Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – September 24, 2020

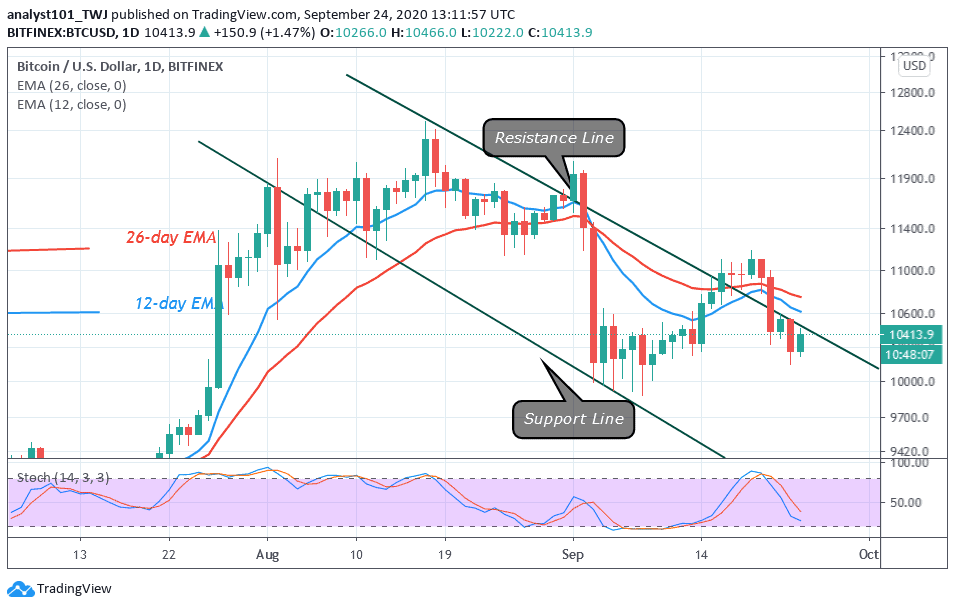

Bitcoin makes a gradual downward move. On September 21, the coin drops to $10,321 Low. It corrected upward and reached a high of $10,600. After retesting the recent high, it dropped to $10,152 low. In a nutshell, Bitcoin is making lower highs and Lower Lows.

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

Following the rejection at the $11,000 resistance, the selling pressure is ongoing. Yesterday, BTC/USD dropped to $10,152 and it corrected upward. After the breakdown on September 21, the BTC price has been falling in a bearish pattern. The price is rising to retest or break the $10,400 or $10,500 high. The coin will revisit the previous low at $9,800 if the current move faces rejection at the recent high.

Eventually, if the $9,800 is breached, the downtrend will resume. The crypto will fall and reach another low of $9,300. Conversely, if the price falls to the previous low and rebounds, it is a signal of a bullish resumption. Meanwhile, BTC is below the 50% range of the daily stochastic. It indicates that the coin is in a bearish momentum.

Institutional Investors Intend to Buy the Dip on Every Bitcoin Price

A crypto asset insurance company, Evertas, surveyed 50 institutional investors who are keen to invest in Bitcoin. The participants believe that regulations for the crypto market will improve and become clearer in the future. Also, they believe that the market will eventually become bigger, providing better liquidity, a quality that most institutional investors require.

The survey has it that the institutional investors plan to extensively increase their stakes in Bitcoin and other digital assets in the future. The survey is on investors who manage over $78 billion in assets across the United States and the United Kingdom. A standout response has it that 26% of participants believe that pension funds, insurers, family offices, and sovereign wealth funds have indicated to raise their stakes in crypto currency.

In the same vein, 32% of people believe hedge funds will augment their crypto holdings considerably. The survey found out that there are obstacles in the road to crypto services. Many participants are worried about the lack of insurance for digital assets, while others are concerned about the quality of custodial services, trading desks, reporting facilities, and the procedures of other companies working in the sector.

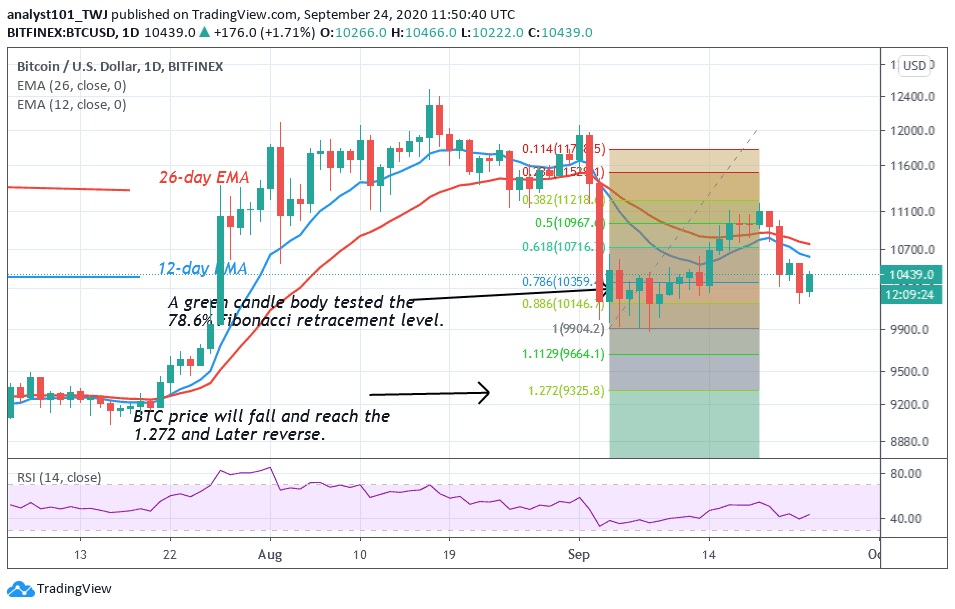

Meanwhile, Bitcoin is fluctuating above the $10,000 support. Yesterday, it reached a low of $10,100 before moving up. The Fibonacci tool analysis will hold if the price breaks the support level. On the September 3 downtrend, the retraced candle body tested the 78.6% Fibonacci extension level. It indicates that Bitcoin will fall and reach the 1.272 Fibonacci extension or $9,325.80 low.

Join Our Telegram channel to stay up to date on breaking news coverage