Join Our Telegram channel to stay up to date on breaking news coverage

After Bitcoin tumbled to below 20k levels last week, the crowd started waiting for some signs of recovery. It seems that this week, it has hit it. Bitcoin price has crawled its way back to above $20k, and market watchers are happy.

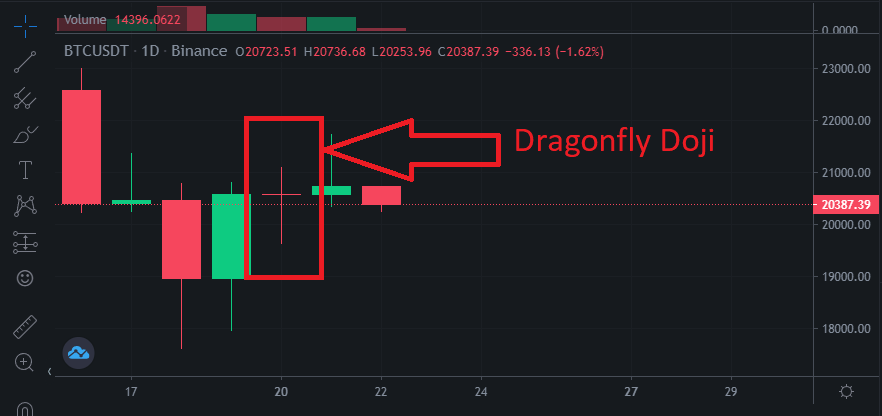

However, Bitcoin painted a bullish engulfing pattern after the appearance of a Dragonfly Doji pattern on June 20th. It shows that the opening and closing price of Bitcoin is virtually the same. Novice watchers have wondered if the price trends are going to reverse.

What is a DragonFly Doji?

A dragonfly Doji is a candle stick pattern in which the opening and closing price of an asset are the same. Dragon Doji candle sticks appear as a cross and are used extensively in the analysis of asset classes.

Why does such a pattern form? It does as a signal to show a reversal pattern. In the current bear market, it could mean that the Bitcoin trade could soon hit the green zone. However, it also points to continuation, which means that buyers and sellers are equally increasing.

There are three kinds of Doji candles:

- The Long-Legged Doji, when the opening and closing wicks are of the same length

- The Gravestone Doji, when opening and closing prices are near the bottom wick. It appears as an upside-down cross.

- And the third is the dragonfly Doji, where the opening and closing price are near the top wick – something that Bitcoin formed on June 20th, 2022.

What could Dragonfly Doji mean for Bitcoin Price?

The world’s first crypto asset hit the Dragonfly Doji on June 20th, 2022, in which its opening and closing prices were $20,574 and $20,573, respectively. It created a bullish engulfing pattern the next day (engulfing the previous day’s red). Here is a breakdown of what it could mean for Bitcoin’s price:

Bullish Sentiment

A Dragonfly Diji signifies the rejection of the price trajectory. While Bitcoin was trading in green a day earlier, it has been on the bear run since the start of the year. The appearance of a Dragonfly Doji can mean that the Bitcoin market has entered a bull phase.

It means buyers believe in Bitcoins’s future and are standing their ground, hoping to enter the bull stage.

Trend Reversal

When Bitcoin created a Dragonfly Doji pattern, its trading volume was $35.58 billion. It is a high volume, and that’s why it is a more reliable signal that the price trends might see a reversal. Since then, the Bitcoin price has shown a marginal uptick that can mean it is time that investors can be hopeful.

The appearance of a Dragonfly Doji is rare and may signal a trend reversal. However, the crypto market is still volatile, and crypto enthusiasts must still be careful.

The appearance of a Dragonfly Doji during a downtrend means that the buyers are gaining more power than sellers. It indicates the trend is about to change. However, it is also important for the investors to wait for confirmation before following the candle straightaway.

Bitcoin Price Prediction

At the time of writing, Bitcoin is trading at $20,382. It is down 0.97% in the last 24 hours. It seems little, but the market watchers state that the bulls are trying hard to maintain the Bitcoin price above the $20k level. Perhaps, that was the reason behind the appearance of the rare Dragonfly Doji.

As for where the Bitcoin price might head next, most predictors are saying to wait for confirmation on any change in the trends. The token price has been acting erratically since the beginning of this week.

Bitcoin got above $21k levels for a few short hours that people mistook for the end of the bear market.

The appearance of any Doji after Bitcoin painted a bullish engulfing pattern is rare. And since the token hit Dragonfly Doji – a pattern that signals the end of the bear run, it is important to be extra careful. Traders must first wait for confirmation before trading. It is also important not to put complete faith in one pattern. Focusing on the Relative Strength Index and Stochastic Oscillator will help investors accurately determine the price trends.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage