Join Our Telegram channel to stay up to date on breaking news coverage

World’s largest cryptocurrency exchange Binance had transferred more than $400 million from Binance.US’s account at crypto-friendly California-based bank Silvergate Capital to Merit Peak Ltd, a trading company controlled by Binance CEO Changpeng Zhao, according to a Reuters report on Thursday that reviewed the quarterly banking records and company messages.

BREAKING: Binance is just like FTX. And will meet the same fate.

I hope all the "cryptobros" realize they were foreign agents and mafia patsies. https://t.co/J83pHx1xEy

— Eric Garland (@ericgarland) February 17, 2023

Based on the reports, the funds were transferred between January and March 2021 from a Silvergate account owned by Binance.US, the United States affiliate of Binance, registered under the name BAM Trading. Company messages show the transfers to Merit Peak started in late 2020. A person close to the matter has also indicated, “An unspecified portion of the money was subsequently sent to the Silvergate account of a Seychelles-incorporated firm called Key Vision Development Limited.”

In a 2021 corporate filing by another Binance unit, CEO Zhao was identified as the director of Key Vision, with a former Silvergate executive confirming that Key Vision held an account with Silvergate at the time.

Binance.US Representative: “Report Used Outdated Information”

According to the report, the reasons for the transfers could not be determined, as well as whether any of the funds originated from Binance.US customers, but specified that the global Binance exchange does have the authorization to operate in the U.S. At the time, the exchange’s public terms of use noted that its customers’ dollar deposits were held at Silvergate and Prime Trust LLC., a Nevada-based custodian firm.

The bank records show that during the same quarter, Prime Trust made $650 million in wire transfer deposits into the Binance.US account.

In a statement, however, a Binance.US representative Kimberly Soward told Reuters that the report used “outdated information” and failed to address the transfers directly. Soward also explained:

Merit Peak is neither trading nor providing any kind of services on the Binance.US platform.

According to the Binance.US spokesperson, “only Binance.US employees have access” to the bank accounts of the U.S. company. Nevertheless, she did not specify when Merit Peak’s activities ceased.

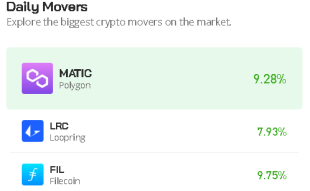

Consequently, Binance Coin (BNB-USD), the native token for the Binance ecosystem, experienced a downward pressure earlier in the week, with regulators taking jabs at Binance-branded stablecoin BUSD. Nevertheless, all the losses have since been recovered, with the broader crypto rally taking credit for the positive outlook.

Binance global exchange, Binance CEO Zhao, and Prime Trust are yet to respond to detailed questions concerning the transfers, but a Silvergate spokesperson has since come forward to say, “The bank does not comment on individual customers.”

Binance.US Executives Concerned

Messages reviewed by Reuters show that Binance.US executives find the outflow issue very concerning as they never knew the transfers were taking place. Catherine Coley, who was Binance.US CEO at the time, reached out to Binance finance executive Susan Li in an open letter in late 2020. In the write-up, she demanded an explanation for the transfers, describing them as “unexpected” and saying, “no one mentioned them.” Part of the message read:

Where are those funds coming from?

In her response, Li never explained the transfers, only noting that Merit Peak was a ‘vendor that facilitated trading” on Binance.US and had offered loans and capital injections to the American exchange. Notably, Coley exited Binance.US later in 2021. It is also worth mentioning that Li and several senior Binance.US employees had access to the Binance.US Silvergate account.

Binance Global Managing Binance.US Finances

The money transfers indicate that Binance global crypto exchange, which is not authorized to operate in the U.S., managed the finances of Binance.US despite claiming that the American organization is fully autonomous and operates as a “U.S. partner.”

Notably, the U.S. DOJ and SEC have reached out to Binance and Binance.US concerning their relationship as part of a continuing probe into what appears to be a “breach of financial rules.” The agencies also intend to determine whether Binance is using the American exchange as cover for operating in the U.S.

In a February statement, Binance.US CFO, Jasmine Lee, told the Wall Street Journal that “the extent of our relationship” with Binance.com is a shared name and a licensing agreement for technology, adding, “We do not transfer our funds back and forth.”

Read More:

- Crypto Meets Real Estate: Buy Property Has Never Been Simpler!

- New Lawsuit Accuses Silvergate Bank of Assisting SBF And FTX Fraud

- These Crypto Coins are Expected to Pump 55x by 2024

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage