Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – March 4, 2021

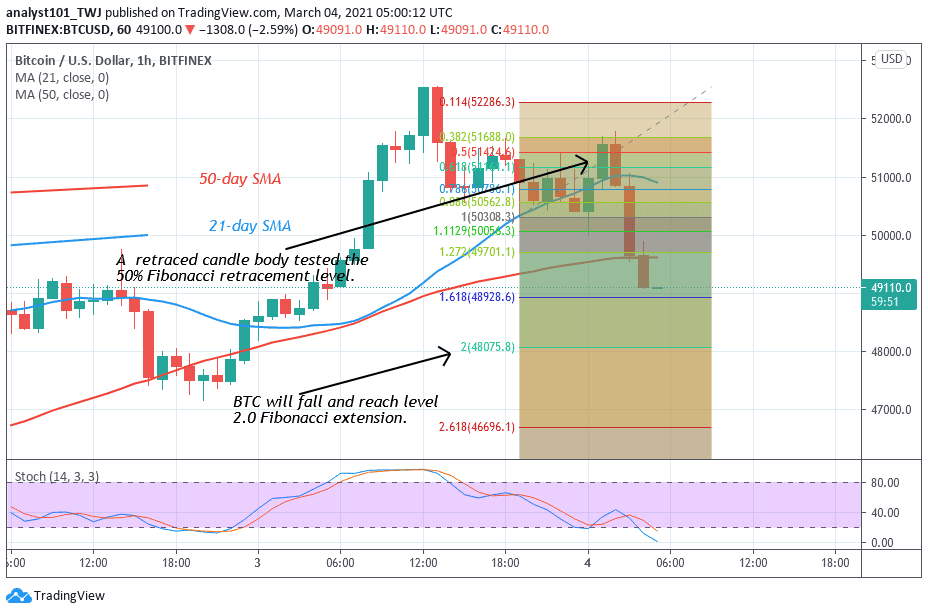

Bitcoin bulls fail to sustain above the $52,000 resistance level. Consequently, BTC/USD price is falling but the bulls are struggling to sustain the price above the psychological price level. Presently, sellers have shorted below the $51,000 and $52,000 resistance zones.

Resistance Levels: $58,000, $59,000, $60,000

Support Levels: $40,000, $39,000, $38,000

Following the breakout above the psychological price level on March 3, the bulls failed to sustain the price above the $52,000 resistance zone. Before now the bullish scenario is that if the bulls are successful above the $52,000 resistance level, the market will rally above the $58,000 overhead resistance. The bearish scenario that was earlier anticipated was that the BTC price will fall or the price will be range-bound between $44,000 and $52,000. Bitcoin is falling as bears threaten to break the $50,000 support. The bottom line is that if the bears break the $50,000 support, Bitcoin will further decline to $48,000 support. Meanwhile, Bitcoin is trading at $49,327 at the time of writing.

1 in 5 Investors Don’t Trade in Crypto but Are Likely in Future, by JP Morgan

A survey of more than 3,400 investors representing 1,500 institutions has been carried out by JP Morgan. It was discovered that 11% of respondents that work at firms trade or invest in crypto, while 89% do not. The other firms that don’t trade in cryptocurrency are likely to do so in the future. These include 22% of respondents from firms that do not trade or invest in crypto. Meanwhile, a good number of institutional investors lack faith in cryptocurrency. Out of the survey carried out,14% answered that it’s “probably rat position squared” and something to avoid, while 21% believe crypto is just a temporary fad. Just 7% of investors think it “will become one of the most important assets.” Nevertheless, some analysts believe that sustained institutional buying will keep the BTC price up to $50,000.

Meanwhile, Bitcoin is retracing after failing to sustain above the $52,000 resistance level. On March 3 downtrend, a retraced candle body tested the 50% Fibonacci retracement level. The retracement indicates that Bitcoin will fall to level 2.0 Fibonacci extension. The retracement will reach this low and perhaps resume upward,

Join Our Telegram channel to stay up to date on breaking news coverage