Join Our Telegram channel to stay up to date on breaking news coverage

According to recent research, individuals from all around the world are allegedly using inside information to manipulate Binance’s billion-dollar security mechanisms.

Following the FTX scandal, Binance, the biggest cryptocurrency exchange in the world, has worked hard to be as secure and transparent as possible. However, recent reports suggest that some of its employees have apparently been engaging in unethical behavior to harm the company’s reputation.

An investigation by CNBC claims that Binance staff members and volunteers have helped Chinese consumers circumvent the exchange’s Know Your Customer controls (KYC).

Changpeng “CZ” Zhao, Co-founder and CEO of Binance, only announced last week through Twitter that the exchange would convert the last $1 billion of the money from its Industry Recovery Plan to “local crypto” due to “changes in stablecoins and banks.”

Binance’s KYC Norms being Flouted for Customers

CEO Zhao has praised the exchange’s KYC procedures, intended to deter users from using the platform, especially Chinese citizens. However, the latest CNBC story suggests that some Chinese users are allegedly manipulating Binance’s billion-dollar security system with the assistance of some exchange employees.

These alleged behaviors were observed in the over 220,000-strong Binance official Chinese language chat groups.

https://twitter.com/Usmanghazi55/status/1639331379551797253

Some of the methods that staff members and volunteers have discussed entail providing fraudulent information, such as forged bank documents or addresses. Others merely involve system manipulation on the part of Binance.

Hundreds of conversations from a Discord server and a Telegram channel run and managed by Binance were obtained, translated, and evaluated by CNBC. Anyone who joined and registered in the chatroom could view them for free. There were no access restrictions up until the end of March, which is how CNBC was able to examine texts from 2021 to 2023.

The messages CNBC analyzed were posted by users claiming to be either Angels or employees of Binance. They discussed methods in these communications for getting around Binance’s KYC, residency, and verification processes.

Workers, volunteers, and clients also distributed documentation and video tutorials. These demonstrated how mainland citizens might lie about where they lived in order to obtain a Binance debit card. Obtaining it would effectively convert their Binance cryptocurrency into a standard checking account.

According to a Binance hiring page, the training procedure for Chinese-speaking Angels at the company might last up to a year. They operate under the direction of Binance staff after being screened, trained, and distributed across the Telegram and Discord groups.

Reuters has previously covered how Binance gives its Angel cryptocurrency discounts in exchange for their labor. In a CNBC-reviewed interaction from October 2022, an Angel offered advice to a user who was having problems using the specific Binance webpages that were meant to function inside mainland China.

The user was instructed by Angel to try again after switching their VPN to a different area.

Why This is An Issue

Since 2017, both cryptocurrency exchanges and cryptocurrencies themselves have been forbidden in China. At the same time, the effectiveness of Binance’s anti-money-laundering initiatives is also called into doubt due to recent happenings. KYC and anti-money-laundering initiatives are crucial for global companies like Binance in ensuring that clients aren’t involved in unlawful behavior like terrorism or fraud.

Bloomberg stated that Binance had stopped allowing Chinese mobile phone numbers to sign up on the platform in 2021 after China outlawed bitcoin. Bloomberg was informed by the company that it has also blacklisted IP addresses from China.

Whats that? More fraud over at Binance dot com?

Say it ain't so.https://t.co/siTXOP9E03

— Bitfinex'ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) March 23, 2023

Yet, Chinese users have persisted in looking for ways to trade on Binance, including using guidance offered by staff members and volunteers. Some of these instructions make use of virtual private networks, or VPNs, which employ software to mask the user’s location and send messages across China’s internet censorship.

Financial regulation experts have expressed alarm over how readily Binance’s KYC and AML processes may be bypassed. Some are even concerned about how terrorists, criminals, money launderers, North Korean cyberterrorists, Russian billionaires, etc. might utilize this to gain access to this infrastructure.

In the meantime, Chinese authorities are moving forward with their ambitions to create the digital yuan, which will serve as their national currency. Recent adoption initiatives have cost millions of dollars. China undertook initiatives to increase awareness of the digital yuan (e-CNY) last month through a variety of commercial and government-sponsored events and government giveaways to promote its use.

What Next for Binance and KYC Regulations?

A spokesperson for Binance has noted in response, “We have taken action against employees who may have violated our internal policies, including wrongly soliciting or making recommendations that are not allowed or in line with our standards.”

“Binance employees are explicitly forbidden from suggesting or supporting users in circumventing their local laws and regulatory policies and would be immediately dismissed or audited if found to have violated those policies,” they added.

While CEO Zhao is typically most active on Twitter, where he addresses nearly every situation involving his exchange, he is yet to comment on the CNBC report.

We communicate more frequently during issues.

Trading halts are P0 all-hands-on-deck issues. All internal meetings cancelled, for 8000+ people. Single focus until full recovery.

My main job is tweeting, while listening in on the dev call. No filter or proof-reads. https://t.co/rm114qvXVr

— CZ 🔶 BNB (@cz_binance) March 24, 2023

CNBC has also shared a number of specific posts and messages in the course of asking Binance for comments on the accuracy of its report. After CNBC handed them to Binance, all such tweets and messages—including the one from the Binance employee sharing a tutorial—have been deleted.

Moreover, tweets alleging that Binance debit cards of some users had been frozen started appearing on Twitter hours after Binance reacted to CNBC.

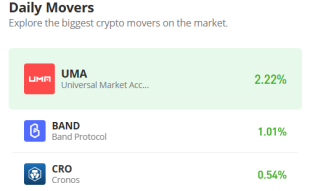

BNB, the exchange’s native coin, has also slowed recently. The digital asset has dropped 2.58% over the last week to trade at $321 as of this writing.

Related Articles

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage