Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin threw a wave of excitement as it crossed the $23k price target a couple of days back, consequently pulling above $24k as well; leading to an overjoyed crypto market. The celebration, however, was quite short-lived as bitcoin’s price dropped back to hovering between the above-mentioned price levels. Investors are now curious as to where the frontrunner crypto is headed in the near short term, and if it will cross the $25k level anytime soon. Well, let’s find out.

Bitcoin Price Hovers Between $23k and $24k After Hinting A Possible $25k

The value of Bitcoin saw a significant increase recently, reaching the $24,000 level for the first time since August. This sudden jump in value coincided with a broad rally in stocks, particularly the Nasdaq, as well as a drop in U.S. Treasury yields and the U.S. Dollar Currency Index (DXY). Despite this positive trend, many investors and analysts remain cautious as they anticipate a pullback in prices before stabilization.

The day before the jump in Bitcoin value, the Federal Reserve raised its benchmark interest rate, which some saw as a dovish move. However, Fed Chairman Jerome Powell noted that although inflation appears to be slowing, it still remains elevated and more evidence is needed before the central bank can confidently say inflation is approaching its 2% target.

Ethereum also saw a surge in value, almost reaching $1,700, the highest since September. However, if it does not break through the $1,700 resistance level, a correction may occur.

On Friday, there was some profit booking in Bitcoin and other major altcoins after the interest rate hike by the U.S. Federal Reserve. Bitcoin dropped 2% but remained above the $23,000 mark, while Ethereum dropped more than 2% but held above the $1,600 level. Other altcoins showed mixed results, with some trading lower and a few trading higher. The total trading volumes were flat, slipping only 1% close to $61.25 billion.

The $24k target was deemed quite crucial by market analysts as it opened doors for the token to reach $25k and continue to rise from there. However, the latest contraction has raised some scepticism towards these theories.

Bitcoin Technical Analysis

The world’s largest cryptocurrency Bitcoin is expected to see a “golden cross” soon. This technical event happens when the 50-Day Simple Moving Average crosses above the 200-Day SMA, which is often viewed as a bullish sign by traders. As long as the price of Bitcoin doesn’t see a significant drop, the golden cross is predicted to occur in the coming week.

Recently, Bitcoin’s price has seen a surge of over 40% since the start of the year. However, the cryptocurrency faced a drop on Friday as market volatility increased before the release of the U.S. non-farm payroll reports. The 14-day relative strength index was unable to break a key resistance level, leading to a drop in the price of Bitcoin.

As of now, the index is under the 70.00 support level. If it fails to hold, there is a likelihood of the price moving below $23,000. In the medium to long term, Bitcoin has broken through a falling trend channel, indicating a slower rate of decline or a more horizontal trend.

The token is between support at $21,400 and resistance at $25,000, and a definitive break through one of these levels will dictate the direction Bitcoin follows. With a positive volume balance and RSI above 70, the currency is showing strong positive momentum and a further increase is expected. However, a high RSI value could also indicate the coin is overbought and a reaction downwards is possible. On a purely technical front, Bitcoin is assessed as neutral for the medium to long term.

Will Bitcoin Push Back Up?

After a challenging market crash in 2022, Bitcoin (BTC) has made a strong start to the year 2023, with over a 40% increase in price over the last month, making it the best January performance since 2013 and the best-performing month since October 2021.

The current market conditions are believed to be bullish for Bitcoin, with a possible end to the tightening financial conditions and potential interest rate cuts by the end of 2023. According to multiple on-chain and technical indicators, the bottom of the bear market in 2022 appears to have passed.

Investors have been unfazed by the recent Fed decision to hike interest rates, with the upcoming US jobs report expected to be the next catalyst for risk. Crypto traders are confident heading into the report and are looking for opportunities to test Bitcoin’s resistance around $24,000, or even push it to near $25,000.

The bottom in $BTC is a double walled fulcrum pattern. Extremely rare. The 2X target is mid 25's. pic.twitter.com/NfffzbniO5

— Peter Brandt (@PeterLBrandt) January 29, 2023

At present, Bitcoin is trading at $23,480 with a market cap of $493 billion. If the price moves above the crucial resistance of $24,300, its next target could be $25,000. Seasoned trader Peter Brandt has also predicted that the Bitcoin price could rise to $25,000 in the near future, citing a “double-walled fulcrum pattern” in the market.

Data also shows that traders are optimistic about the future of Bitcoin prices, with the long-short ratio and lending rates indicating that bulls are in control. However, some experts warn that this overconfidence may signal that the current crypto rally is built on weak technical and fundamental foundations, forming a new bubble.

Now that the Fed’s interest rate hike is out, the future price action of Bitcoin will greatly depend on macro developments. As for the chart patterns, the current price movement of Bitcoin resembles its price performance a week back. Which has been consistent for a while. If that info is to account for, then it’s safe to say that the $25k price target for Bitcoin isn’t too far.

Meta Masters Guild To Outperform Market Leaders

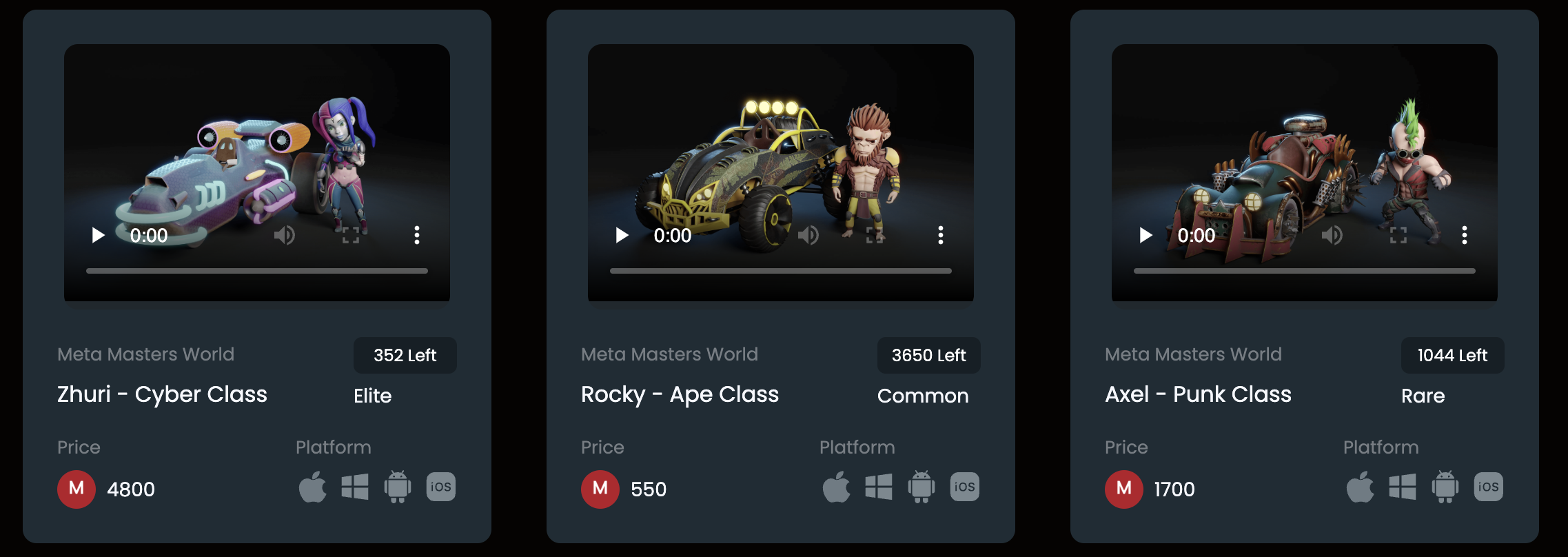

Meta Masters Guild is an exceptional new project that could bring innovation to mobile gaming and generate profits for early investors. It aims to combat the common unethical practices in the gaming industry and provide a unified crypto platform for mobile games.

The MEMAG token is an integral part of the ecosystem and will be used for transactions, rewards, and trading within the games. The MEMAG presale has already raised $2.7 million and is in stage five of its presale, with a limited time left to invest at a discounted price.

The focus is on the fastest-growing and most profitable market in the mobile gaming industry, which is estimated to generate a revenue of $172 billion in 2023. The project currently has three games under development, covering various genres, and are planned for release with new titles added regularly.

The MEMAG token will be listed on leading exchanges and platforms post-presale, with a demo of Meta Kart Racers and NFT characters expected by the end of 2023. This is a promising opportunity, so don’t miss out on investing in MEMAG before the price rises.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage