few months. However, the price reached $29k regardless, likely for fundamental reasons.

Many assume that the new wave of BTC ETF requests inspired optimism among investors. Coupled with $3.5 billion in BTC that the whales accumulated over the last week or so, and it is not surprising that the coin saw a major price surge.

The big question now is how long it will be able to go on like this before the correction ultimately catches up.

Related

- How to Buy Bitcoin Online Safely

- The Bitcoin Price Prediction as the Coin Grows to a Resistance at $27k and Reclaims 50% Market Dominance after 2 Years

- Bitcoin’s Market Dominance Surpasses 50% After Years, Adoption Continues Amidst Regulatory Challenges

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage