Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price climbed 1% in the last 24 hours to trade at $97,531 as of 11 p.m. EST on a 15% slump in trading volume to $31.35 billion.

This follows Abu Dhabi’s bold $436.9 million investment in BlackRock’s iShares Bitcoin ETF (IBIT), signaling growing institutional confidence in digital assets. The investment, made through Mubadala Investment Company, a $280 billion sovereign wealth fund, aligns with the Middle East’s increasing adoption of cryptocurrencies.

Abu Dhabi just dropped $437M into BlackRock’s Spot Bitcoin ETF. 🤑

Big money is making moves while retail watches from the sidelines.Smart money or nah? 👀 pic.twitter.com/znroCvXATH

— damaze 😵 (@damaze_bro) February 14, 2025

Notably, the move came as BlackRock secured a commercial license in Abu Dhabi. Abu Dhabi has been expanding its crypto presence, including a 2023 Bitcoin mining project with Marathon Digital and Zero Two, highlighting the region’s commitment to blockchain integration and digital finance innovation.

Bitcoin Price At A Crossroads: Will It Break $100K Or Face A Reversal?

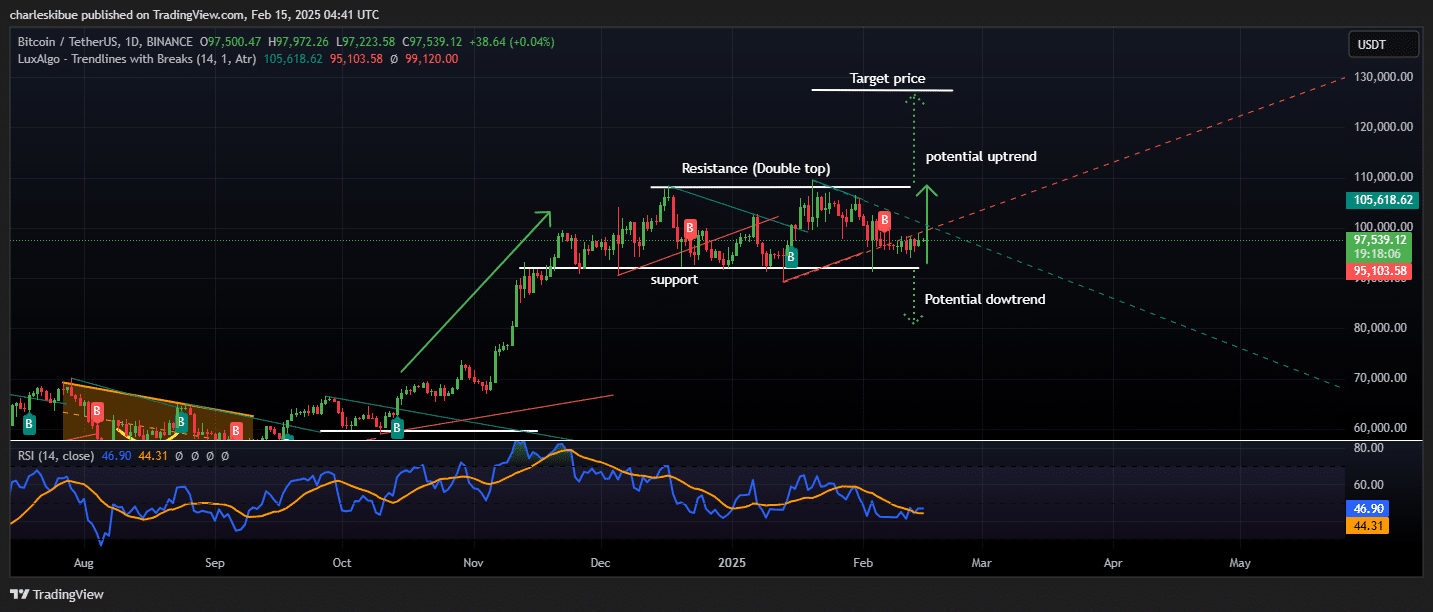

Bitcoin (BTC) is currently trading at $97,539, teetering just below the crucial $100,000 resistance level as traders brace for a major move. Over the past few weeks, BTC has tested this level multiple times, forming a double-top pattern.

This historically bearish signal hints at a potential reversal if buyers fail to push prices higher. However, strong support at $95,000 has prevented a major downturn, creating a tense consolidation phase where the next breakout could dictate Bitcoin’s direction in the coming weeks.

BTCUSDT Analysis Source: Tradingview

Bitcoin’s Relative Strength Index (RSI) currently stands at 46.90, hovering below the neutral 50 level, which indicates a lack of strong bullish momentum. If RSI climbs above 50, it would confirm renewed buying pressure, while a drop below 40 could signal a deeper correction.

Additionally, LuxAlgo trendlines highlight key breakout and breakdown levels, with upper resistance at $105,618 and lower support at $95,103. These technical markers provide a clear roadmap for Bitcoin’s next potential move.

Bitcoin Price Analysis: Breakout Or Breakdown?

The market is at a pivotal moment, with Bitcoin facing two major possibilities. If BTC breaks above $100,000 with strong volume, it could trigger a bullish rally toward $105,000, with further upside potential extending to $110,000–$120,000 in an extended uptrend. Such a move would likely attract fresh institutional interest, reinforcing Bitcoin’s dominance in the market.

On the other hand, if Bitcoin fails to break resistance and loses support at $95,000, it could signal the beginning of a downtrend, with potential price targets at $85,000, $80,000, or even as low as $70,000. A breakdown below $95,000 would likely shake investor confidence and trigger stop-loss liquidations, accelerating the decline.

Traders remain on edge, closely watching for a decisive breakout or breakdown. On-chain data indicates that long-term holders are still accumulating, indicating confidence in Bitcoin’s long-term potential. However, short-term traders are exercising caution, as macro-economic conditions and regulatory developments could influence market movements.

BTC Bull Token Presale Heads For $2 Million – Best Crypto To Buy Now?

As the Bitcoin price outlook remains uncertain, investors are flocking to a new meme coin called Bitcoin Bull (BTCBULL), which launched just five days ago and has already raised over $1.5 million in its presale.

This Bitcoin-themed meme coin has gone viral in large part due to the way it offers holders a direct way to earn actual Bitcoin (BTC).

BTCBULL rewards its community with BTC airdrops whenever Bitcoin hits key price milestones. The next targets for the delivery of free Bitcoin to holders are $150K and $200K, making it an attractive option for those betting on Bitcoin’s future gains.

The system failed us. So we created a new one. BTCBULL is leading the charge. 🐂🔥 pic.twitter.com/DSoZ7fPzt8

— BTCBULL_TOKEN (@BTCBULL_TOKEN) February 11, 2025

In addition to BTC airdrops, the team will also burn a percentage of the $BTCBULL token supply forever each time BTC goes up by another $25,000, creating upward price pressure.

Investors can also stake BTCBULL for an annual percentage yield (APY) of 262%.

An analyst on 99Bitcoins, a prominent YouTube channel with over 725k subscribers, predicts BTC BULL Token has the potential to soar 10X after launch.

Investors interested in participating in the presale can visit the official BTC Bull website to buy BTC BULL Tokens for $0.002365 each using BNB, ETH, USDT, or a bank card.

Buy before a price hike in less than 3 days to secure the best deal.

Buy BTCBULL Tokens on the official website here.

Related Articles:

- BTC Bull Token ICO Zooms Past $1.2M In First 3 Days

- AI Agent Crypto Market Cap Soars By $139M As MIND Hurtles Past $6M

- Ripple Token Jumps 3%, While This Wallet ICO Races Toward $10M

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage