Join Our Telegram channel to stay up to date on breaking news coverage

After constantly increasing for the past seven days, the Bitcoin price suddenly dropped on Thursday, June 22nd. The drop was not particularly big, but it was quite sharp, as the price sank from a resistance at $30,300 to $29,700.

Immediately after dropping to this level, however, the price started recovering, and it easily climbed back up to $30k.

Unfortunately, the level at $30,100 now became a strong resistance that is preventing Bitcoin from heading further up.

With the arrival of June 23rd, the Bitcoin price was going up and down between $30,050 and $29,900, making several attempts to breach the smaller resistance. It finally managed to do so over the past hour, successfully climbing to $30,165 at the time of writing.

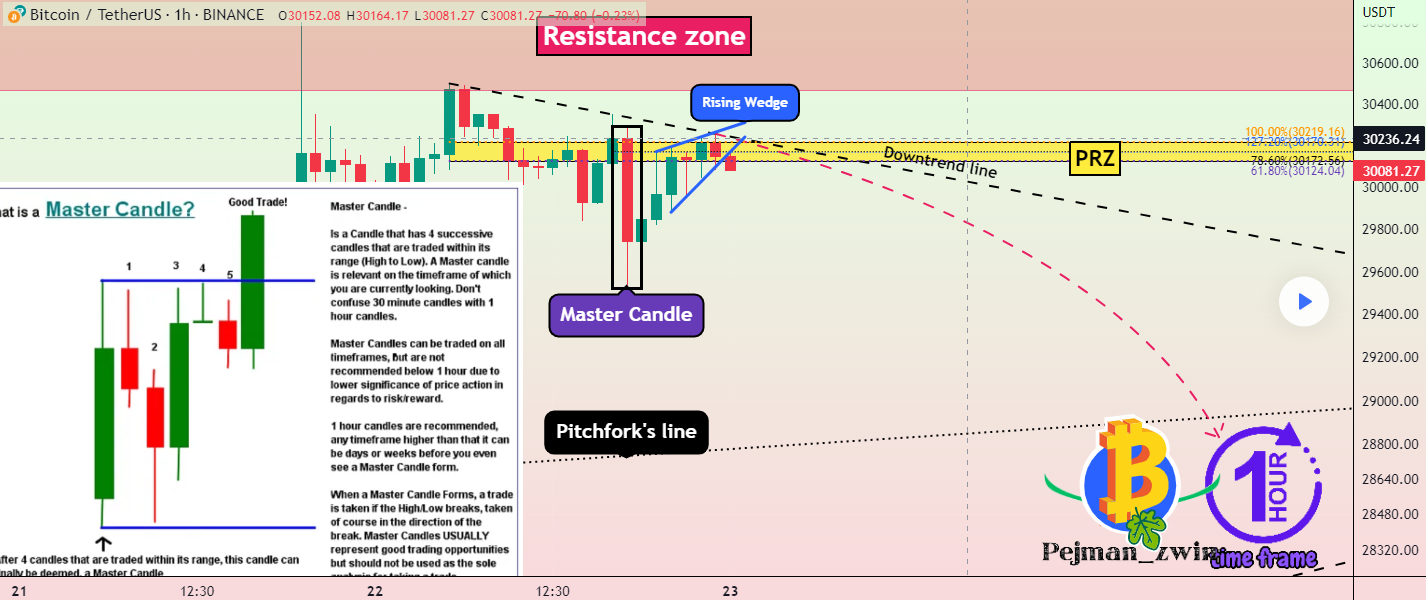

Commenting on the coin’s increased volatility over the last 24 hours, analysts pointed out that Bitcoin was able to create a Master Candle in the 1-hour time frame. It is now expected that the master candle’s lowest price will be broken within the following candles.

Others have noticed that the price remains bullish from a short-term perspective, particularly after breaking above the major highs.

However, it is still around a strong resistance zone, so new bearish correction movements remain a possibility.

Still, Bitcoin would have to break below the swing low in order for bears to get their chance to take over. It is not impossible, but it will be difficult for them to take over now, as the bulls are still in control.

Speculation about Bitcoin ETF continues to fuel the rally

Bitcoin has been rallying ever since BlackRock’s Bitcoin spot ETF filing with the US SEC, which several other firms then followed.

While the ETF proposals did come at an unusual time — as the US SEC cracked down on Binance and Coinbase — they managed to seriously disrupt the bearish market dynamic.

Coupled with whales who were investing billions into BTC while its price was down, the ETF filings managed to trigger a bull run.

It has been a week since then, and while BTC is starting to experience difficulties, it is still showing strong signs of growth.

Matrixport’s BTC Greed & Fear Index surpasses 90%

After Bitcoin chalked up a price gain of over 20% in a single week, some have suggested that the rally may take a customary breather soon.

Specifically, this message came from Matrixport’s Bitcoin Greed & Fear Index (GFI). According to the firm, GFI spiked up from under 10% to above 90% in roughly a week, reaching 93%.

The purpose of the index is to keep track of the overriding market emotions, and a reading of more than 90% signals that the market is seeing greed and excess optimism.

Meanwhile, reading under 10% are a signal of extreme fear and pessimism. Matrixport’s head of research and strategy, Markus Thielen, said,

Our Bitcoin Greed & Fear Index has reached exuberant levels in record time. It could be well advised to lock in some gains for short-term traders.

Wall Street Memes presale nearly at $10 million raised

While Bitcoin might be losing its strength, Wall Street Memes presale continues to push further and more strongly than ever. The project has already raised $9.8 million, putting it on the brink of reaching $10 million raised.

Its token, WSM, is currently selling for $0.0304, but even so, investors are more than happy to continue buying.

The project emerged as a way to remember and honor a subreddit called WallStreetBets, which stood up against institutional investors in 2021.

After institutions started shorting the stocks of several companies, threatening to destroy them along the way, amateur investors from Reddit engaged in mass stock purchases to counter them.

Related

- How to Buy Bitcoin Online Safely

- Battle for Spot Bitcoin ETF Heats Up as Valkyrie Funds Steps In

- Bitcoin’s Market Dominance Surpasses 50% After Years, Adoption Continues Amidst Regulatory Challenges

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage