Join Our Telegram channel to stay up to date on breaking news coverage

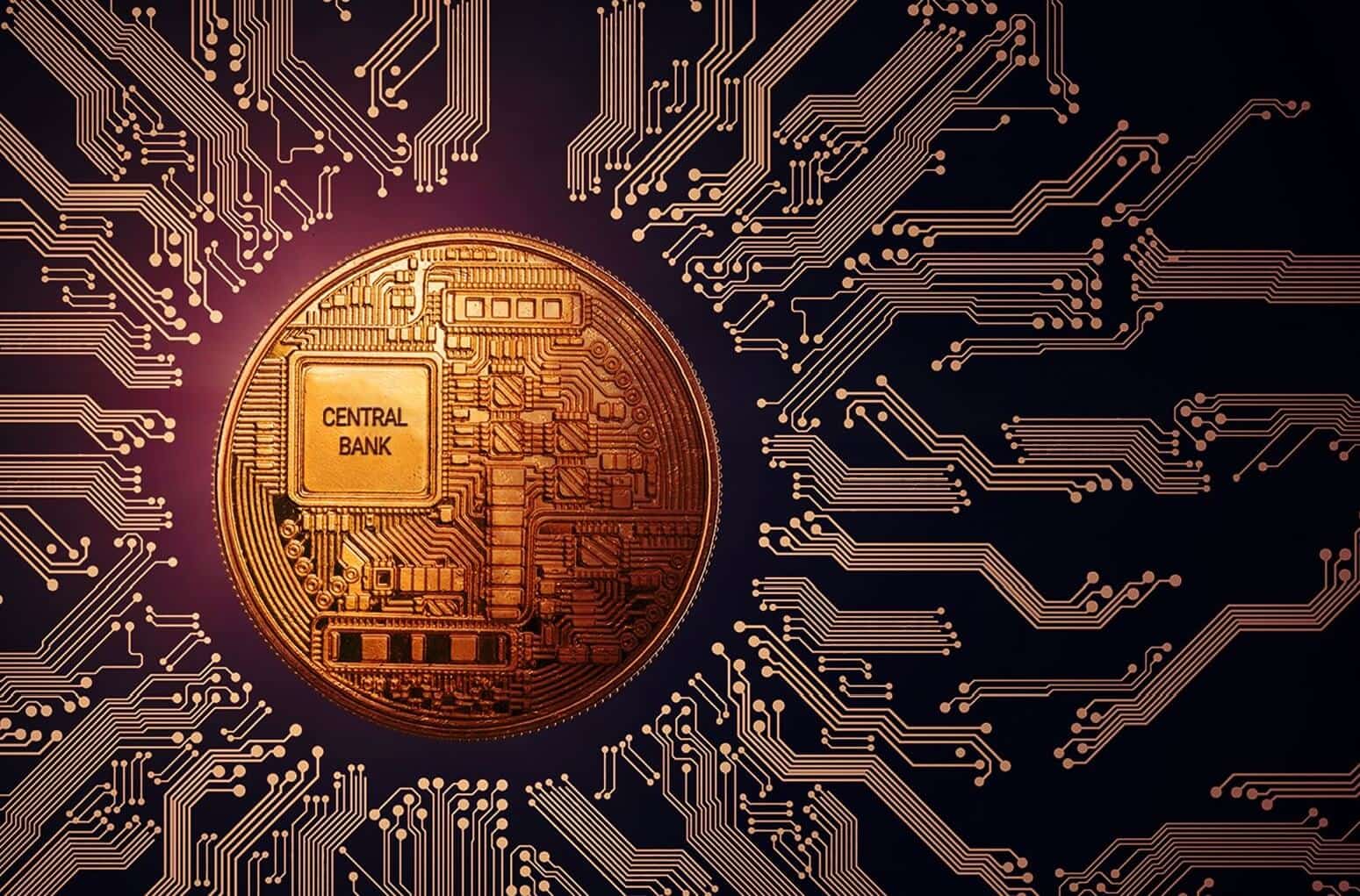

A new report from the Bank for International Settlements (BIS) published on January 23rd is pointing out a positive outlook on the issuance of digital currencies in developing economies.

CBDC survey result

The new report is based on a follow-up survey on the issuance of a central bank digital currency (CBDC). BIS talked to 66 banks in the 2019 study to discuss the possibility of a central bank backed currency in their economies. Last time, 56 central banks participated in the survey. It suggests that central banks are interested in digital currencies and are experimenting with new innovations in this field.

BIS broke down the results of the survey into emerging and advanced economies. It suggests that Emerging Market Economies (EMEs) are poised to move from the research phase to the public development phase. It states that the developing economies are

“driven by stronger motivations than those of advanced economy central banks. Central banks representing a fifth of the world’s population say they are likely to issue the first CBDCs in the next few years.”

What else does the report suggest?

According to the report, larger economies like the US or European Union countries are moving ahead in understanding the implications of digital money. It suggests that the developing economies are moving at a faster than expected pace when it comes to the development of digital money. Some of these economies have made intensive advancements but cryptocurrencies are still a niche payment sector.

The BIS is owned by 60 of the world’s largest central banks that control over 95% of the world’s total GDP. The organization promotes financial cooperation amongst the central banks of the world. Overall, the survey shows a clear tendency amongst developing economies to support their banknotes with digital currency.

However, no central banks suggest any significant development that would push digital currencies towards widespread public use. They are not being used for any domestic or international payments as of now. About 60% of the central banks suggest that they are thinking about the monetary impact of stablecoins.

Most EME central banks are planning to use digital currencies to reduce their dependence on cash. Advanced economies are trying to remove any issues that may prevent users from accessing central bank currency.

Join Our Telegram channel to stay up to date on breaking news coverage