Join Our Telegram channel to stay up to date on breaking news coverage

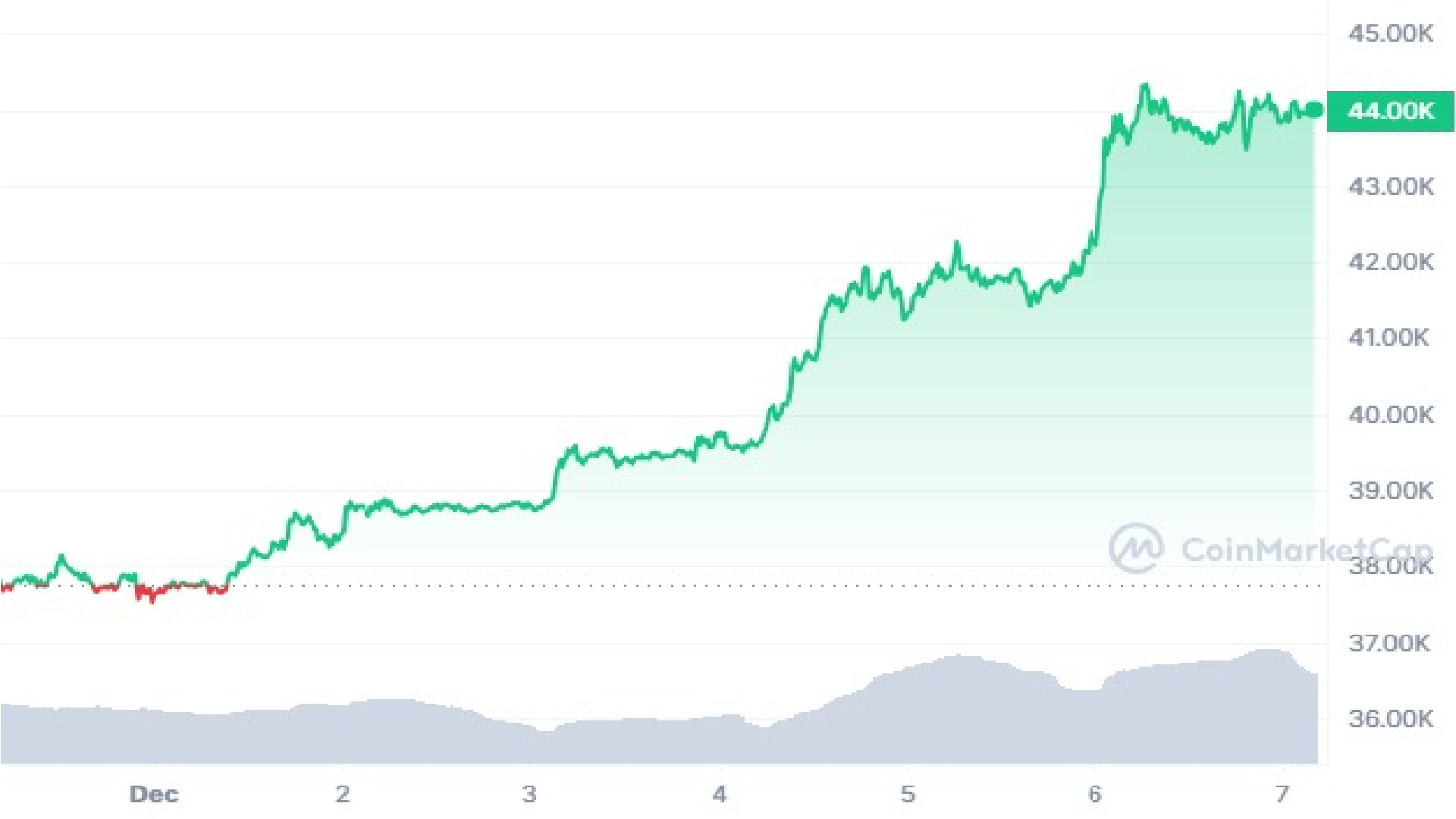

Bitcoin has been on a steady upward trajectory since Monday, reaching a new high for 2023 and currently holding at $43,971. This represents a significant 16% increase over the past week. The rise in Bitcoin’s value shows its ongoing positive momentum, helped by different factors.

These factors include Bitcoin halving and growing excitement about the possible approval of a Bitcoin spot exchange-traded fund (ETF) in the United States by January 2024.

Bitcoin ETF Approval Imminent? BlackRock and ARK Invest at the Forefront

Leading asset manager BlackRock Inc. is poised to make significant strides in the competitive landscape if the United States Securities and Exchange Commission (SEC) approves its spot Bitcoin ETF.

Observers anticipate approval, speculating that BlackRock may have already taken strategic steps to establish dominance in the ETF competition.

Bloomberg ETF analyst Eric Balchunas suggests that BlackRock could transfer assets from its Bitcoin private trust to the ETF upon regulatory approval, potentially giving an early boost to its iShares Bitcoin Trust.

Originally launched last August, the private trust caters to institutional clients interested in tracking Bitcoin’s performance. With nearly $200 million invested, BlackRock is well-positioned for a strong ETF market entry.

Recent amendments to its ETF application indicate constructive discussions with the SEC, emphasizing strong monitoring, AML compliance, and collaboration with third-party platforms for KYC enhancement. BlackRock aims for SEC approval by January, with plans advancing rapidly and seed funding secured.

An undisclosed investor has committed $100,000 to iShares Bitcoin Trust shares, received as of October 27, 2023.

Furthermore, Bloomberg analyst James Seyffart expresses optimism, forecasting the potential approval of a spot Bitcoin ETF around December 10. Additionally, he expects approval for ARK Invest’s Spot Bitcoin ETF by January 10 of the following year.

Here's the most updated version of my spot #Bitcoin ETF race table pic.twitter.com/jYmrg8SI3I

— James Seyffart (@JSeyff) December 5, 2023

Bitcoin Halving Countdown Adding Fuel to Crypto Rally

Adding to the positive outlook in the market is the expectation of Bitcoin’s halving event, set to happen in 132 days. This event, integrated into bitcoin’s underlying blockchain by its anonymous creator Satoshi Nakamoto, was introduced as a measure against inflation when the cryptocurrency launched in 2009.

Occurring roughly every four years, the lead-up to halving has traditionally been the most lucrative period for crypto investors. Historically, these events, reducing the rate of new Bitcoin creation, have foreshadowed significant price surges.

This upcoming halving is increasingly seen as a trigger for steady growth and lasting value increase in Bitcoin. Despite the SEC’s hesitancy in outright approving a spot Bitcoin ETF, these recent developments, combined with the trading excitement and the upcoming halving, suggest a crypto market on the verge of a transformative period.

$BTC Price Prediction

Bitcoin’s price currently sits at $43,971, with a trading volume of $60.36 billion and a market cap of $859.33 billion. Over the past 24 hours, the price has seen a small increase of 0.45%. On several timeframes, Bitcoin’s price is showing a strong upward trend and forming a bullish pattern.

Recently, the price broke through the $40,000 barrier and gained for five consecutive sessions. This demonstrates the strength and confidence of buyers, along with the involvement of major investors.

The buying volume is also steadily increasing, positively impacting the price. If the current momentum continues and buyers can break through the $45,187 hurdle, further upward potential exists.

With the Fear and Greed Index indicating extreme greed, Bitcoin is inching towards the $45,000 mark. Both regular traders and analysts are closely observing its momentum.

For a thorough analysis of Bitcoin price predictions, check out the video above, and subscribe to his YouTube channel for additional crypto-related content. Jacob Crypto Bury also runs a Discord community with 17,000 members, providing trading tips and insights into upcoming crypto presales.

Conclusion

Should Bitcoin secure approval for ETFs and mirror a rally similar to the least dramatic post-halving surge of 122% after reaching $50K, there’s potential for it to hit or even surpass $110,000 by the close of 2024.

Although these projections are cautious, the growing momentum around Bitcoin suggests that the $100,000 milestone might be attained even earlier. The cryptocurrency market is poised on the brink of anticipation, awaiting the SEC’s decision.

The approval of a spot Bitcoin ETF could mark a revolutionary phase for Bitcoin and the broader cryptocurrency landscape, potentially triggering a surge in institutional adoption and investment.

On the other hand, a negative decision particularly one that classifies Bitcoin as a security, could create disruptions in the market, challenging Bitcoin’s resilience and putting its upward momentum at risk.

Related

- Bitcoin Price Prediction: BTC Defies ECB’s ”Last Gasp” Prediction As It Flirts With $45K, But Investors Flock To This BTC Altcoin To Play The Next Crypto Bull Run

- Bitcoin Price Prediction: BTC Touches $45K As This Bitcoin ETF-Themed Coin Closes On $3 Million

- BTC Price Set To Soar Past $50K As Crypto Traders Flock To Bitcoin ETF Token Following Bumper $2.5 Million Fundraising

- Bitcoin Price Prediction: With BTC Exploding To 20-Month High, Could This ETF-Linked Presale Coin Make You A Millionaire?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage