Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s performance has been erratic as of late. After building anticipation and giving people hope that the days of crypto winter might be over, Bitcoin has been retracing. The $30k spike, which, according to some experts, was due to some whales wanting to make a play at moving Bitcoin back to its pre-winter phase, has failed to sustain itself for a long time. And now that the Bitcoin price has dropped just above $28k, will the $30k be coming back soon?

Bitcoin Price Drops Steeply from nearly $30k to Just Above the $27k Mark

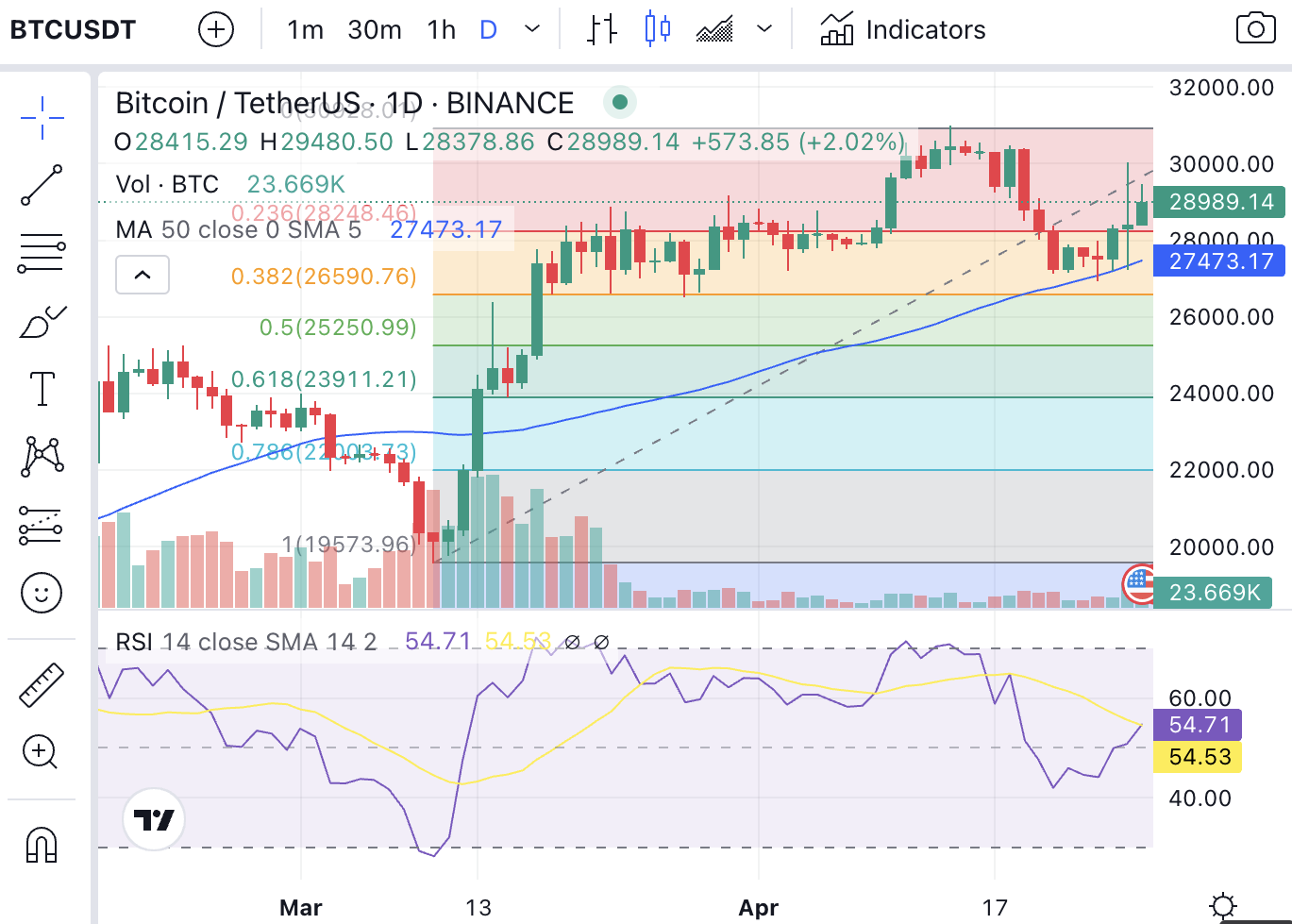

The hourly trading charts for the Bitcoin price show the formation of a large red candle last evening after the token was trying to sustain a level closer to its $30k mark.

The rapid drop came after the 4% increase yesterday, the reason for which experts are scrambling to find. Many were speculating about the driving factor behind the upswing when the large candle formed and Bitcoin fell below the $28k mark before bouncing.

The News of Republic Bank Likely The Reason Behind the Last Surge

Q1 2023 has laid heavy on traditional banks. First, we saw the downfall of Signature Bank, and then the Silicon Valley Bank started looking for life support – all these events contributed to people consolidating their positive stance towards cryptocurrency – leading to Bitcoin’s recent surge.

The last surge, however, was likely due to a report by Fox News that the First Republic Bank will be seized by the US government.

BREAKING: First Republic Bank is expected to be seized by the US government per Fox News

— Matt Couch (@RealMattCouch) April 26, 2023

Catalyzing that downfall was the news that clients had withdrawn over $100 billion deposited from banks in the first quarter of 2023.

The rapid withdrawals fuelled the flames of rumors that the First Republic Bank, one of the leading Banks in all of America, would be the third bank in line to fall after Signature and SVB.

While that pushed people to grow more bullish about Bitcoin – which led to it crossing the $30k mark. The recent drop has been worrisome, to say the least.

The Reason Behind Bitcoin’s Recent Price Drop

The massive red candle formed a few hours ago in the Bitcoin Price, indicating the crypto’s failure to sustain a level above the $30k mark. The recent drop has caused a whirlwind of rumors – one of which is liquidity concerns.

However, we looked into the member feed in CoinMarketCap and found many talking about why it might have happened.

Satechainmedia, one of the leading verified users on CoinMarketCap, has alleged that the recent price correction is the result of circulating activities of old Bitcoin whale wallets that have not been active for a long time.

Other lesser-known but still good traders are saying that the recent erratic behavior is likely because of major players trying to confuse the market.

That may be the case since most experts haven’t been able to give a consolidated answer as to why the Bitcoin price has been behaving this way.

That said, the crypto is still above its 50-day AMA, which is great news for corporations. As companies like Apple, Meta, and Alphabet announce their quarterly results, Bitcoin may be able to bounce back to its $26 mark.

But as of right now, the token is trying to establish support at the $28k mark (0.236 Fibs). If Bitcoin fails to do so, it might continue to drop to settle around the $26k level.

Is the $30k Spike Just the Beginning?

Is Bitcoin hitting the $30k mark just the beginning of signs that the market is going to get back on track? We are not certain. And considering that one of the central banks of America – First Republic Bank – might be on the verge of closing its doors, we can expect another short-term rally soon.

But that would be a short-term rally backed by whales who are moving the assets. It is important to know that the Bitcoin price is not essentially the indicator of how many people have adopted this token to hedge against the traditional markets.

That said, many institutions are predicting that Bitcoin might reach $100k by 2024.

Standard Chartered Bank Says That $100k Coming to Bitcoin in 2024

Standard Chartered Bank published a report on Monday suggesting that Bitcoin can potentially reach $100,000 by the end of 2024.

The Bank has attributed many factors to this prediction, one of it which is the recent bank sector crisis, which would push people towards a more decentralized resource – which is Bitcoin.

The number 2 reason is Federal Reserve loosening its grip when it comes to hiking the interest rate. People might get some reprieve from the Fed’s de-inflationary measures, which would work well to push the Bitcoin price upwards.

JUST IN: Bear market is over and #Bitcoin could hit $100K by end of 2024 – Standard Chartered pic.twitter.com/mhrBTNxbNm

— Bitcoin Archive (@BTC_Archive) April 24, 2023

Bitcoin Price Has Bounced Closer to the $29k Mark

The rapid decline that Bitcoin received only lasted a short while as the market got back in action to push BTC back to its recent highs.

If Bitcoin is able to consolidate around the current support level – $28277, it might move up to test the $30.9k resistance level. Thankfully, that seems like a possibility since the current RSI – Relative Strength Index – of BTC is 54, placing it right in the middle.

New Cryptocurrencies Form a Better Option

While a rebound is happening, things can move in a different direction in the crypto sector without any warning. Further bearish trends for this token can still emerge – which makes it necessary for people to look for other, better alternatives that can generate profit without the market risks.

New cryptocurrencies like AiDoge and DeeLance are better alternatives to invest in right now. These crypto assets are currently available as presales, bringing you a chance to lock in gains even before they start live trading on cryptocurrency exchanges.

Related Articles

Join Our Telegram channel to stay up to date on breaking news coverage