Join Our Telegram channel to stay up to date on breaking news coverage

BTC is currently valued at around $21,900 and has a $15.3 billion 24-hour trading volume. With a #1 ranking, a $420.7 billion market valuation, 19.3 million coins in circulation, and a 21 million maximum supply of BTC coins, it has increased by 0.45% during the past 24 hours. On Saturday, Bitcoin broke through a crucial support level of around $21,875—raising the likelihood of a negative trend in BTC. If there is a bullish break through this level, the next resistance limits of $22,300 to $22,850 may be reached.

The decline might extend to the $21,200 level, though, if it is unable to break underneath the $21,750 mark. BTC’s price might crash to its nearest support of $20,600 if it breaks through this level.

Bitcoin Fundamental Outlook

Despite worries about potential regulatory surprises shortly among certain cryptocurrency traders, a group of well-known investors seems unconcerned. If no US lenders come forward to lend help after crypto exchange Binance temporarily suspended US Dollar withdrawals and deposits, a crisis might develop.

The issue could become clearer next week, but the latest $30 million agreement reached between Kraken as well as the US SEC caused a sharp decline in market prices. Following the agreement, Brian Armstrong, the CEO of Coinbase, warned that the SEC would eventually outright prohibit cryptocurrency staking. In light of this, recent comments from SEC head Gary Gensler imply that crypto businesses would need to provide comprehensive disclosures, supporting the prospect of future enforcement of such measures.

In addition, Gensler goes so far as to claim that the only option for crypto enterprises to continue operating is to comply with US regulations requiring complete and truthful disclosures.

Technical Analysis of Bitcoin

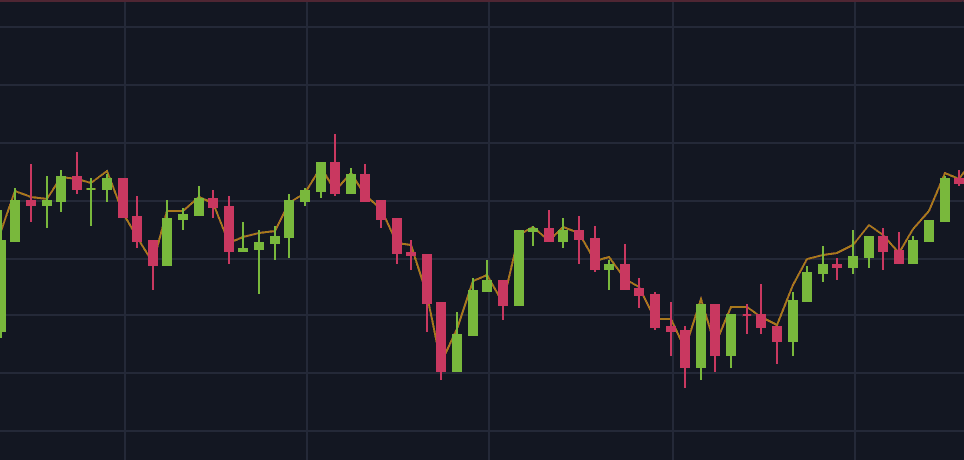

Following the market crash in May 2022, the price of bitcoin started to rise within a symmetrical pennant, which collapsed in November as a result of the failure of FTX. The price was helped to restore its levels inside the pennant, nonetheless, by the current rise that began at the beginning of 2023.

The BTC value is currently being rejected from the triangle’s higher resistance and may soon retrace its steps forward toward the bottom support before consolidating once more until it hits the pennant’s edge. By breaking out over the key obstacle at $30,000 well before the end of Q2 2023, the price of bitcoin may break out at its top and go above the adjacent resistance at $25,347.

The entire quantity of BTC tokens stored in wallets across all exchanges makes up the supply on exchanges. These levels reveal how market participants are feeling and whether they want to sell or keep the asset for a longer period. Given that market participants frequently accumulate and move their assets into their wallets, a decrease in supply on platforms is typically positive.

Sadly, the inventory on the markets has dramatically grown after being close to its lowest point in December 2022. Therefore, it suggests that the investors accumulated while the markets were nearing their bottom and that they are now getting ready to take advantage of the rising prices to extract gains.

How Whales are Changing the Bitcoin Landscape

Whales are huge investors that own a sizable portion of a specific asset as well as have the power to dramatically affect the market. The actions of whales on the cryptocurrency market may significantly influence the value of top altcoins too, other than Bitcoin.

Recent evidence and statistics point to the possibility that whale activity in the market may be the cause of the present spike in trade volume. The examination of their actions provides hints about the market trend, which may assist investors in making sound decisions.

Bitcoin whales, those with a holding of more than $1 million in BTC, bought more at the current price when the price fell. This buying rush was especially intense following the FTX crash in November 2022, according to on-chain statistics.

The activity of these whales shows that the unfavourable reactions to Kraken’s decision to stop offering crypto staking facilities would be transient and that they perceive a chance to buy substantial quantities of BTC below the $22,000 mark.

Price History of Bitcoin

The catastrophic financial market crash of 2008, which caused a severe slump and prolonged recession, was a contributing factor in the creation of Bitcoin. The whitepaper was published by “Satoshi Nakamoto,” a pseudonym for a person or maybe a group of people.

The currency was initially made available for trading against the dollar at the New Liberty Monetary Exchange, where 5050 BTC of its value was exchanged on the BitcoinTalk forum for $5.02 using PayPal.

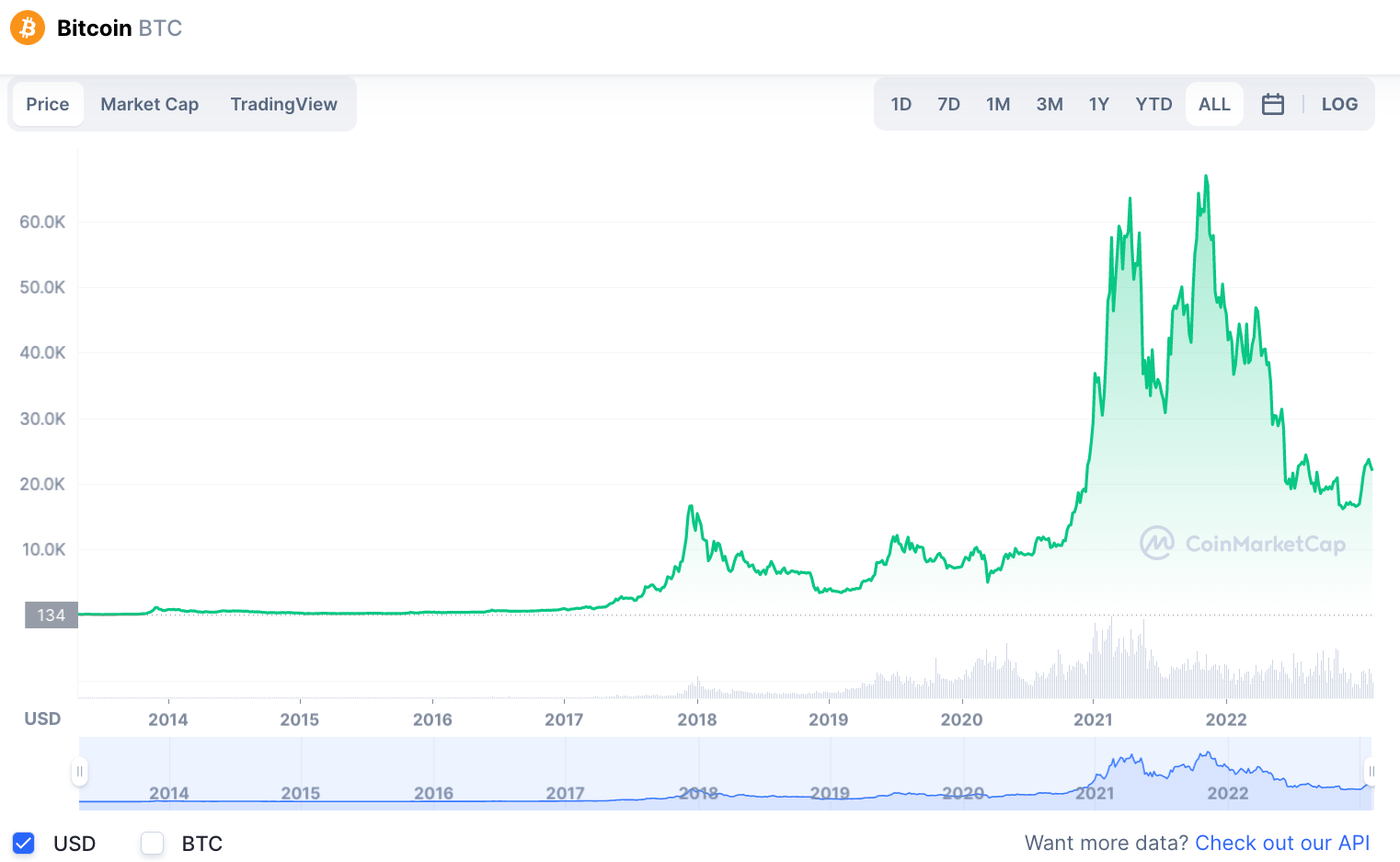

In February 2011, the price of Bitcoin crossed the $1 threshold, and it subsequently rose sharply in subsequent years. The price went through its first price surge in 2013 and reached highs around $1200 before falling swiftly and staying flat throughout 2014 and 2015. This was mostly because of the hack of the Mt. Gox exchange, which was the first security violation to result in a loss of 744,400 BTC.

The following bull run began at the close of 2017 and continued through the first few months of 2018, during which time the price of bitcoin rose above $19000. However, a bear market struck, which was partly fueled by the COVID epidemic, and forced the price to consolidate until March 2020.

After surviving the bad market, the price once more sparked a bull run to set new records over $69,000 in 2021 before resuming its bearish trend throughout 2022.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage