Join Our Telegram channel to stay up to date on breaking news coverage

BCH Price Prediction – March 9

Bitcoin Cash struggles to stay above $285 as bears call for $270. The coin is likely to settle in consolidation around $275 for the short term.

BCH/USD Market

Key Levels:

Resistance levels: $370, $390, $410

Support levels: $195, $175, $155

At the time of writing, BCH/USD is pushing for consolidation around $270 but the trend has a bearish inclination, which may likely test the support at $230 as it moves below the 9-day and 21-day moving averages. More so, the technical indicator has remained bearish as the MACD continues to dig deeper in the negative region while the bearish divergence reflects the influence the sellers have over the price.

Moreover, the best the bulls can do is defending the support at $300 and focus on pulling towards $350. At the weekend, the Bitcoin Cash lost balance alongside other cryptos and the sharp drop affected the buyers from an attempted recovery above $350. However, losses became unstoppable with BCH/USD which is unable to find balance at multiple support areas including $330, $300 and $270. The bearish leg extended towards $250 but a low formed at $260, giving the buyers a chance to enter the market.

However, BCH/USD is making an effort to jump above $270 and it is also looking forward to reclaiming the ground past $280. The coin is already at the negative side and therefore a reflex bullish action is expected to correct the declines with a possible jump above $300. Meanwhile, if there is an increase in buying pressure, the price may break out of the ascending channel to reach the $350 resistance. While trading at that level, a bullish continuation could reach the resistance levels of $370, $390 and $410 respectively.

In other words, a minimum swing may likely push the market to a $250 level of support. Exceeding this level could take the bears to $195, $175 and $155 levels by crossing the lower boundary of the channel.

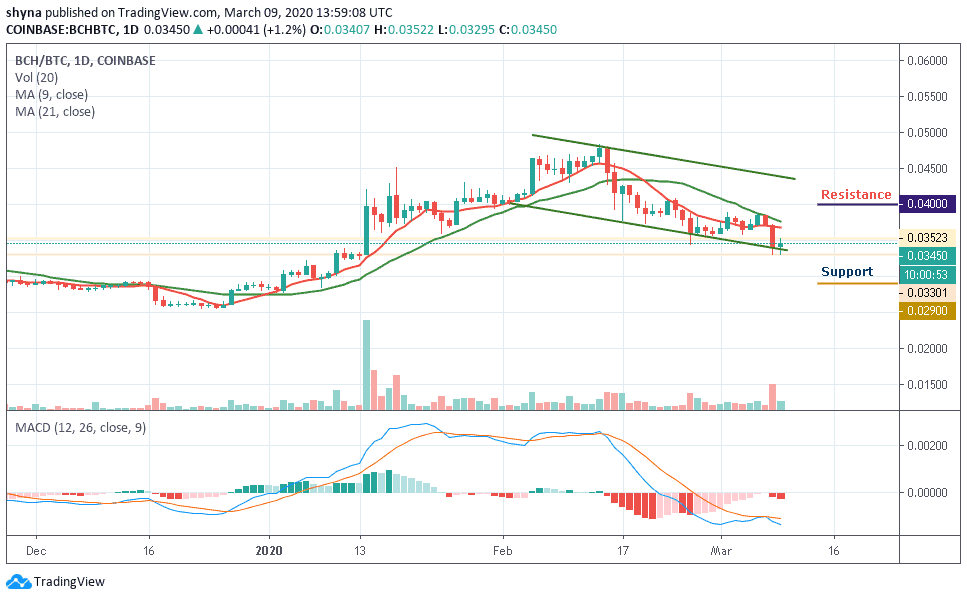

As revealed in the daily chart, against BTC, the bears are still showing more commitment to BCH trading. Following the recent negative sign, the trend may continue to follow the downtrend in as much as the buyers failed to push the price above the 9-day and 21-day moving averages.

However, as the signal lines of MACD are hovering within the negative side, once it moves out of this zone, the market price may likely begin an upward trend to touch the resistance level of 0.040 BTC and 0.042 BTC but a retest could lower the price to 0.029 BTC and 0.027 BTC support levels.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage