Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – August 25, 2020

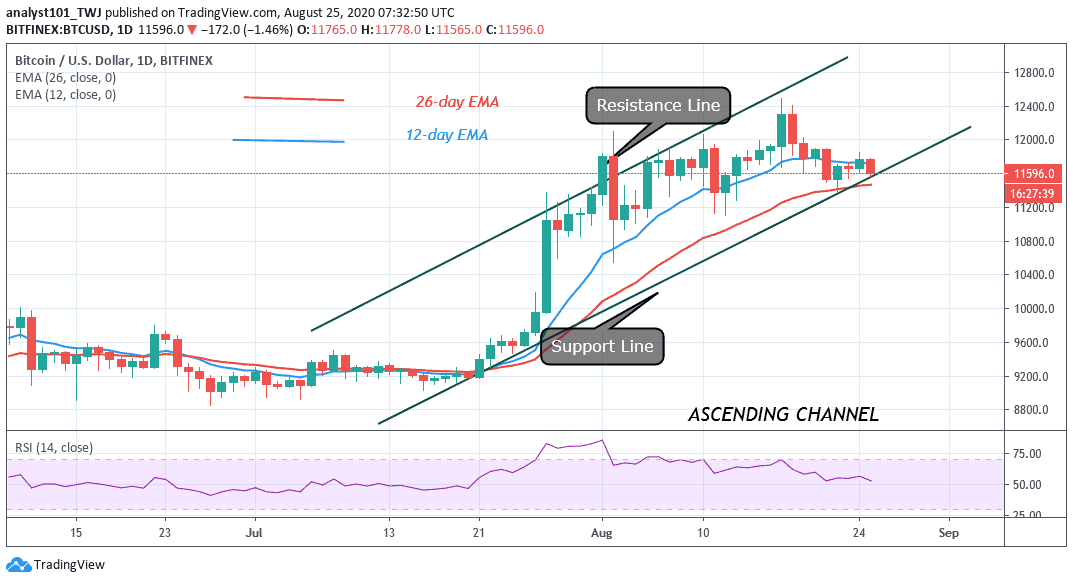

Yesterday, BTC retested the $11,800 resistance and was repelled. The price fell and it is approaching the low of $11,500 at the time of writing. For the past four days Bitcoin fluctuates between $11,400 and $11,800.

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

BTC/USD has been trading marginally for the past few days. Yesterday, a retest at the $11,800 resistance was not sufficient to break the resistance level. In previous price action, BTC rebounded above the $11,700 to break the current resistance. Bitcoin is falling and approaching the crucial support level at $11,400. The crucial support levels of $11,400 and $11,600 have been holding since the beginning of August.

Nevertheless, if BTC retraces to $11,400 and rebounds twice, the momentum will propel price to rally above $11,800. A rally above $11,800 will mean a greater task to break the overhead resistance. The bottom line is that BTC’s next target will be $13,000 high, if the bulls can push BTC above $12,000 and $12,400 resistances. However, sellers may not condone the breaking of the overhead resistance. Given that they will put up resistance at $12,000 high.

Bitcoin Volatility May Explode Before August Ending

According to analysts, some factors will contribute to a possible breakout at the end of August. One such factor is the presence of prolonged consolidation. For instance, after the downtrend on August 19, BTC has been consolidating between $11,400 and $11,800. A breakout will occur after price consolidates for an extended period without a clear direction. The second factor that can cause a spike in volatility is the upcoming expiration of BTC futures and options contracts. According to reports, the simultaneous expiration of August options and futures contracts could cause a large Bitcoin price movement.

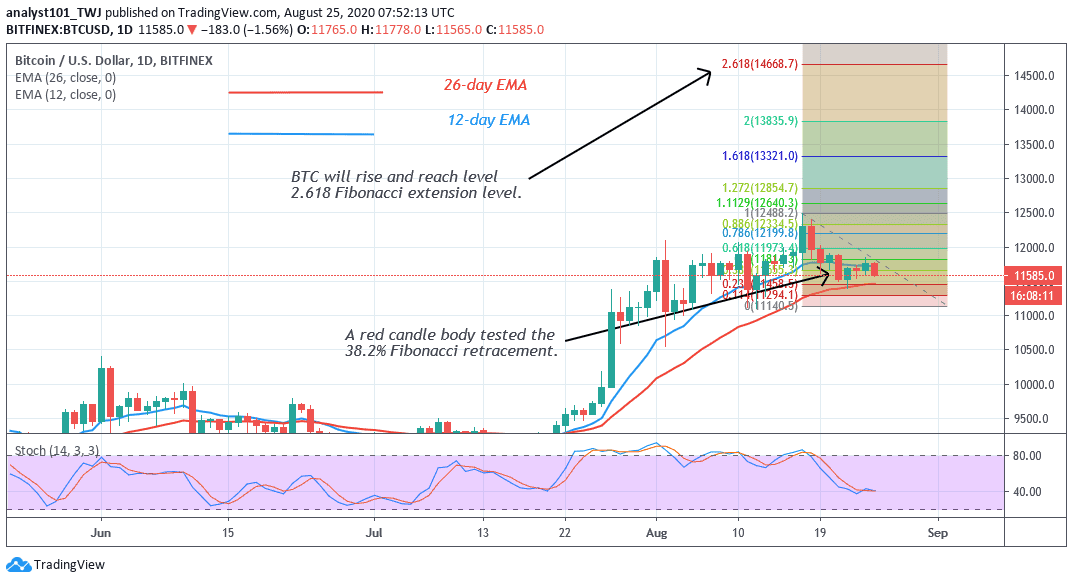

Nonetheless, after the downtrend, buyers have made the first retest at the $11,800 resistance. Meanwhile, in the August 17 uptrend, BTC was repelled at the $12,400 resistance. However, a bearish candle body tested the 38.2% Fibonacci retracement level. This indicates that BTC will rise and reach the 2.618 Fibonacci extension level. In other words, the market will reach $14,500 high.

Join Our Telegram channel to stay up to date on breaking news coverage