Join Our Telegram channel to stay up to date on breaking news coverage

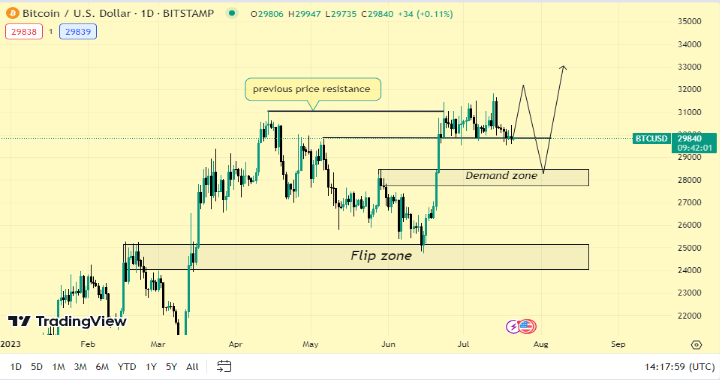

Bitcoin has struggled to move beyond $31k since early June when it touched this price level. Despite numerous attempts to break out of this zone in recent years, none has succeeded.

It is possible that we could see a minor price surge to $32k if the price flips this zone.

Bitcoin Price Action that Deserves Attention

After a remarkable rebound from the November 2022 bearish slump that drove Bitcoin to the $15,000 range, the cryptocurrency demonstrated a strong recovery, reaching an impressive $31,000 in June.

However, caution is warranted as there is a possibility of a price decline in the coming weeks if it breaks out of the current consolidation zone. Today, the live Bitcoin price is $29,810.95, with a substantial 24-hour trading volume of over $13.5 billion.

Despite recent gains triggered by EFT filings from major investment firms like BlackRock and Ripple’s partial win against the United States SEC on July 13, market sentiment is bearish, leading to losses across various assets, including BTC, eroding some of the earlier gains. Investors are keeping a watchful eye on the market as it navigates through this volatile period.

Bitcoin chart key levels

Over the past few days, Bitcoin has shown a relatively bullish trend, thanks to the positive market sentiment following Ripple’s partial victory against the SEC. The crypto asset’s price has been struggling within the $31k-$29k range, encountering significant resistance in its attempt to break out of this level.

The “flip zone” represents the previous price support area, while the “Demand zone” becomes a crucial point from which the market might bounce back if it fails to break past the current consolidation level of $31k.

According to the path tool on the chart, a potential pullback into the demand zone could serve as a catalyst, propelling the price to gain momentum and surge beyond the $32k mark in the weeks ahead. Investors and traders will closely monitor these levels for potential price movements and trend shifts.

Bitcoin Price Indicators

The chart analysis reveals a promising outlook for Bitcoin, with the price currently trading above the 50-day and 200-day Simple Moving Averages (SMA), indicating a bullish momentum in the medium and long term. This positive market sentiment may attract more buyers, potentially leading to further price increases in the long run.

Caution is advised as the Moving Average Convergence Divergence (MACD) indicator is below the signal line, signaling a potential bearish trend in the asset’s price action. This could weaken momentum and possible price declines, prompting investors to consider selling or adopting careful trading strategies.

The Relative Strength Index (RSI) at 54.95 suggests moderate bullish momentum, indicating slightly higher buying pressure than selling pressure but not overbought.

Traders may interpret this as a potential continuation of the current uptrend or a period of sideways price movement. It’s essential for investors to closely monitor these indicators to make informed decisions in the dynamic cryptocurrency market.

Factors that could influence the long- or short-term price action of Bitcoin

Apart from general market sentiment, whale activities, and regulation, other notable factors could influence the price of Bitcoin. One such factor is Bitcoin halving, which occurs approximately every four years, reducing the block reward for miners by half.

This mechanism controls cryptocurrency’s inflation and manages its scarcity. Historically, halving has led to significant price rallies in Bitcoin due to decreased supply and increased demand. With fewer new coins entering circulation, a supply shock is created, potentially leading to higher prices as demand outpaces supply.

Market dynamics and external factors also play a role in influencing the price, making it challenging to predict the exact impact of halving. Nonetheless, its scarcity-driven nature generally generates positive market sentiment.

Another factor that could significantly impact the price of Bitcoin is the integration of Bitcoin into ETFs (Exchange-Traded Funds). ETFs make it easier for institutional and retail investors to gain exposure to Bitcoin without directly owning it, thus increasing its accessibility and liquidity.

Increased demand from ETF investors could drive up the price of Bitcoin, reflecting its perceived value and potential for long-term growth. Mainstream acceptance and regulatory approval associated with ETFs may improve Bitcoin’s reputation, attracting even more investors.

It’s essential to note that negative sentiments or market fluctuations can also affect ETF prices, making the relationship complex and subject to factors beyond Bitcoin’s inherent value. Overall, Bitcoin’s halving and integration into ETFs are crucial factors influencing its price and market dynamics.

Bitcoin Price Prediction by Experts

According to Changelly’s projections, the price of Bitcoin is set to witness notable fluctuations in 2023. At its lowest point, the minimum cost of Bitcoin is predicted to be $27,228.56, while the highest level it can reach is anticipated to be $31,733.76.

The average trading price throughout the year is expected to be approximately $36,238.95. However, based on the observed price fluctuations at the beginning of the year, crypto experts at Changelly forecast an average BTC rate of $32,166.50 in July 2023. During this period, Bitcoin’s minimum and maximum prices can be expected to hover around $30,106 and $34,227, respectively. Investors and traders must closely monitor these fluctuations to make informed decisions in the ever-evolving crypto market.

The Crypto Space’s Leading Player, Launchpad XYZ

Launchpad XYZ (LPX) is a cutting-edge crypto project on the Ethereum blockchain, aiming to facilitate a smooth transition into Web3 technology. With a focus on empowering individuals and businesses, the platform offers many features and functionalities.

It serves as a knowledgeable guide in the complex crypto space, leveraging the latest advancements in the field. One of its standout offerings is the immersive Metaverse experience library, delving into virtual reality and blockchain-based environments.

This curated library allows users to explore and grasp the ever-evolving landscape of virtual reality. Launchpad boasts a comprehensive trading terminal for seamless and efficient trading, enabling users to monitor market trends, execute trades swiftly, and access real-time data.

The platform also caters to the surging popularity of play-to-earn (P2E) gaming, dedicating a game hub within its ecosystem. Users can engage in various P2E games, earn rewards and actively participate in the flourishing P2E gaming ecosystem, bridging the gap between entertainment and tangible incentives.

Initiation of LPX Presales

The LPX presale has exceeded expectations, witnessing impressive strides since its inception, as it continues to draw substantial interest from eager investors seeking early entry into the promising project.

The current phase presents a unique opportunity for investors to acquire LPX tokens at a discounted rate of $0.0445 per token, a price that has caught the attention of many individuals looking to capitalize on the favorable rates and secure their tokens ahead of the official listing.

The presale fundraising efforts have been remarkable, with LPX raising more than $1.17 million. This achievement speaks volumes about the project’s strong appeal, inspiring confidence and trust among investors who recognize LPX’s inherent value and growth potential.

The funds raised represent a significant step towards the project’s ultimate target of $1,550,000, demonstrating the substantial traction and support LPX has already garnered in the market.

The presale’s diverse and engaged investor base is a testament to the project’s vision and potential.

LPX is determined to build upon this initial success as the presale progresses, sustaining momentum and attracting further investments.

LPX tokens are available at a discounted price before the project reaches its ambitious goals, thus encouraging prospective investors to seize this opportunity.

With its promising outlook and robust backing, LPX is set to pave the way for a bright future in the cryptocurrency landscape.

An Overview of the LPX Features

Launchpad is a game-changer, empowering individuals and businesses with its cutting-edge technology and powerful features. One of its standout offerings is the fractionalized asset marketplace, breaking valuable assets into more affordable portions and broadening investment opportunities for a diverse audience.

At the platform’s core, a custom-built DEX ensures secure and efficient cryptocurrency trading within the Launchpad ecosystem, eliminating centralized exchanges. Furthermore, recognizing the significance of Web3 compatibility, Launchpad introduces a specialized Web3-based wallet that allows users to securely manage and interact with their digital assets while embracing Web3 technology’s decentralized nature.

With Launchpad, users gain control and access to previously exclusive opportunities in the world of blockchain and finance.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage