Join Our Telegram channel to stay up to date on breaking news coverage

BCH Price Prediction – May 18

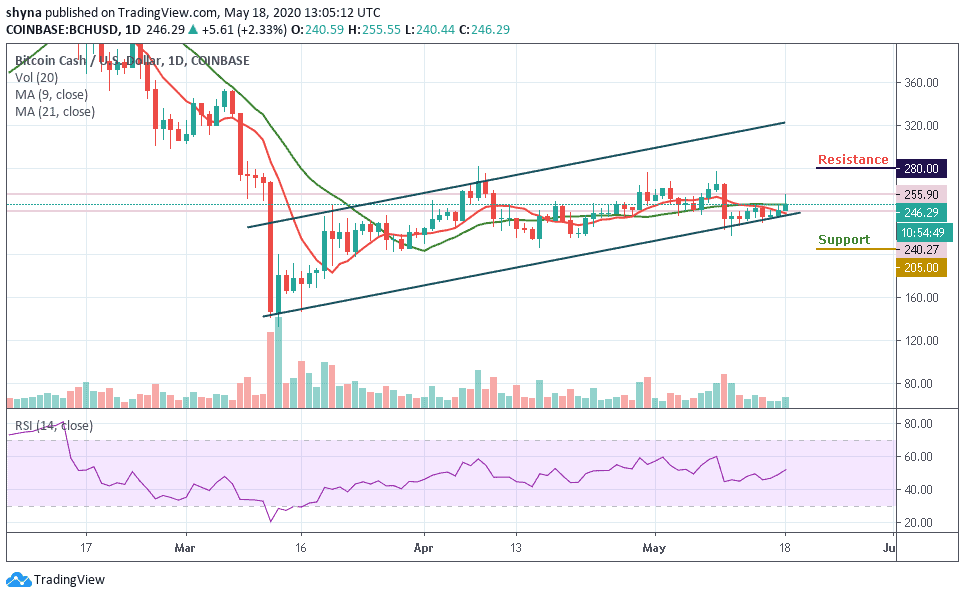

Bitcoin Cash buyers defend $240 support, which results in a shallow recovery above $245.

BCH/USD Market

Key Levels:

Resistance levels: $280, $300, $320

Support levels: $205, $185, $165

BCH/USD is still positive but it looks like it lacks enough momentum to hit 260. Following the recent price, Bitcoin Cash faces a potential resistance at $255 level above the 9-day and 21-day moving averages. A break above this is likely to produce a huge green candle to the upside, marking resistances at $255 and $265 levels.

On the other hand, peradventure the market drives below the channel, the BCH price may likely slump to the initial support at $220, which may later bring the price to its critical supports at $205, $1858 and $165. But presently, the signal line of RSI (14) faces the north and this could increase the buying pressure as the price may cross above the 9-day and 21-day moving averages to reach the resistance levels of $280, $300 and $320.

In other words, over the past few days, the Bitcoin Cash price range has continued to support the market, against selling pressure. However, if Bitcoin Cash returns to the old support and break-even, bears could take over the market. But as it stands, the bulls are coming up. Therefore, traders can always expect a bullish chase before another reversal occurs.

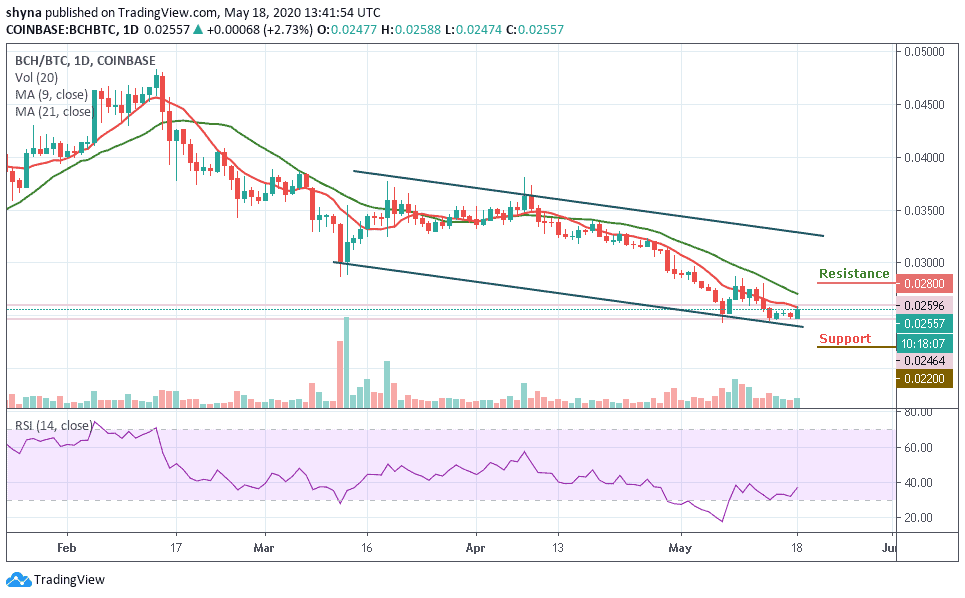

Meanwhile, against BTC, the daily chart reveals that the bulls are showing a great commitment to BCH trading. Therefore, they are following the recent positive sign that started today; the trend may continue to go up if the buyers can sustain the pressure further. However, if the bulls succeeded in breaking above the 9-day and 21-day moving averages, the market price may reach the next resistance level of 0.028 BTC and 0.030 BTC.

In other words, a retest could allow the pair to go below the lower boundary of the channel and lower the price to 0.022 BTC and 0.024 BTC support levels. With the look of things, the RSI (14) is moving towards the 40-level which could boost the bullish movement.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage