Join Our Telegram channel to stay up to date on breaking news coverage

Binance, the world’s largest crypto exchange, is making changes to its futures structures as the company recovers from internal sabotage. Yesterday, the exchange’s Vice President of Futures, Aaron Gong, said on Twitter that an unnamed competitor had sabotaged its USDETH Perpetual Futures.

Closing Loopholes

As Gong’s tweet leads to belief, the attack could have happened earlier in the week. The executive explained that a trader had instigated the attack, although all parties appear to have lost eventually.

“It was caused by one trader, both ways. We believe this may be intentional sabotage from a competitor. The trader lost lots of money himself. But also caused other stop orders to trigger. We will make a few changes to reduce in the future.”

The exchange explained that I would change its stop order default to “Mark (index) Price,” instead of “Last Price.” They will also activate the Price Protection feature on all stop orders to ensure that stop orders trigger if Last Price and Mark Price figures differ significantly.

In addition, Binance will encourage more market makers, thus improving liquidity and deepening the order book. They believe that these measures will prevent a repeat of the attack.

A Tough Month for Binance

The attack on its futures market caps off what has been a torrid month for Binance, following the closure of its Jersey-based subsidiary, Binance Jersey.

Per reports, the company announced last week that it would shut down Binance Jersey, which it opened about two years ago as a means of expanding into the European markets. While it tried to make Binance Jersey a “major driving force” for crypto adoption in Europe, the subsidiary showed faltering statistics all through. The latest data from CoinMarketCap shows that its 24-hour trading volume hovered around $582,000. Trading pairs for BTC/GBP and BTC/EUR were $240,000 and $210,000 respectively.

All other trading pairs posted figures less than $100,000, while the Binance Coin – Binance’s in-house trading token – is entirely flat.

Binance confirmed that it would restrict all new deposits of EUR and GBP, as well as all supported digital assets, from October 30. The exchange will allow withdrawals and trading for all currencies and pairs until November 19, with the final platform shutdown is scheduled for November 30.

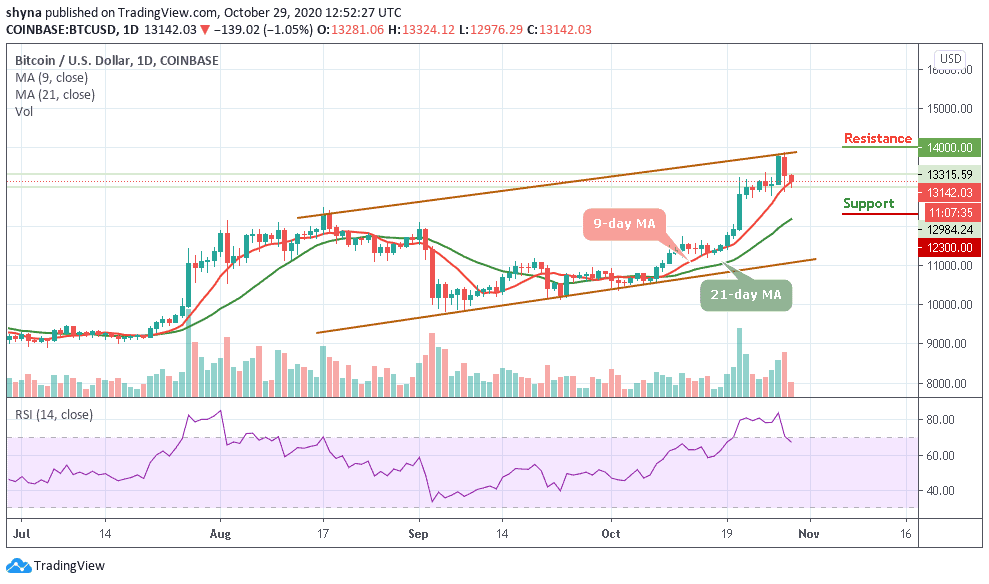

Binance also lost its #2 ranking in futures markets earlier this month, after the Chicago Mercantile Exchange (CME) Bitcoin futures market overtook it. On October 10, Skew Markets reported that the open interest on the CME Bitcoin futures market had risen sharply by 1,500 contracts. Since then, Bitcoin surged and hit a $13,000 value threshold.

Still, Binance can take solace in the fact that it has managed to break the Bitcoin futures duopoly that was held by OKEx and BitMEX. Both companies are currently facing down years as well, thanks to criminal investigations into BitMEX and a suspicious shutdown on OKEx. This has allowed companies like Binance, ByBit, and more to hold a larger market share.

Join Our Telegram channel to stay up to date on breaking news coverage