Join Our Telegram channel to stay up to date on breaking news coverage

Traders have closely monitored Bitcoin’s price for days as they waited for the coin to make its next move.

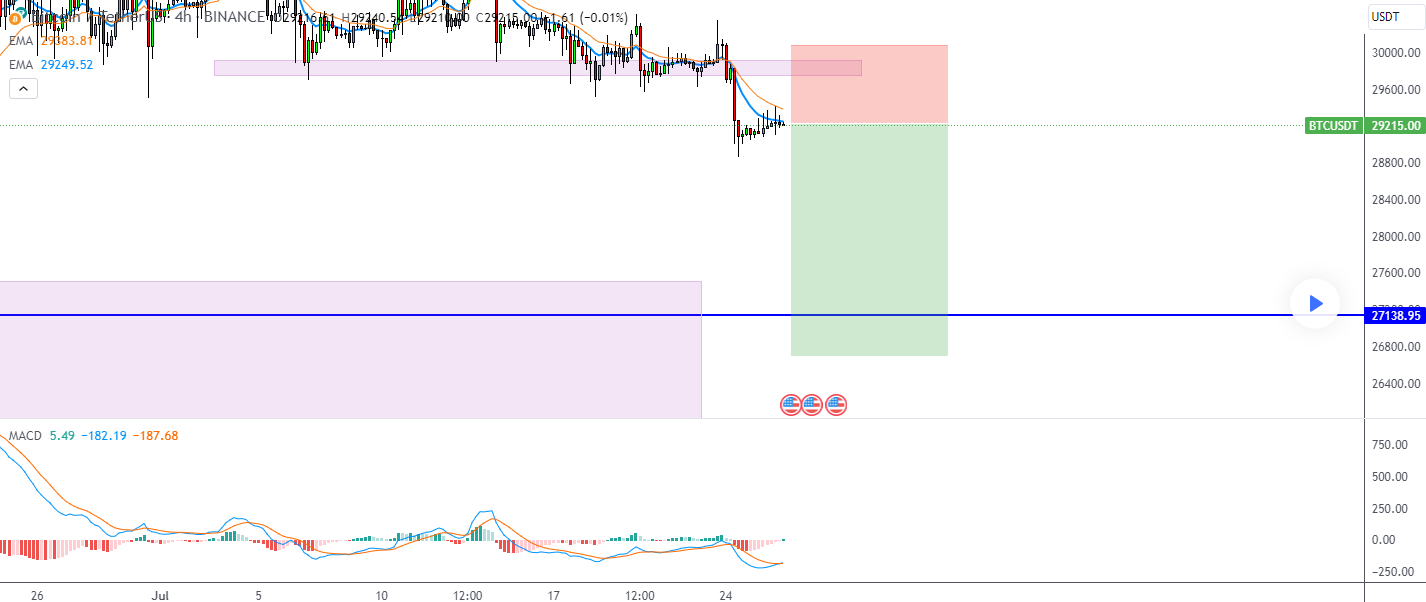

After dropping from $30k to $29k at the start of the week, Bitcoin found temporary stability for about 24 hours, starting on Monday after the drop. However, on Tuesday afternoon, July 25th, the coin started seeing greater volatility.

Its price surged from $29.1k to $29.35k, only to drop back down to $29.2k. Since then, this level has mostly held as a new support, but the coin found several resistances above it, including the ones at $29.25k, $29.30k, and $29.35k.

The last one was reached only once in the last 24 hours, although the coin approached it on two other occasions without being able to reach it fully.

At the time of writing, Bitcoin’s price sits at $29,188, with its price only 0.01% higher than 24 hours ago.

Bitcoin awaits spot ETF decision

Bitcoin’s recent volatility shows increased uncertainty among traders, which likely comes from uncertainty surrounding the Bitcoin spot ETF status. The coin’s price has seen a bearish wave recently, but the possibility of an ETF approval is still giving hope to some traders.

It has also been speculated that the approval of the ETF might trigger a Bitcoin rally in the absence of any other macro catalyst.

On that front, ETF analyst James Seyffart suggested a series of important dates in the race for approval which include deadlines for different ETF filings.

By popular demand — Here's the most updated list of dates to watch for the current #bitcoin ETF Race.

(Grayscale is also sorta in this race via their lawsuit against the SEC. Judges should issue a ruling there within the next month or two) pic.twitter.com/agJj82XanO

— James Seyffart (@JSeyff) July 25, 2023

It is possible that the coin’s price will see greater volatility as these dates approach, as the excitement builds up among traders and investors.

Bitcoin drops ahead of Fed meeting

Another event speculated to have a strong impact on Bitcoin is this Wednesday’s Fed meeting. The Fed is widely expected to hike interest rates by 25 basis points at the end of its two-day meeting later today, as the inflation remains above the central bank’s target.

A hawkish tone might end up boosting US Treasury yields and the USD, which would weigh on Bitcoin, as well as Ethereum. The expectation alone may have been enough to cause the coin’s 3% drop from earlier this week.

There has also been concern about the recent revelations regarding Binance.

Specifically, the exchange’s CEO, Changpeng Zhao, apparently suggested in a private conversation that took place in 2019 that Binance affiliates had accounted for a significant portion of trading volume during the launch of Binance.US.

Now, some are questioning whether this activity constituted wash trading, which was supposed to inflate volume.

Bitcoin whales moved $60 million in 5 days

Whale activity is another thing that commonly causes unease among traders, and there has been plenty of it recently.

Even the long-dormant whales have been making moves lately. On July 20th, two wallets from 2021 have moved their BTC to a different address after 12 years of inactivity. Each of the addresses had 10 BTC.

Only a day after that, another wallet holding 5 BTC started showing signs of activity.

As traders started to wonder what this meant, another wallet moved over $30 million in BTC, moving the coins for the first time since 2012. In total, these whales moved over $60 million in BTC in only five days.

A BTC whale that has been dormant for 11 years transferred all 1,037.42 $BTC($37.8M) to a new address"bc1qtl" an hour ago.

The whale received 1,037.42 $BTC($5,107 at that time) on Apr 11, 2012, when the price was $4.92.https://t.co/k8ZmO5vc8X pic.twitter.com/xBaw2dQfY8

— Lookonchain (@lookonchain) July 22, 2023

What do the analysts say?

Bitcoin is in a period of great uncertainty, fresh out of crypto winter, but not yet in its bullish phase. Its price does not have a clear course so that it can do essentially anything. Many are concerned that the price will spiral down, but one analyst wrote that their examination of technical analysis led to a positive conclusion.

According to their research, indicators and patterns suggest a favorable outcome, indicating potential opportunities and positive market trends. Still, they noted that it is extremely important to continue to monitor the market closely.

Evil Pepe presale is closing in on $1 million

While some enjoy the speculative period that Bitcoin is in right now, others have turned to new opportunities in the meme coin sector. Specifically, one project has been attracting a lot of attention lately — Evil Pepe (EVILPEPE).

This is a crypto project based on a popular meme, and it invites users to embrace their evil side. Each investor has that little voice inside of their mind that tosses in an occasional intrusive thought, such as taking on huge risks and spending all of their money on risky assets.

Evil Pepe takes responsibility for this voice and encourages users to invest.

So far, many have seemingly listened, as the project’s presale raised over $860k in only a few days. The presale will last for another week, selling $EVILPEPE at a price of $0.000333 per token.

Users can buy it with ETH or USDT at any time during the next 7 days.

Related

- Bitcoin Price Still Flat at $29,000 Level While Evil Pepe Presale Shows BTC How to Pump

- Bitcoin Bounces Below $30k As Weekly Range Tightens – Breakout This Week?

- Bitcoin Price Prediction As King Crypto Makes Virtually No Gains in July

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage