Join Our Telegram channel to stay up to date on breaking news coverage

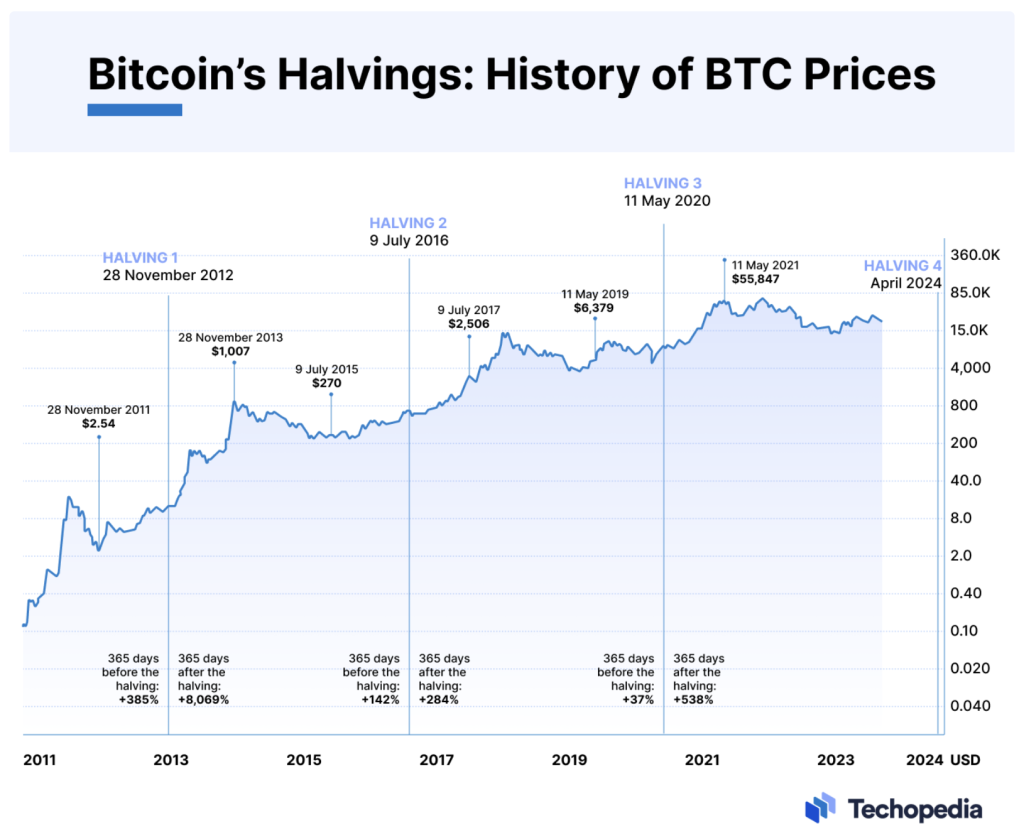

In a recent video titled “Bitcoin: Early Halving Year Pattern,” known YouTuber Benjamin Cowen explores a recurring pattern in Bitcoin’s behavior in the early phase of its halving year. The halving event, which occurs approximately every four years, is a significant occurrence in the Bitcoin ecosystem, reducing the reward for mining new blocks by half, thereby diminishing the rate at which new bitcoins are generated.

What is Halving and How Does it Work?

Bitcoin was initially designed with a maximum circulating supply of 21 million coins. This design was intended to establish scarcity and uphold the coin’s long-term value. Halving, which reduces the block rewards, is a strategic move to restrict the introduction of new coins into circulation, preventing mining from causing inflationary pressures.

By gradually introducing new BTC coins over several years through the halving process, the objective is to manage supply inflation, foster market stability, and ensure a fair distribution of the cryptocurrency.

The Pattern of Pre-Halving Years

Cowen begins the video by recalling a prediction made in the third quarter of the pre-halving year. It was speculated, based on historical patterns, that Bitcoin would fall below its bull market support band during this period. This pattern, observed in previous pre-halving years, did indeed repeat itself, as Bitcoin dropped below the support band, aligning with past trends.

February of the Halving Year: A Key Period

A crucial part of the video focuses on the behavior of Bitcoin in February of the halving year. The author notes a consistent pattern where Bitcoin has always been at its bull market support band during this month. This pattern is not about Bitcoin being above or below the support band but precisely at it in February of each halving year.

Historical Evidence and Future Predictions

The presenter provides historical evidence to support this observation. They cite the instances of February 2012, 2016, and 2020, showing that in each of these years, Bitcoin reached the bull market support band during this month. Based on current levels, reaching the support band would imply a significant drop in Bitcoin’s price, estimated around 15%. However, the rate of descent could vary depending on the movement of the support band itself, which might increase over time.

Market Movements and External Factors

The video also touches upon Bitcoin’s behavior following its reach to the support band. In 2012 and 2016, Bitcoin held the support band level, but in 2020, it failed to maintain this level due to the pandemic and subsequent economic recession. These observations suggest that external economic factors, such as the state of the economy and actions by the Federal Reserve, can significantly influence Bitcoin’s ability to hold the support band level.

Implications for Bitcoin’s Price

Cowen concludes by emphasizing the importance of this pattern and its potential implications for Bitcoin’s future price movements. The anticipation is that, as February approaches, Bitcoin might experience a drop to the bull market support band, though the exact trajectory could vary based on various factors.

Related News

- Where is Bitcoin Headed Next?

- Microsoft Hires Sam Altman after Weekend-Long OpenAI Drama That Sent Worldcoin Price On a Wild Ride

- Bitcoin Price Prediction: VanEck Sees BTC Hitting ATH In November, But This Bitcoin ETF-Themed Coin Is Primed To Explode Next Month

- Bitcoin Breaks $30K Amid Rising Optimism Over Imminent ETF Approvals After SEC’s Ripple “Capitulation’’ – And That Indicates Boom Times For Bitcoin Minetrix

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage