Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – February 15, 2021

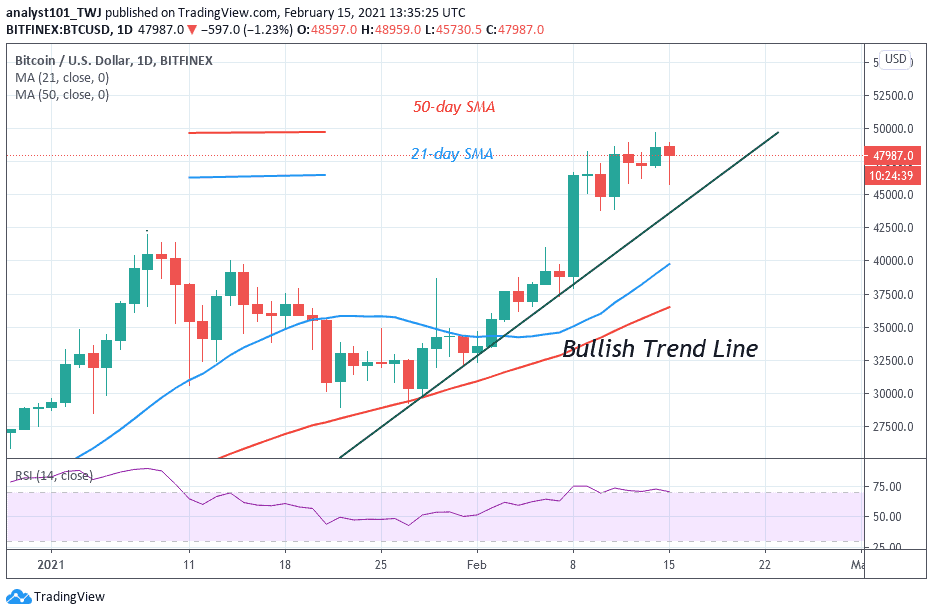

Yesterday, BTC/USD attained its peak price as it reached a high of $49,695. Soon after the attainment of the new price level, BTC was repelled. The king coin dropped to $45,730.50 low. As usual, the bulls buy the dips as price corrected upward. The bottom line is that Bitcoin bulls are yet to break the $48,000 resistance level, convincingly. Consequently, Bitcoin has been fluctuating between $44,000 and $48,000 since February 9.

Resistance Levels: $48,000, $49,000, $50,000

Support Levels: $35,000, $34,000, $33,000

Today, the Bitcoin price dropped to $45,730 after rejection from the peak price of $49,695. Since February 9, Bitcoin bulls failed to break the $48,000 overhead resistance. Instead, BTC price fluctuated between $44,000 and $48,000 price levels. Buyers have retested the $48,000 resistance thrice but unable to push above it. Consequently, BTC price will slump to the $44,000 low, each time it faces rejection from the recent high. The bulls have the advantage over the bears to break the current resistance level. On the upside, if the bulls break the resistance at $48,000, the bullish momentum will extend to the $50,000 high. Bitcoin will rally to the next psychological price level once it breaks the $50,000 high. Conversely, if the bears break the $44, 000 support level, the king coin will resume a downward move.

Bitcoin Price Rebounds as Morgan Stanley Considers Buying BTC

Morgan Stanley is one of the biggest investment banks in the United States of America. Reports have it that the bank is considering investing in Bitcoin. Morgan Stanley’s Counterpoint Global considering Bitcoin as an investment for two main reasons. Firstly, Morgan Stanley is a top financial institution in the U.S., and its influence in the banking sector is immense. Second, the bank has boosted its holdings in MicroStrategy, which has accumulated over a billion dollars in Bitcoin.

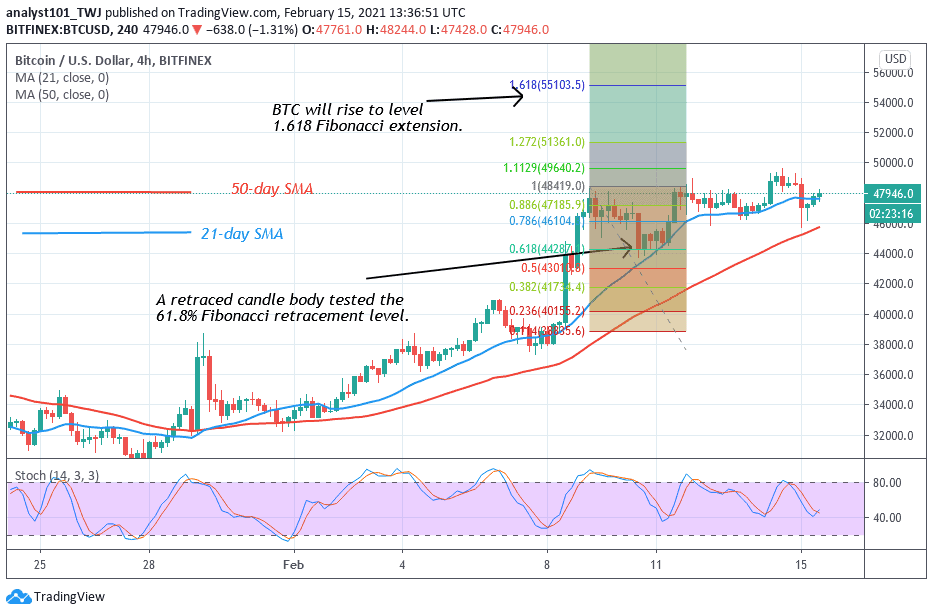

Meanwhile, Bitcoin has continued its fluctuation below $48,000. According to February 9 uptrend; a retraced candle body tested the 61.8% Fibonacci retracement level. The retracement indicates that Bitcoin will rise to level 1.618 Fibonacci extension or the high of $55,102.50.

Join Our Telegram channel to stay up to date on breaking news coverage