Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has been sending mixed signals lately, reaching the highest and lowest point this week within only a few hours.

The coin’s price sank to the lowest point in over a month on August 1, reaching $28.8k. Less than 12 hours later, on early August 2, the price was back at $30k.

Since then, Bitcoin saw another correction which was briefly stopped by support at $29.5k, only for it to continue as the day progressed.

By the end of August 2, Bitcoin was back at $29k, despite the investors’ hopes that it would stay at $29.5k.

In the last 12 hours, Bitcoin has seen smaller fluctuations that made its price go between $29k and $29.1k, but so far, the support level could hold. In the last 24h, the coin has seen a 1.35% drop in total, leaving its value at $29,135.

According to analysts, the coin’s hourly chart is showing bullish swings, and there has been excess demand due to the decline of inflation.

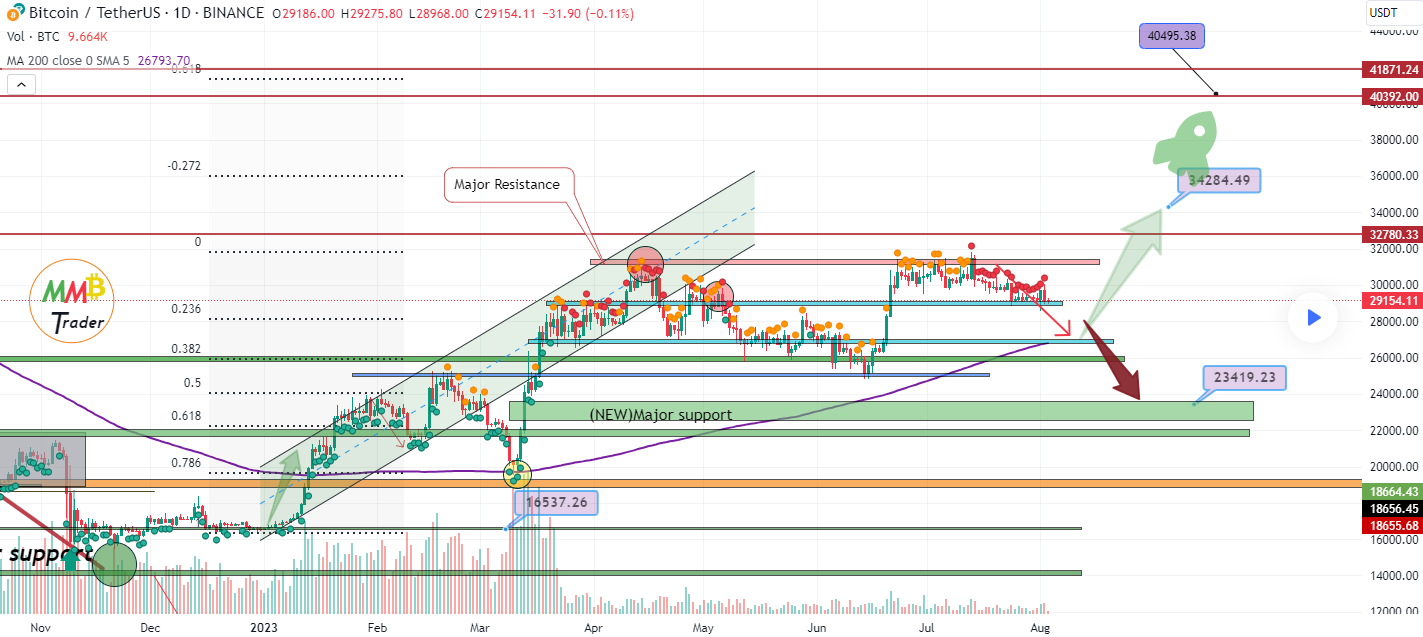

Some still expect a heavy dump to follow and send the coin to new major support at $23,419. While this would mean massive losses, it would also open up a new opportunity for the coin to grow moving forward.

At this time, Bitcoin is still primarily engaged in sideways trading, and investors are expecting a significant move at any moment, likely a bearish one.

MicroStrategy is After as Much Bitcoin as it can Get

Despite negative expectations regarding Bitcoin’s price in the short term, MicroStrategy’s Chairman Michael Saylor believes this is the right time to purchase as much BTC as the market allows.

He disclosed that the company currently holds almost 153,000 BTC, with nearly 500 of those purchased between June 30 and August 3. The firm said that it is accumulating Bitcoin on behalf of shareholders, with the strategy including cash flows, equity, and debt issuances occasionally.

Bloomberg says Odds of Bitcoin Spot ETF Approval have Grown

One thing that would be able to disrupt the current Bitcoin price predictions significantly is believed to be the approval of a Bitcoin ETF. However, after the US SEC spent the last year rejecting applications, many are skeptical about finally getting a green light.

Still, Bloomberg’s recent ETF analysis says that the odds of getting an ETF approved have increased from 50% to 65% in light of “recent events and new information,” as the publication said.

Based on recent events and new information @ericbalchunas and I are officially increasing our spot #Bitcoin ETF approval odds to 65%. That's from 50% a couple weeks ago and 1% a few months ago. pic.twitter.com/VBLG8EYfoP

— James Seyffart (@JSeyff) August 2, 2023

The announcement came from Bloomberg analysts James Seyffart and Eric Balcunas, who said that the SEC chairman Gary Gensler has been downplaying his role at the agency.

They noted that the pressure from BlackRock, one of the largest Bitcoin ETF applicants, as well as the Democrats, could make another ETF rejection politically untenable for Gensleer.

Launchpad XYZ Presale Raises Over $1.2 Million

While the tensions surrounding Bitcoin continue to grow alongside the risk, investors are turning to more stable assets. Many are considering investments in new arrivals to the crypto market, such as Launchpad XYZ (LPX).

This new project aims to offer tools users need to succeed in Web3, from insight and learning to trading, strategy, and analytics.

The project’s presale raised over $1.2 million, offering its token for $0.0445 per LPX. Interested users can purchase LPX with ETH, USDT, BNB, or credit card.

Related

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage