Join Our Telegram channel to stay up to date on breaking news coverage

For several weeks, the Securities and Exchange Commission (SEC) has been embroiled in a dispute with Binance, the world’s largest cryptocurrency exchange.

Recently, the SEC filed a lawsuit against the exchange, raising concerns across various aspects of Binance’s operations. As a result, Binance has witnessed a significant decline in its spot trading volume.

#BINANCE , one of the world's largest #cryptocurrency exchanges, experienced a 70% decline in spot trading volume during the second quarter of this year#cryptomarket #Cryptocurency @binance pic.twitter.com/BSPiRG7w2Y

— Crypto Luster (@CryptoLstr) July 4, 2023

In addition, Judge Jackson dismissed the SEC’s request for a temporary restraining order against Binance.US during the legal proceedings. However, Binance has proactively taken measures, including submitting an application for deregistration as a crypto service provider in Cyprus and withdrawing its license application in Austria.

Insiders familiar with the situation have revealed that Binance has terminated the employment of 50 individuals amid the ongoing legal dispute. These anonymous sources disclosed that the affected staff members were part of Binance.US’ legal, risk, and compliance departments.

The SEC directed CZ’s platform and Binance to participate in a mediation meeting to address the imposed restrictions on the exchange.

The lawsuit filed by the SEC against Binance has also contributed to spreading fear, uncertainty, and doubt (FUD), which has consequently led to a decline in market prices. Furthermore, the SEC has sued Coinbase, the largest cryptocurrency player in the United States.

Lowest Spot Trading Volume Recorded

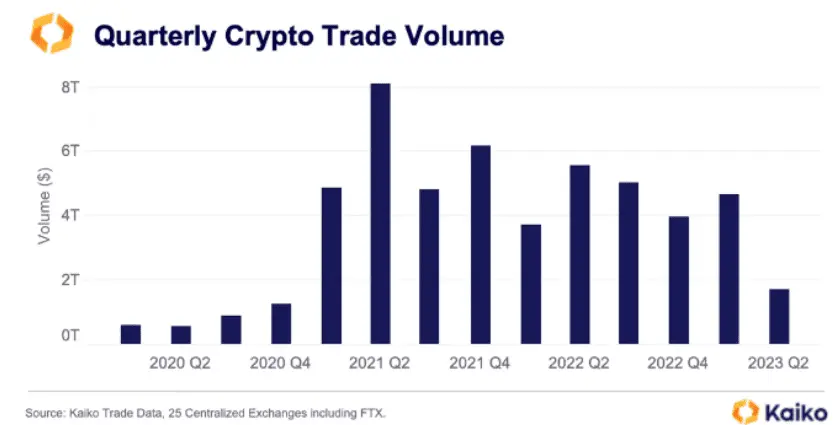

The ongoing lawsuit has resulted in a decline in spot trading volume for CZ’s exchange during the second quarter of 2023.

According to a recent research report from Kaiko, the leading cryptocurrency exchange has witnessed a substantial decline of 70% in its combined spot trading volume.

The data indicate that the volume has reached its lowest point, a level not observed since the fourth quarter of 2020.

Besides the unprecedented regulatory aggression, Binance’s (BNB) underperformance can also be attributed to the decision to reimpose fees on various bitcoin (BTC) trading pairs.

The situation has also affected not only Binance but also other exchanges.

The report emphasizes that Coinbase, Kraken, and OKX have also experienced a decline of over 50% in their spot trading volume.

The regulatory uncertainty prevailing in the United States could be one of the main factors contributing to this decline.

Simultaneously, trading momentum surged for the Spot Bitcoin ETF as excitement intensified over a prominent asset management firm’s potential introduction of a Spot Bitcoin ETF.

The ProShares Bitcoin Strategy (BITO) fund experienced a remarkable daily trading volume surpassing $500 million, marking the fifth occurrence of such a milestone in its operational history.

Related News

- SCORP Presale Heating Up: Is It Still the Right Time to Grab Your Share of Daily Passive Income?

- Founders of 3AC to Donate OPNX Future Earnings to Creditors

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage