Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – October 24, 2020

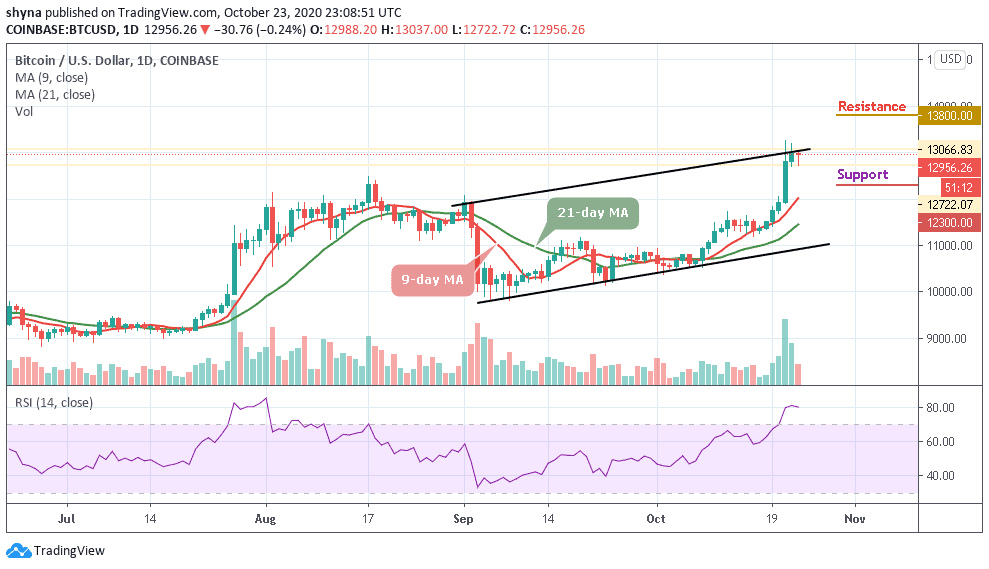

On October 21, Bitcoin price rallied to a $13,200 high. For the past four days, the king coin has been fluctuating between $12,800 and $13,200. The current uptrend will resume, once the resistance at $13,200 is breached.

Resistance Levels: $13,000, $14,000, $15,000

Support Levels: $7,000, $6,000, $5,000

In the previous uptrend, BTC/USD price broke the critical resistance levels of $12,000 and $12,460 as Bitcoin resumed an uptrend. In August, BTC failed to break these levels as the coin crashed to the $10,000 psychological support level. After breaking the resistance levels, BTC price rallied to a $13,200 high. For the past four days, the coin has been in a sideways move below the recent high.

In other words, the BTC price is fluctuating between $12,800 and $13,200 in a tight range. If price continues fluctuation in the current price range, BTC will encounter a breakout or breakdown. A breakout above $13,200 will push Bitcoin to $14,000 high. However, a breakdown will plunge BTC to a $12,200 low. The king coin is above 80% range above the daily stochastic. It indicates that the coin is in the overbought region of the market. However, in a trending market, the overbought conditions may not hold.

Microstrategy, CEO, Michael Saylor Intends to Hold Bitcoin for ‘100 Years’

Michael Saylor, CEO, the Microstrategy has decided to hold his Bitcoin for 100 years. Because of this, on Aug. 11, the firm announced that it has bought 21,454 BTC for $250 million. This investment is now valued at more than $278 million, which represents an increase of 11% in two months. Michael Saylor said he will hold his company’s Bitcoin and has no intention of selling it. He describes it as “the world’s best collateral.” According to him, the decision to invest $250 million was informed by a discussion between its board of directors and the firm’s investors, auditor, and executives.

He said: “This is not a speculation, nor a hedge. It is a deliberate corporate strategy to adopt the Bitcoin Standard.” According to reports, the company restructured its treasury in response to recent global economic uncertainty. Mr. Saylor decided to invest in Bitcoin after considering various options. He said: “ Tax and fees kill almost all other assets, he concluded, and those that aren’t killed are instead crippled because they are controlled by a CEO, government or country ”.

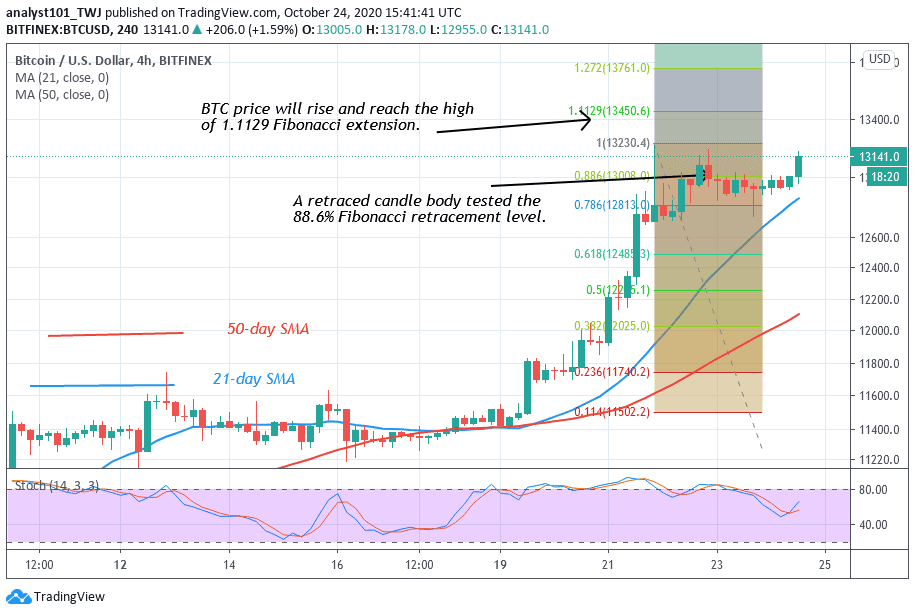

Meanwhile, BTC has resumed an upward move to break the resistance at $13,200. In the same vein, on October 22 uptrend the retraced candle body tested the 88.6% Fibonacci retracement level. This gives the impression that Bitcoin will rise and reach level 1.1129 Fibonacci extension. That is BTC will reach another high of $13,450.60.

Join Our Telegram channel to stay up to date on breaking news coverage