Join Our Telegram channel to stay up to date on breaking news coverage

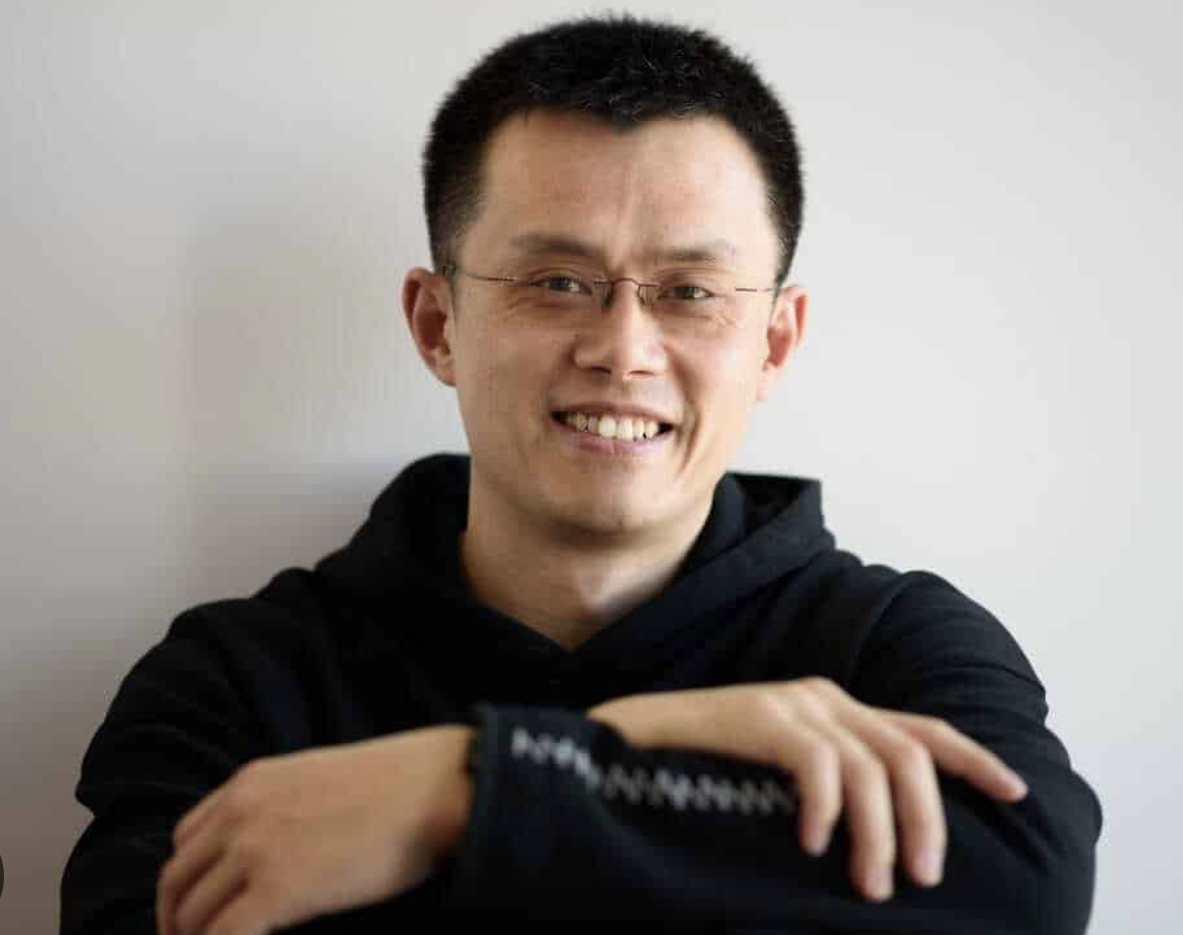

Binance, its subsidiaries, Chengpang Zhao, and Samuel Lim have filed a motion to dismiss CFTC’s case against the exchange.

Binance seeks a joint Motion to Dismiss the Complaint, filing a court order involving Foreign Binance Entities and Zhao.

In March 2023, the US Commodity Futures Trading Commission (CFTC) filed a complaint against Binance, accusing the exchange of violating the United States Commodity Exchange Act. The CFTC claimed that Binance deliberately disregarded the applicable provisions of the Act and used regulatory arbitrage to its advantage.

Motion to Dismiss More than 15 Pages

Binance has requested the court to remove the 15-page limit for its Motion of Dismiss in response to the CFTC’s complex complaint, as it requires making multiple arguments to support its case.

The top cryptocurrency exchange has requested an exemption due to Local Rule 7.1, which limits support or opposition to any motion to 15 pages unless prior court approval is granted.

The CFTC has filed 73 pages of charges.

What is CFTC’s issue with Binance?

The Commodities Futures Trading Commission has filed a civil enforcement action in the US District Court against Binance, Chengpang Zhao, and three Binance entities for multiple violations of the Commodities Exchange Act and CFTC regulations.

The CFTC, in its press release on March 27, 2023, announced its intent to pursue disgorgement, civil monetary penalties, permanent registration/trading bans, and a permanent injunction against Binance.

In a press release, CFTC’s Enforcement Division Principal Deputy Director and Chief Counsel, Gretchen Lowe, accused Binance of willfully evading US laws, claiming that the exchange’s compliance measures were a “sham” and it prioritized profits over regulations on multiple occasions.

Changpeng Zhao responded to the complaint, dismissing it as an “incomplete recitation of facts.”

CZ’s Response to the CFTC Complainthttps://t.co/iIoDR70IT9

— Binance (@binance) March 27, 2023

Highlights of CFTC’s Complaint

Binance was accused of bypassing compliance controls to offer services to US citizens, not enforcing KYC verification for customers, instructing VIP members on ways to evade regulations, and willfully evading CEA requirements.

Binance Also Tackling Charges From SEC and DOJ

The Securities and Exchange Commission has filed a lawsuit against Binance, accusing the leading exchange of operating a “Web of Deception” and facing over 13 charges.

In May 2023, Bloomberg reported that the exchange is facing charges from the US Department of Justice for violating Russia-related sanctions.

Related

- Binance Says SEC Made Delusive Statements on Exchange Assets

- The Binance.US and SEC Deal

- Binance Review

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage