Join Our Telegram channel to stay up to date on breaking news coverage

BCH Price Prediction – November 30

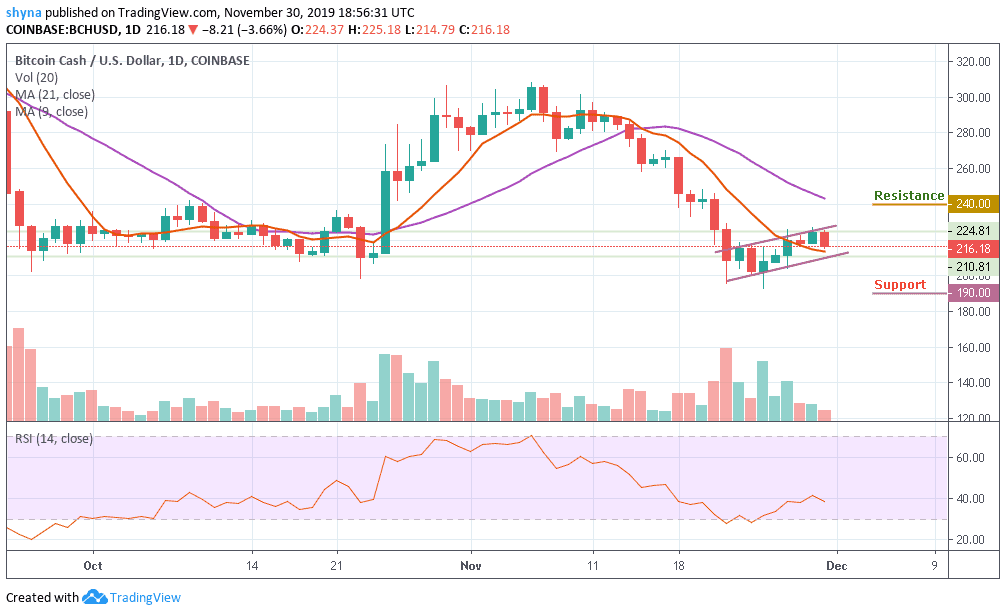

Bitcoin Cash extended the bullish action above $223 but declines swept in pushing back under $220.

BCH/USD Market

Key Levels:

Resistance levels: $240, $250, $260

Support levels: $190, $180, $170

Since BCH/USD couldn’t break out of the ascending channel and move towards the 21-day moving average today, the price has had a bearish inclination and became an uphill task to sustain the gains above the critical $225 due to the renewed bearish momentum emanating from the rejection around $224. Bitcoin Cash (BCH) price has been down by 19.39% over the last few months, and the value has now fallen to as low as $216 from $225.

Furthermore, looking at the chart, we can easily observe that BCH/USD is changing hands at $216 and if the market price drops further and move below the 9-day moving average by breaking down the lower boundary of the channel. More so, a break below the ascending channel is likely to produce a huge red candle to the downside, marking supports at $190, $180, $170 levels and below.

Meanwhile, a strong buying pressure may take the price back to the resistance level of $225. While trading at $230, a bullish step back is likely to roll the market to the resistance levels of $240, $250 and $260, establishing a new high for the market. In other words, the RSI (14) is moving below level 40, indicating more bearish signals may come to play out.

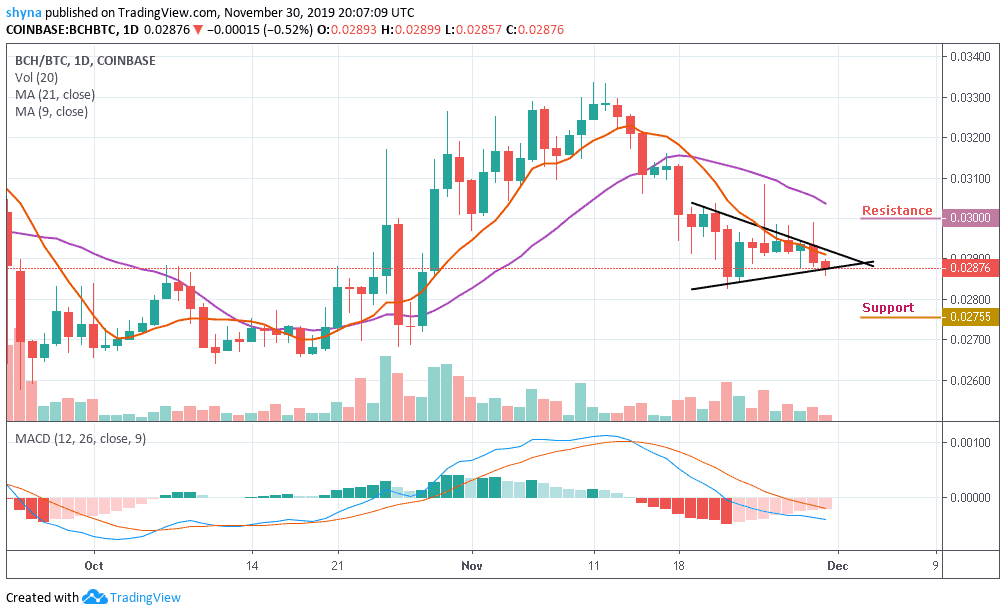

Looking at the daily chart while comparing it with BTC, we can observe that the traders are yet to show a strong commitment to buying in the market. Meanwhile, in as much as the bulls turn strong now, we may expect the market to roll back to the 0.0300 BTC and 0.0305 BTC resistance levels.

However, the 0.0275 BTC and 0.0270 BTC levels may likely produce support for the market should in case the buyers failed to push the price to the north. Whichever way, the BCH/BTC pair continues to remain in a downward range while the MACD signal lines are already crossing to the negative side.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage