Join Our Telegram channel to stay up to date on breaking news coverage

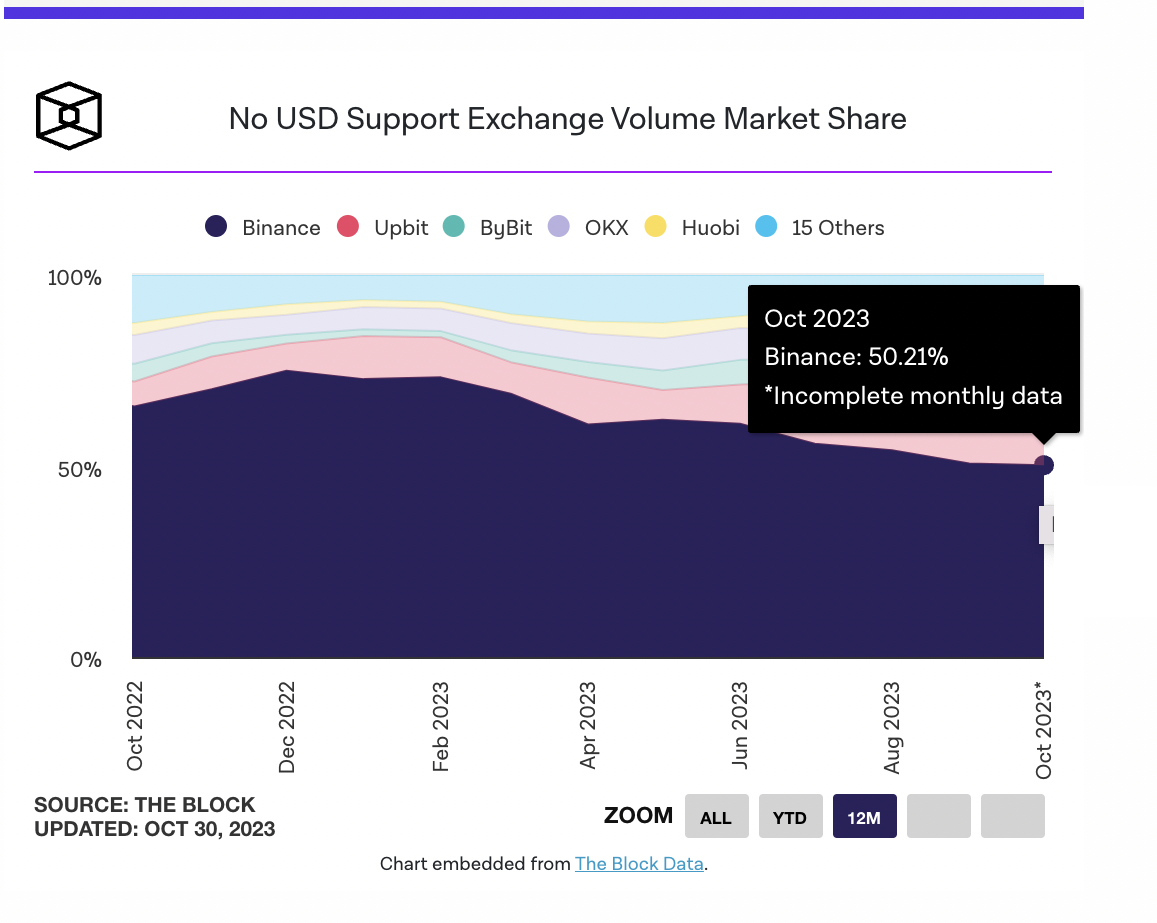

Binance is hemorrhaging market share as lawsuits and regulatory crackdowns undermine its ability to retain and attract business, according to research by The Block.

The world’s largest cryptocurrency exchange’s market share among exchanges that do not support USD has decreased from 74% in December 2022 to 50% this month, according to data compiled by The Block.

Binance's marketshare continues to decline amid rally https://t.co/RpWMXBjn00

— The Block (@TheBlock__) October 28, 2023

Binance’s market share has fallen even after the crypto market experienced one of the most bullish fortnights since March 2022.

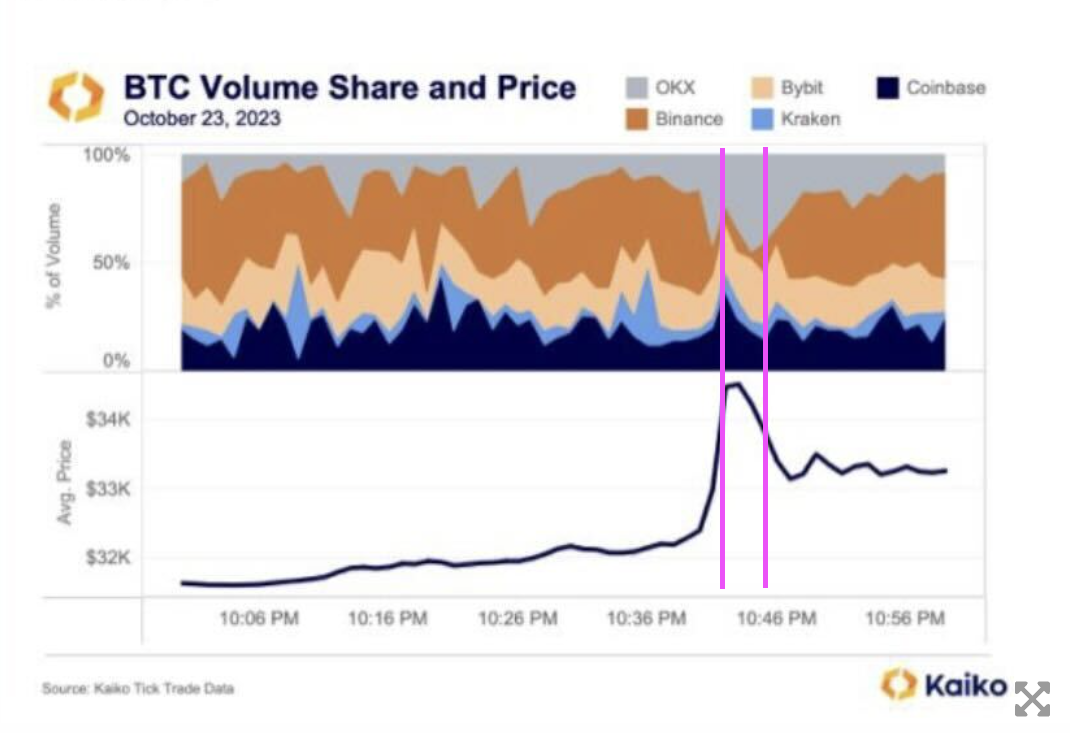

The “pullback among traders from Binance was particularly evident on October 23,” The Block said, when Bitcoin soared 14% to trade above $34,000 while the exchange’s market share “virtually dropped to zero.”

In contrast, other exchanges have seen their market shares increasing. Upbit’s market share has grown from 9% in August to 14% in the current month. Bybit and OKX have seen their non-USD support exchange market share grow by 2.5% each over the same period.

Data from Kaiko shows that OKX has witnessed its market share surpass 50%.

OKX accounted for about 50% of spot BTC volume share when Bitcoin moved above $34,000 on Oct. 23. | Source: Kaiko

By September, the spot trading market share of the exchange led by Changpeng Zhao had dropped for seven consecutive months, reaching a low of 34.3%.

When compared to the beginning of the year, Binance’s market share in the spot trading segment was well over 55%. This decline in trading volumes has had a direct and adverse effect on the exchange’s profitability.

Binance CEO Changpeng Zhao’s Fortune Also Declined

In addition to reducing trading volumes on Binance, Changpeng Zhao’s net worth has recently been reported to have taken a massive hit, plummeting by $12 billion.

That’s according to an Oct. 26 report by the Bloomberg Billionaires Index, which also slashed its estimates of revenues at Binance by 38% amid a slump in exchange volumes.

Zhao’s wealth has plunged by more than 80% from its $97 billion peak in January last year.

Moreover, the company is currently facing legal scrutiny from both the US Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC).

The SEC sued Zhao, Binance, and Binance.US in June, alleging that the exchange violated rules, including operating “a web of deceptions”, selling unregistered securities, and mishandling customer assets.

In March, the CTFC’s suit claimed Binance violated derivatives trading laws and operated what the regulator said was an “illegal” exchange and a “sham” compliance program.

However, Binance disputes the allegations and is fighting them.

This situation has prompted apprehension among several users and trading firms, causing them to reduce their trading operations on the platform.

Related News

- Binance.US and Changpeng Zhao Face Class-Action Lawsuit Over FTX Collapse

- Binance and Changpeng Zhao Seek Dismissal of SEC Lawsuit, Citing Regulatory Overreach

- Binance and Changpeng Zhao Want CFTC Lawsuit Dismissed

- Crypto Firms Are Breaching New U.K. Promotion Rules About 13 Times A Day

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage