Join Our Telegram channel to stay up to date on breaking news coverage

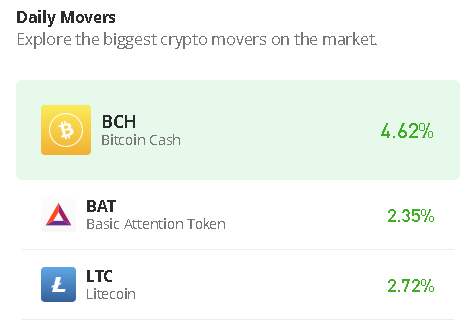

The Bitcoin Cash price prediction is currently facing a serious decline in value of 1.27% after being rejected at a $366 resistance level.

Bitcoin Cash Prediction Statistics Data:

- Bitcoin Cash price now – $250.1

- Bitcoin Cash market cap – $4.86 billion

- Bitcoin Cash circulating supply – 19.4 billion

- Bitcoin Cash total supply – 19.4 billion

- Bitcoin Cash Coinmarketcap ranking – #15

BCH/USD Market

Key Levels:

Resistance levels: $370, $380, $390

Support levels: $150, $140, $130

BCH/USD is likely to follow the sideways movement as the coin moves to cross the 9-day and 21-day moving averages. Looking at the daily chart, Bitcoin Cash (BCH) shows that the price is still moving within the channel, though the price may need to retreat a little bit before heading to the upside.

Bitcoin Cash Price Prediction: BCH May Face the Downtrend

The Bitcoin Cash price remains within the 9-day and 21-day moving averages, therefore, should buyers manage to power the market; they may likely find resistance levels of $370, $380, and $390. Nevertheless, bulls need to reclaim the resistance level of $259 to begin an upward movement.

However, if the market experience more drops, it could hit the nearest support at $245 and a further drop toward the lower boundary of the channel could pull the market to the support levels of $150, $140, and $130 respectively. Therefore, the technical indicator Relative Strength Index (14) is moving above the 50-level, indicating more bearish signals in the nearest term.

Against Bitcoin, the Bitcoin Cash price is likely to follow the downtrend if the coin crosses below the 9-day and 21-day moving averages. Meanwhile, the Bitcoin Cash bears are likely to drag the price below the moving averages, any further bearish movement could take the coin to the support level of 470 SAT and below.

Looking at the technical indicator, the Relative Strength Index (14) on the daily chart, it appears that bears are likely to put pressure on the bulls as the signal prepares to cross below the 60-level. Therefore, if the bulls can regroup and halt the downward movement, the Bitcoin Cash price may begin an uptrend and head toward the upper boundary of the channel to reach the resistance level of 1250 SAT and above.

Alternatives to Bitcoin Cash

The Bitcoin Cash price is likely to cross above the 9-day and 21-day moving averages at around $250. Meanwhile, if the price continues to create a bullish movement, traders can then expect a bullish continuation toward the upside. However, as the technical indicator, Relative Strength Index (14) remains above the 50-level, and the Bitcoin Cash price could head toward the upper boundary of the channel.

Nevertheless, the Wall Street Memes token is a fully community-driven project. It highlights its commitment to user adoption through its community-first tokenomics. However, the entire WSM token supply is available for investors, with no separate allocation to teams or private sales. The token has already raised almost $19m in the ongoing presale.

Read more:

New OKX Listing - Wall Street Memes

- Established Community of Stocks & Crypto Traders

- Featured on Cointelegraph, CoinMarketCap, Yahoo Finance

- Rated Best Crypto to Buy Now In Meme Coin Sector

- Team Behind OpenSea NFT Collection - Wall St Bulls

- Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage