Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin is back to trading below $23,000 after hovering there for a while. The token’s unreliability in volatile performance has put investors in a tough spot to predict its near future. Here’s a closer look at what’s up with the frontrunner crypto.

Powell Saves Bitcoin From A Downfall

Federal Reserve Chairman, Jerome Powell recently made comments saying that the Fed is still trying to bring inflation under control and that the disinflationary process is in the early stages. This provided some reassurance to investors since the news of the US unemployment report a week back had caused serious tension in the market, leading to a decline in the price of cryptocurrencies.

He further added that if there is a decline in the number mentioned by the inflation reports, or the labour markets continue to be strong; the Fed may have a reason to raise interest rates further. However, the process of disinflation won’t be quick, nor any less painless. And there is a possibility for the reversal of terminal-level interest rates.

Pushing on the same predictions, Naeem Aslam said that the interest rates can no longer be expected to stay between 4.75 – 5%. Naeem is a chief market analyst at AvaTrade, and believes that the interest rates could go up to 5.25%. These comments, however, received some criticism from Michael Hewson, director of analysis at CMC Markets.

Apart from this, other factors such as the sale of Grayscale, the largest bitcoin fund in the world, have caused some discomfort when it comes to trust in Bitcoin. From the looks of it, the price behaviour for Bitcoin seems to rest only on headlines for now. A closer look at Bitcoin’s price performance so far, since its inception, will help understand how the coin could perform in the future.

The Rise And Fall Of Bitcoin Throughout History

The rise of Bitcoin, starting from its inception in 2008, has been nothing short of remarkable. The idea of a decentralized, digital currency based on blockchain technology was introduced by the pseudonymous Satoshi Nakamoto in a white paper. And on January 3, 2009, the Bitcoin network went live with the mining of the genesis block, which marked the beginning of the blockchain.

The block contained a note that referenced the financial crisis of 2008-2009, hinting at the reason why Bitcoin was created – as a response to the way the events of those years played out.

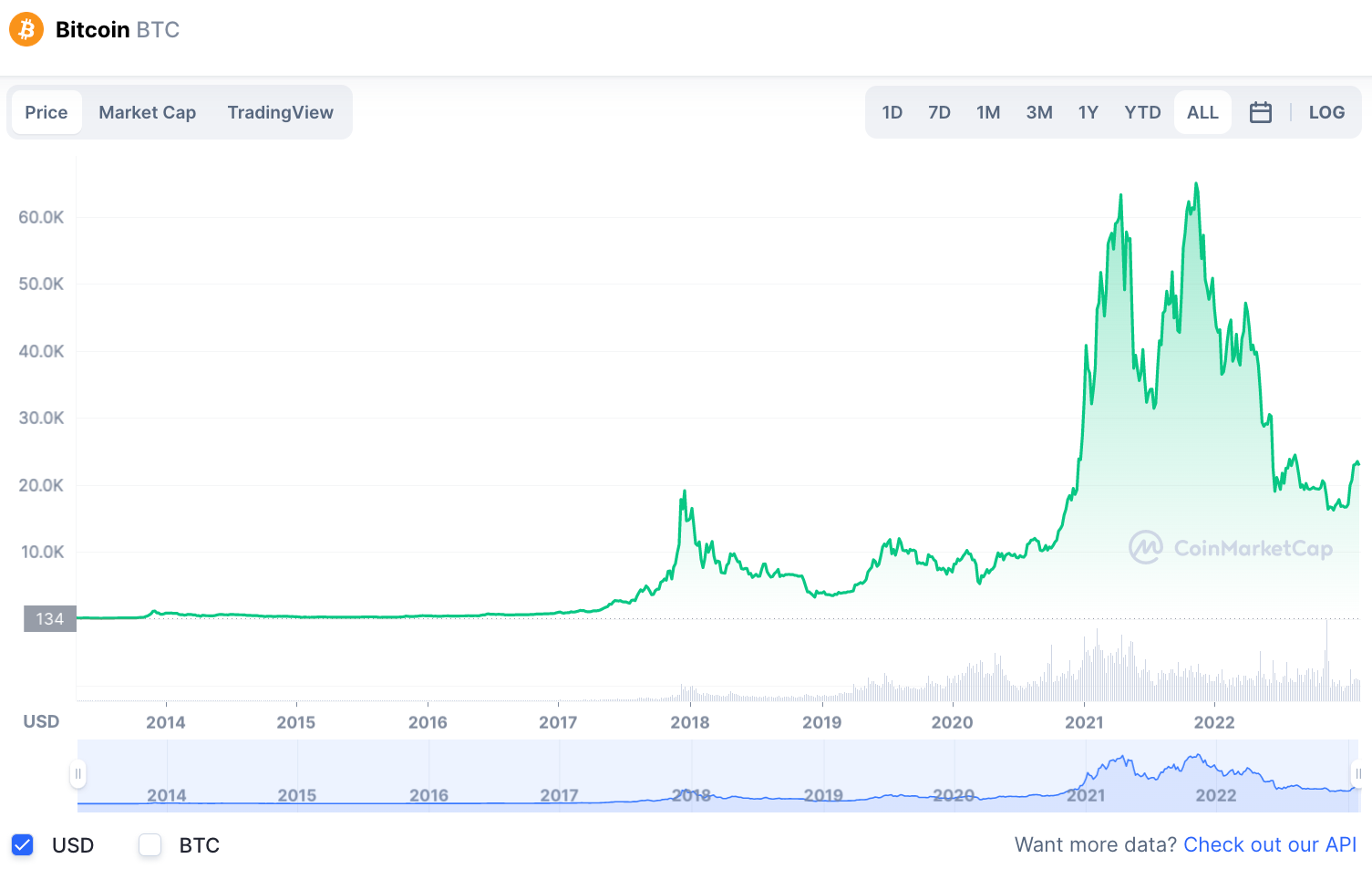

In 2011, Bitcoin experienced its first major price surge, rising from $0.30 to $30 but dropping back to under $5 by year-end. The cause for this is unknown but competition from other cryptocurrencies may have played a role. In 2012, the first halving of Bitcoin took place, reducing the mining reward and setting the stage for future growth.

2013 saw the largest gains in Bitcoin price history with a 6,600% increase, reaching a peak of $1,100 and surpassing a market cap of $1 billion. This was accompanied by increased interest in cryptocurrency, including the emergence of Dogecoin.

From 2014 to 2016, while the crypto industry continued to grow with technological innovations such as proof-of-stake and smart contracts, Bitcoin remained relatively quiet. The price held steady in the $200 to $400 range for much of this time but began to climb with the second halving in 2016, reaching five digits within the year, peaking at nearly $20,000 in December of 2017.

In 2020, the third halving took place, reducing the mining reward from 12.5 coins to 6.25 coins. The price of Bitcoin saw an increase from around $7,000 in March to over $40,000 in December, driven in part by institutional investors and growing adoption by businesses and corporations.

The year was marked by increased regulation, with governments and central banks around the world taking a closer look at cryptocurrencies. Despite this, the price of Bitcoin remained volatile, with fluctuations throughout the year.

The rise of Bitcoin, from its inception in 2008 to the present day, has been marked by volatile price movements and increased public awareness and interest. Despite the challenges and fluctuations, cryptocurrency continues to grow and mature, with greater adoption and investment from institutions and businesses. The future of Bitcoin and the crypto industry remains uncertain, but one thing is for sure – it has come a long way since its early days and has the potential to restructure the world of finance.

Will Bitcoin Rise Again?

Investors and market analysts are divided over Bitcoin’s future outlook, at least in the short term. The positive outlook for bitcoin for the next few months suggests a bullish trend since many investors believe that the token has found a bottom at the $17,000 price level in December. This is a huge determining factor for the token’s price if the macroeconomic conditions are not taken into consideration.

On a longer time scale, however, there are a bunch of other factors that are at play. Bitcoin halving, the event where the mining reward is cut in half, is expected to take place next year, and the price is expected to increase due to the deflationary tendency and limited supply of Bitcoin.

Crypto whales, known to make bulk purchases, seem to accumulate bitcoin for the last few weeks. While institutional investors have a bearish view of cryptocurrency. Many predict the token to fall below the $20,000 level, while few investors are coming up with extreme predictions for the token, placing it to drop down to $12,000.

The rise in interest rates might encourage the token to pump, as it is one of the best digital assets to battle inflation. However, in times of such market volatility, investors prefer to avoid risky assets and choose to go for safer options, at the cost of possible high returns.

In the short term, Bitcoin is expected to return back to the $24,000 level. As there is a high rise in the number of small Bitcoin wallets, which suggests that investors are prepping up to accumulate the currency.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage