Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is down 0.5% in the last 24 hours to trade for $42,643 as of 1:30 a.m. EST time, with trading volume rising 17%.

It comes as the market continues to observe how the recently approved spot BTC exchange-traded-funds (ETFs) are impacting the king of cryptocurrencies.

BlackRock, one of the 11 ETF issuers that is the world’s biggest asset managers, was alone able to soak up 11,500 Bitcoin in the first two days of trading last week, translating to about 13 days of Bitcoin production.

InvestAnswers was among analysts pointing out that the situation may trigger ”a severe supply crunch” if the pace continues.

#Blackrock took 11,500 $BTC from Supply in 2 days

900 Bitcoin are issued daily, and you can see Blackrock's move into their cash supply from last night into Bitcoin, buying the dip. Now, they mostly hold Bitcoin.

The key point is 11,500 BTC were sucked from the system in 2 days… pic.twitter.com/GzoEk2uMSl

— InvestAnswers (@invest_answers) January 13, 2024

Bitcoin Price Outlook As BlackRock Soaks Up 13 Days Of BTC

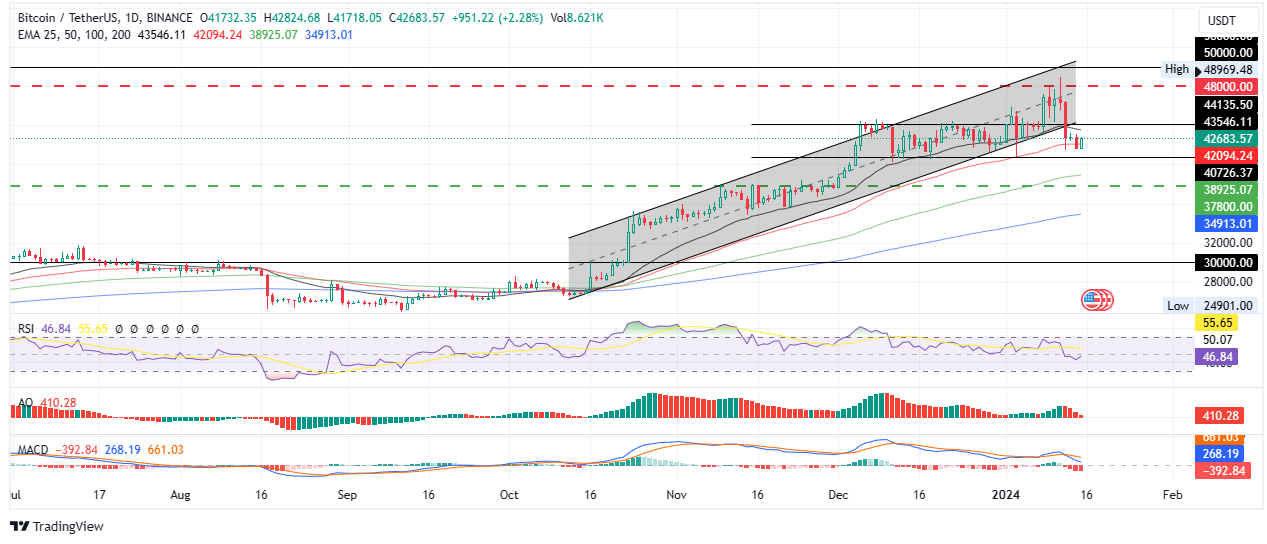

Amid low trading volume, this past weekend, enhanced volatility saw Bitcoin price drop below the confines of an ascending parallel channel. However, the bulls are attempting a recovery, with the Relative Strength Index (RSI) pushing north to show rising momentum. If this trajectory is sustained, the momentum indicator could soon record a cross-over above the signal line (yellow band), a move taken to be a buy signal.

Enhanced buying pressure could see Bitcoin price cross above the 25-day Exponential Moving Average (EMA) at $43,546 before confronting the $44,135 resistance level. A flip of this supplier congestion level could provide leeway for BTC market value to fall into the grasp of the ascending channel, with this bullish technical formation promising more gains.

In a highly bullish case, Bitcoin price could extrapolate the gains, going as high as clearing the $48,000 psychological level, and subsequently the $48,969 range high, before tagging the $50,000 level, standing 17% above current levels.

TradingView: BTC/USDT 1-day chart

Meanwhile, the bearish pull on Bitcoin price remains strong. This is seen with the Moving Average Convergence Divergence (MACD) indicator still moving below the signal line (orange band). The histogram bars of the Awesome Oscillator are also flashing red, supporting the case to the downside.

If the bulls weaken their grip, the bears could seize the opportunity to extend the weekend slump. This could see the Bitcoin price cross below the $40,726 support. Enhanced selling pressure could send BTC to the depths of the 100-day EMA at $38,925, but if this level fails to hold, $37,800 could suffice.

For the big picture bullish outlook in the Bitcoin price to be invalidated, the price must have to drop and close below the $30,000 psychological level.

Promising Alternative To Bitcoin

With Bitcoin price facing a lot of bear pressure, why not consider BTCMTX for your portfolio diversification? It is the ticker for the Bitcoin Minetrix ecosystem and among analysts’ top choice for penny cryptos with the potential for explosive growth.

#BitcoinMinetrix shines with its budget-friendly features.

Eliminating the need for hardware costs, it provides a cost-efficient method for mining. 🧰

Mining participation becomes hassle-free and economical as users can engage without the weight of physical equipment. pic.twitter.com/QmRG2WJZcB

— Bitcoinminetrix (@bitcoinminetrix) January 14, 2024

Bitcoin Minetrix is a tokenized cloud-mining platform that allows everyday people to mine Bitcoin (BTC) in a decentralized way. It fixes the problem of high hardware costs and deceptive frauds that have deterred people from BTC mining.

#BitcoinMinetrix introduces an innovative cloud mining option, facilitating engagement in decentralized $BTC mining.

Emphasizing the elimination of threats linked to deceptive third-party cloud mining, it provides users with complete control over their mining operations. 🛡️ pic.twitter.com/zqBrrCtrUQ

— Bitcoinminetrix (@bitcoinminetrix) January 13, 2024

The project has tokenized cloud mining in a move that ensures a secure and transparent experience for all community members.

Stay alert for #BitcoinMinetrix scams! 🚩

🛑 Verify websites or profiles thoroughly before engaging.

🔑 Keep your private keys and personal info safe—never share them.#CryptoSafety #ScamWarning pic.twitter.com/Xe79HwMul9

— Bitcoinminetrix (@bitcoinminetrix) January 10, 2024

Bitcoin Minetrix is in the presale stage, now recording upwards of $8.468 million out of the $9.103 million target objective. Investors looking to buy BTCMTX can do so on the website, where each token is selling for $0.0128.

The #PhoenixGroup secures a $187 million deal with @BITMAINtech for #Bitcoin mining machines, following their recent IPO and partnerships.

What's your take on their strategic moves?💡#BitcoinMinetrix also achieves another milestone and surpasses $8,200,000! 🎉 pic.twitter.com/zoLvO5vxw6

— Bitcoinminetrix (@bitcoinminetrix) January 11, 2024

Amid the fluctuations in Bitcoin price, much attention is turning to BTCMTX as investors rush to buy the Bitcoin derivative ICO. The token’s sales were first lifted on the back of spot BTC ETF hype, and now also benefits from the expectation of the halving.

This is the best time to buy Bitcoin Minetrix as it also stands among the top three crypto presales to buy now.

Visit Bitcoin Minetrix to buy BTCMTX in the presale here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Bitcoin Price Prediction: BlackRock CEO Larry Fink Says BTC Is An Asset Class As Investors Rush To Buy This ICO Boosted By Bitcoin ETFs

Best Wallet - Diversify Your Crypto Portfolio

Join Our Telegram channel to stay up to date on breaking news coverage