Join Our Telegram channel to stay up to date on breaking news coverage

Data retrieved on March 19 by Finbold shows that Bitcoin’s momentum is likely to stagnate on Easter day, April 9, and could trade at $27,845. To determine Bitcoin’s price during Easter 2023, Finbold tapped CoinCodex’s self-learning machine platform.

Bitcoin’s price decline is ultimately the result of political pressure, technological failures, and media coverage based on the concept of FUD: any news coverage aimed at spreading “Fear, Uncertainty, and Doubt.”

In the Meantime, Volatility Rules

The price of Bitcoin has remained stagnant at $28,000 in recent days. Long-term Bitcoin holders are taking profits, and whale activity is declining. Will the bulls be able to hold on? As long-term holders sell Bitcoin, bulls face fierce resistance at $28,500.

Until Bitcoin reaches most of the world, we can expect both significant price increases and significant price declines. As observed over the past two years, Bitcoin’s price is typically lowest on Friday mornings around 6 a.m. UTC.

Because Bitcoin is volatile, you can earn a lot of money quickly. Trading is most efficient between midnight and 1 p.m. during the UTC time zone, according to experienced analysts. You should open intraday transactions during this period.

As long as Bitcoin does not reach most of the world, we can expect significant price increases and declines. For now, volatility reigns.

“It May Be Illogical” to Expect Bitcoin Prices to Stay the Same

The 70% increase in Bitcoin’s price in Q1 has not convinced everyone that it will keep climbing or even hold its current level near $30,000. According to Bloomberg Intelligence’s analysis of the macroeconomic climate, crypto performance and liquidity levels at global central banks have a close relationship.

Risk assets, including crypto, have declined as banks withdraw liquidity from the economy because of inflation. Bitcoin’s current all-time high coincides with the Federal Reserve’s quantitative tightening (QT) program that began late in 2021.

For the first quarter of 2023, Bitcoin ranked as the best-performing asset class. Nevertheless, macro factors like US prosecutors’ ongoing auction of seized 40,000 Bitcoins and critical bearish on-chain signals pose roadblocks to price gains.

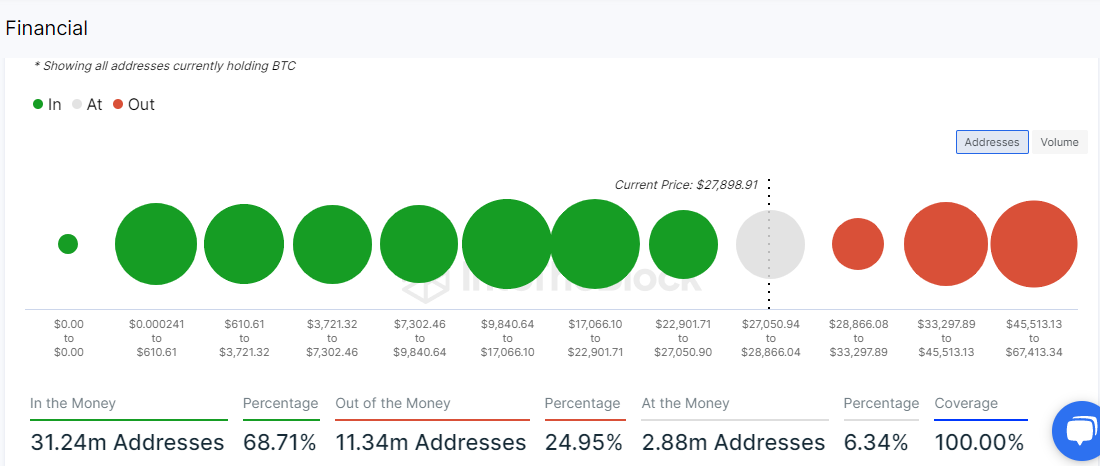

IntoTheBlock data suggests BTC’s road to $30k might be rocky. In the coming weeks, BTC holders can expect another retracement below $27,000, as shown by the In/Out of Money Around Price (IOMAP) data.

Bitcoin’s Rules of Operation

The value of Bitcoin (BTC) does not depend on any single entity, such as the central bank, as it does with fiat currencies like the Euro and the US Dollar. Supply and demand, or the price people will pay, defines the price.

In particular, Bitcoin is experiencing considerable resistance in the $28,500 range. According to data, 1.37 million addresses have taken profits from 821,000 coins. There is a possibility that BTC could retrace to find support at $26,800 if the sell-off continues. Based on 310,000 addresses buying 250,000 Bitcoins, this is the average price.

If BTC surges above $28,700, bulls may become more confident. It is the maximum price at which the 1.37 million resistance army had purchased 821,000 bitcoins. BTC could reach $30,300 relatively easily if it breaks above that zone.

Ultimately, Bitcoin’s price decline comes down to the:

- Pressure from politics,

- Mistakes in technology,

- All news coverage that may spread “Fear, Uncertainty, and Doubt” (FUD)

A Mixed Prediction for Bitcoin’s Future

Despite this, some experts have optimistic predictions for Bitcoin’s future value, with Balaji Srinivasan betting it will reach $1 million within 90 days and Marshall Beard predicting it will reach $100,000 within this year.

Bitcoin (BTC) has performed remarkably well this year, increasing by 70% and currently trading at over $27,912. Nevertheless, Gareth Soloway of InTheMoneyStocks.com predicts a drop to less than $13,000 for Bitcoin. The bearish forecast may limit Bitcoin’s price increases in the future.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage